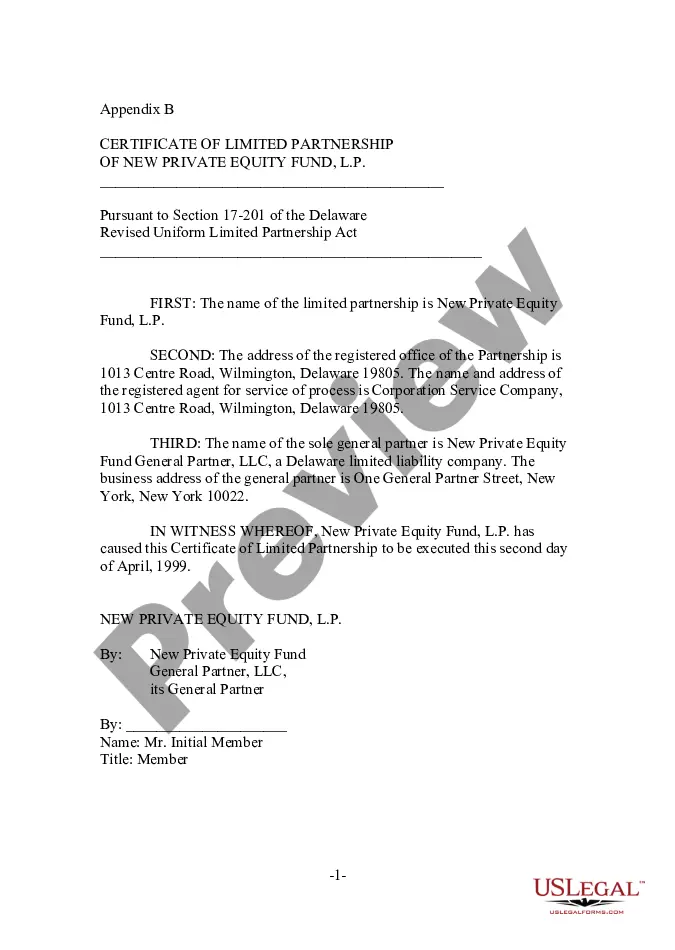

Wyoming Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Certificate Of Limited Partnership Of New Private Equity Fund?

You can spend time online looking for the authorized file template that fits the state and federal needs you need. US Legal Forms provides 1000s of authorized varieties that are examined by pros. It is possible to down load or produce the Wyoming Certificate of Limited Partnership of New Private Equity Fund from my service.

If you have a US Legal Forms account, you are able to log in and click on the Download key. Next, you are able to complete, revise, produce, or indication the Wyoming Certificate of Limited Partnership of New Private Equity Fund. Every authorized file template you purchase is yours eternally. To get one more backup of any obtained type, check out the My Forms tab and click on the related key.

If you are using the US Legal Forms internet site initially, keep to the straightforward guidelines beneath:

