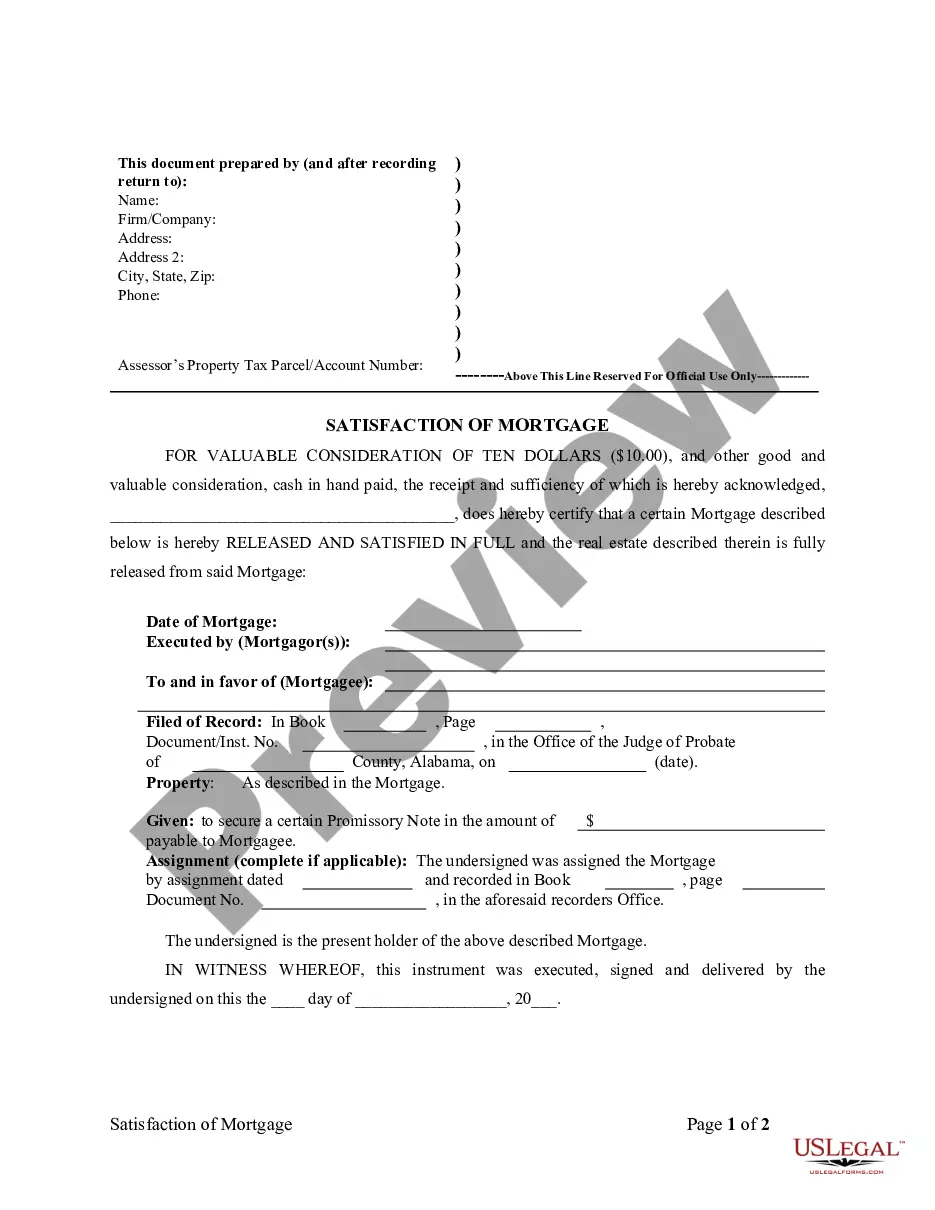

This is a satisfaction or release of a deed of trust or mortgage, for the state of Alabama, by an individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Alabama Satisfaction, Release Or Cancellation Of Mortgage By Individual?

We consistently aim to diminish or avert legal complications when handling subtle legal or financial matters.

To achieve this, we enroll in legal assistance that, generally speaking, tends to be quite expensive.

However, not all legal challenges are comparably intricate.

Many of them can be managed independently.

Utilize US Legal Forms whenever you need to locate and retrieve the Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual or any other documentation swiftly and securely. Just Log In to your account and hit the Get button adjacent to it. If you happen to misplace the form, you can always download it again from the My documents section. The procedure is equally simple if you are unfamiliar with the site! You can set up your account in a matter of minutes. Ensure that the Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual aligns with the statutes and regulations of your state and locality. Additionally, it’s essential to review the form’s description (if available), and if you detect any discrepancies from your initial expectations, look for an alternative template. Once you’ve confirmed that the Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual is suitable for your situation, you can select a subscription plan and proceed with payment. Afterward, you can download the document in any available format. With over 24 years in the industry, we’ve assisted millions by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is a digital repository of current DIY legal paperwork spanning everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to manage your matters independently without relying on legal advisors.

