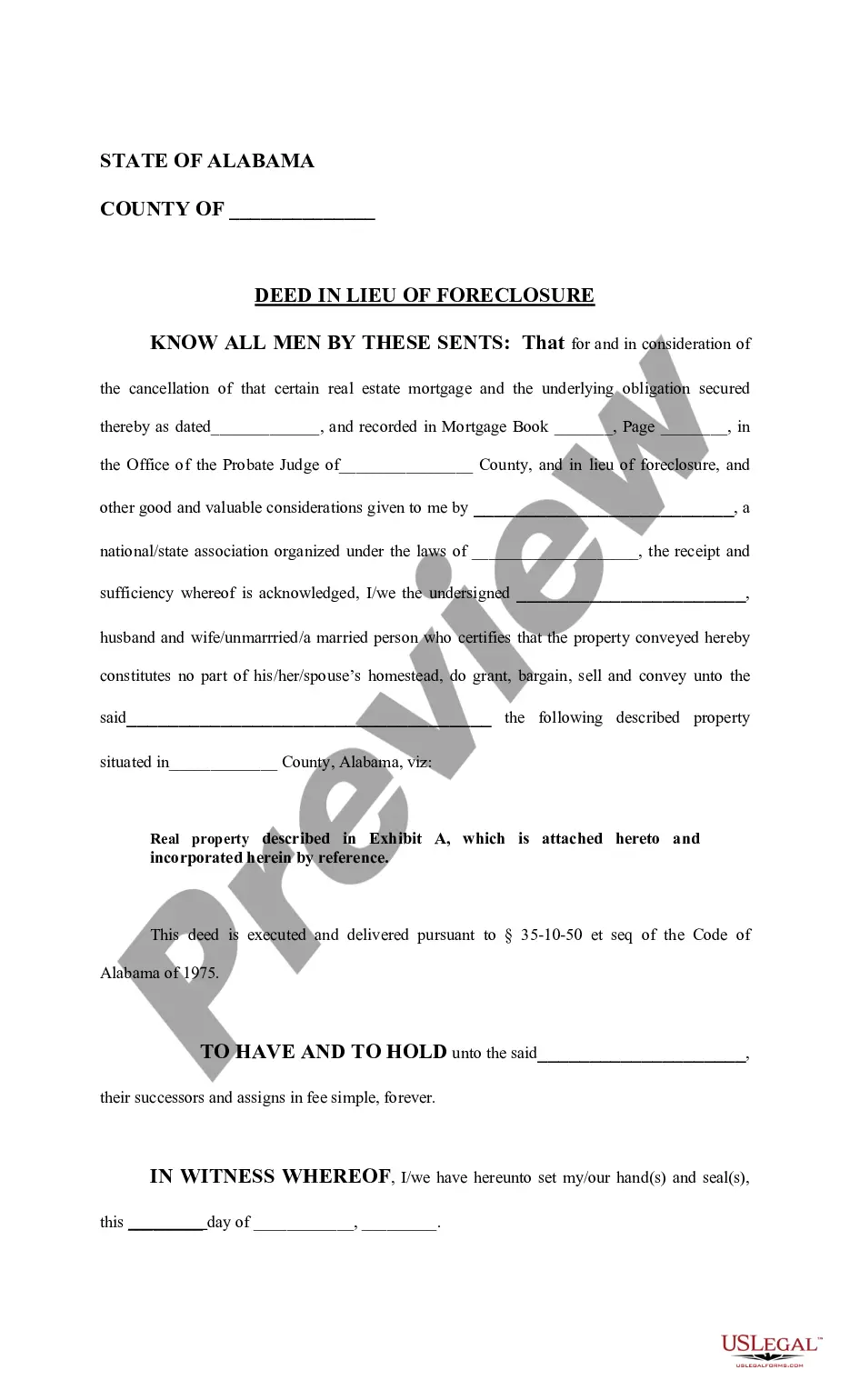

This form is used as a method for a lienholder of property to avoid a lengthy and expensive foreclosure process. With a deed in lieu of foreclosure, a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor simply deeds the property to the bank as a substitute for foreclosure.