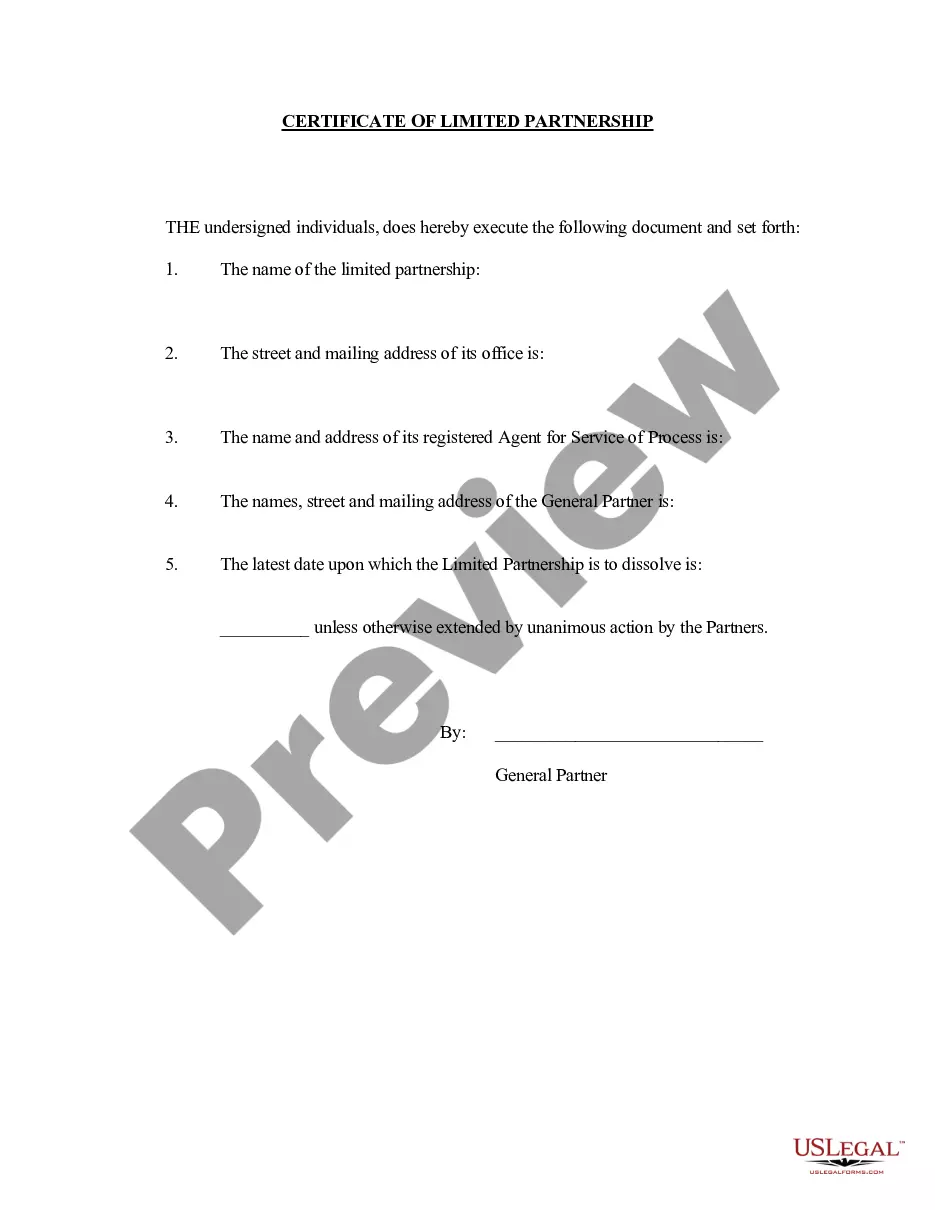

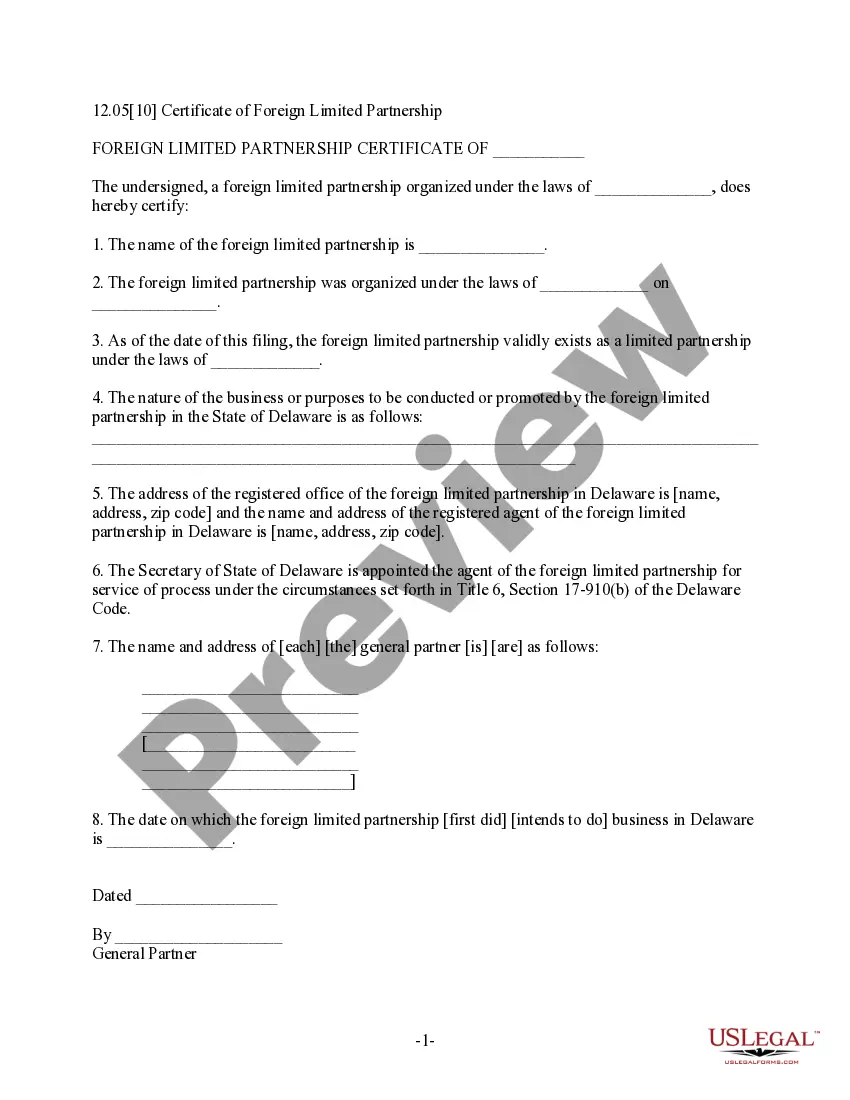

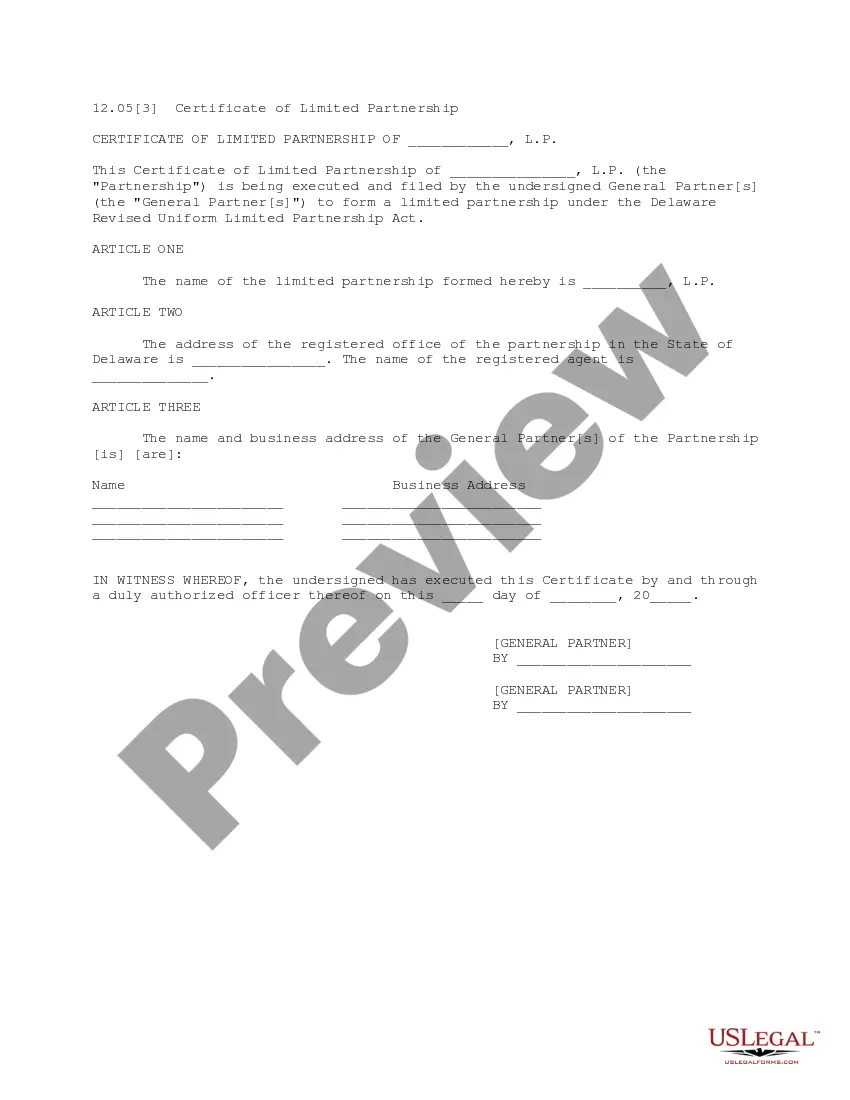

- Initial, be sure that you have chosen the proper file template for that county/metropolis of your choice. Read the type description to ensure you have picked out the appropriate type. If readily available, make use of the Preview key to look from the file template as well.

- If you wish to discover one more model of the type, make use of the Lookup area to discover the template that meets your needs and needs.

- When you have discovered the template you need, click on Purchase now to continue.

- Choose the rates strategy you need, type your references, and sign up for your account on US Legal Forms.

- Complete the transaction. You may use your charge card or PayPal account to purchase the authorized type.

- Choose the formatting of the file and down load it to the product.

- Make alterations to the file if needed. You can complete, revise and indication and produce Wyoming Certificate of Limited Partnership of New Private Equity Fund.

Download and produce 1000s of file templates while using US Legal Forms Internet site, that offers the most important selection of authorized varieties. Use specialist and status-certain templates to take on your company or individual requires.

Form popularity

FAQ

How to Form a Wyoming LP Wyoming doesn't have online filings for LPs, so you must complete the on the Wyoming Secretary of State's website, the LLC filing online is instant. ... Complete Consent to Appointment by Registered Agent. ... Submit the Certificate of Limited Partnership.