- We offer access to legal document templates that are not always readily accessible.

- Our templates cater to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

To negotiate your mortgage effectively, evaluate your financial situation and gather relevant documents. Present your case clearly to the lender, focusing on terms that benefit you. By being proactive and informed, you enhance your prospects for Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual.

In Alabama, lenders typically use a mortgage, but some also utilize a deed of trust. Each instrument serves a purpose for securing real estate loans but has varying implications in cases of default. Understanding the differences can improve your experience and lead to Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual.

The fastest way to stop a foreclosure often involves filing for bankruptcy, which can put an immediate halt to the process. However, this option should be carefully considered due to its long-term implications. Opting for alternative solutions that align with Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual may also offer swift resolutions, allowing for a fresh start.

The foreclosure process in Alabama can typically take between three to six months, depending on various factors such as court backlog and the lender's actions. Understanding this timeframe can help you strategize your next steps. Working towards Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual can shorten your path to resolution.

A deed in lieu of foreclosure is best described as a mutually agreed-upon transfer of property ownership from the borrower to the lender. This agreement helps both parties avoid the complexities of foreclosure. Utilizing this option can foster Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual, simplifying the resolution of housing debt.

A deed in lieu of foreclosure in Alabama is a legal process where a borrower voluntarily transfers their property title to the lender to settle a mortgage debt. This option can provide a quick resolution and save both parties from the lengthy foreclosure process. It serves as a means to achieve Huntsville Alabama Satisfaction, Release or Cancellation of Mortgage by Individual, allowing for a cleaner exit from a challenging financial situation.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

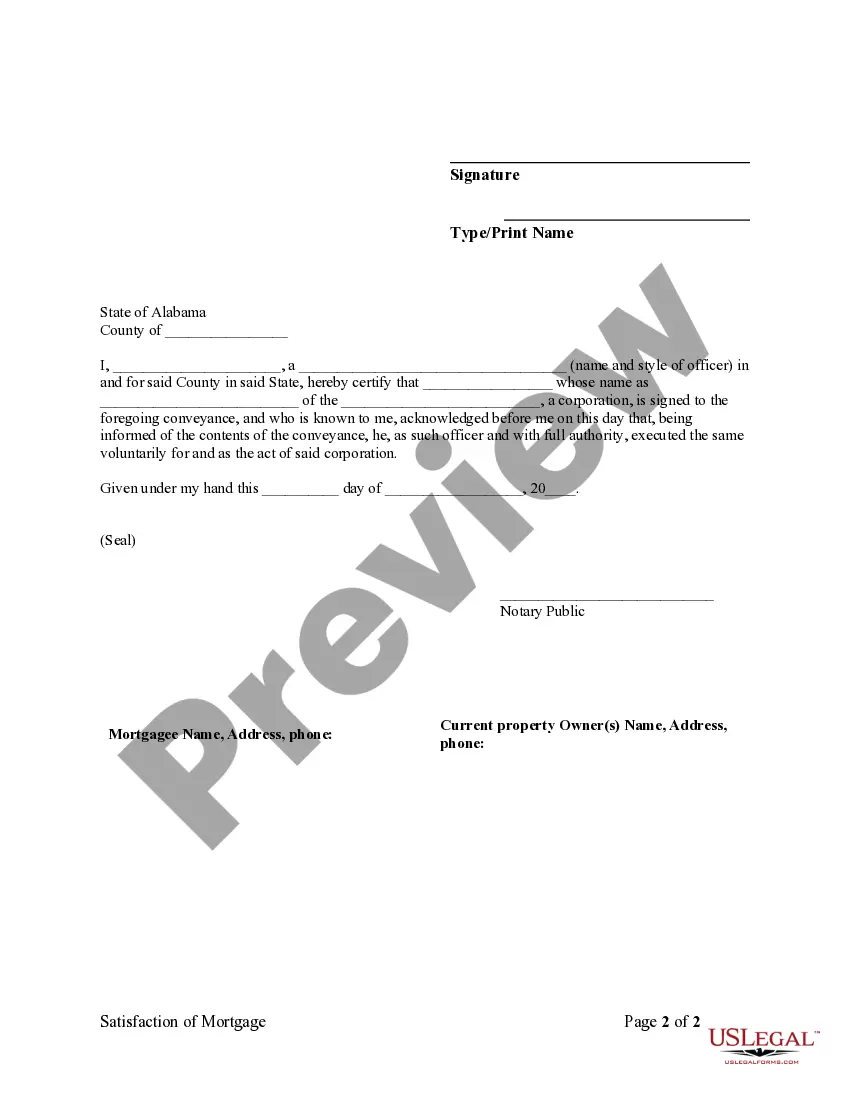

Releasing a mortgage lien often involves two or three signatures. Depending on your state, the person who's given the mortgage, the borrower, and the lender may be required to sign the release. In many states, a notary public signature and, possibly, a seal, is also needed to have a legal release of lien.

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.