Huntsville Alabama Deed In Lieu of Foreclosure

Description

How to fill out Alabama Deed In Lieu Of Foreclosure?

If you are in search of a pertinent document, it’s challenging to select a superior service than the US Legal Forms website – likely the most comprehensive online repositories.

With this collection, you can discover thousands of forms for commercial and personal needs categorized by type and state, or by keywords.

Thanks to the high-quality search functionality, locating the latest Huntsville Alabama Deed In Lieu of Foreclosure is as easy as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Select the file format and download it to your device.

- Additionally, the relevance of each file is confirmed by a team of professional lawyers who routinely evaluate the templates on our site and update them according to the latest state and county laws.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Huntsville Alabama Deed In Lieu of Foreclosure is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions below.

- Ensure you have found the template you require. Review its details and utilize the Preview option (if available) to inspect its content. If it does not fit your requirements, use the Search field at the top of the page to find the correct document.

- Confirm your choice. Select the Buy now option. Then, choose your desired subscription plan and enter your details to create an account.

Form popularity

FAQ

You can obtain a blank deed in lieu of foreclosure form through various online resources, including the US Legal Forms platform. This site offers a wide range of legal documents, specifically tailored for the Huntsville Alabama deed in lieu of foreclosure. By using US Legal Forms, you ensure that your document meets the legal requirements in your area. It is a safe and convenient option for homeowners looking to navigate the foreclosure process.

To complete a deed transfer in Alabama, you need to prepare a deed that includes the property’s legal description and the names of the parties involved. After signing the deed, you must record it with the local county office. If you are considering a Huntsville Alabama Deed In Lieu of Foreclosure, this process can offer a smoother transition away from foreclosure while also maintaining some control over your property’s fate.

Alabama is primarily a mortgage state, meaning that most homes are financed through mortgages rather than deeds. However, understanding the implications of a deed in lieu of foreclosure is critical for homeowners facing financial difficulties. Engaging resources like US Legal Forms can assist in navigating these options effectively.

When dealing with foreclosures, it's essential to rely on accurate sources of information. The most accurate foreclosure site typically offers data that is regularly updated and covers specific locations, like Huntsville, Alabama. Platforms that provide comprehensive listings, such as US Legal Forms, can guide you through the necessary legal documents, making your process smoother.

The biggest disadvantage for a lender in a deed in lieu of foreclosure is often the potential loss of value in the property. While this option prevents a lengthy foreclosure process, the lender may end up taking possession of a property worth less than the original mortgage amount. Additionally, the lender may face challenges in reselling the property. However, the speed and simplicity of this process can outweigh these risks for some lenders.

The fastest way to stop a foreclosure is typically to file for bankruptcy, as this can immediately halt the foreclosure process. Alternatively, negotiating a deed in lieu of foreclosure with your lender may also expedite a resolution. Whichever route you choose, acting quickly is crucial to protect your rights and assets. Consult with a legal expert to ensure you understand your options and the implications of each choice.

A deed in lieu of foreclosure in Alabama is a legal process where a homeowner voluntarily transfers their property title to the lender to settle their mortgage debt. This option can help homeowners avoid the formal foreclosure process while also providing the lender with collateral to recover their losses. This arrangement can be beneficial for both parties, as it often results in a quicker resolution. Consider exploring this route if you're struggling with mortgage payments.

The simplest solution for a foreclosure might be to consider a deed in lieu of foreclosure. This option allows homeowners to voluntarily transfer their property back to the lender, which can simplify the process significantly. By pursuing this route, you can avoid the stress and complications associated with a traditional foreclosure. It's advisable to reach out to your lender and discuss this possibility to see if it suits your situation.