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email or in person, but we recommend faxing. Normal processing takes up to 2 days, plus additional time for mailing, and costs $3 plus $. 50 cents per page for first ten pages plus $.

Wyoming's charging order protection laws are effective for members to protect their LLC assets and ownership from creditors. However, that protection does not extend outside of Wyoming. Members living out of state will have to deal with different laws protecting their LLC assets from garnishment by creditors.

Wyoming requires an annual report for LLCs to be filed on the first day of the month in which the company is formed. The minimum fee due is $60 (with a $2 processing fee if paid online). Most Wyoming annual reports cost $60 to file, with a $2 convenience fee if done online for a total of $62.

Wyoming doesn't have state income taxes, but LLCs are still required to report their income to the IRS. Single member LLCs will file a Form 1040 (personal income tax form).

You can form a Wyoming LLC even if you don't live in Wyoming. Residency in the state, or the USA, is not required to form a company. A majority of LLCs are formed by non-residents. Forming an LLC in Wyoming as a non-resident is the same process as for a resident.

Partnership taxes are typically paid on the partners' tax returns, but Wyoming has no individual state income tax, so it generates tax revenue in other ways. Partnerships may be required to file annual reports.

Annual Reports for corporations, LLCs, LPs, RLLPs and SFs are due on the first day of the anniversary month of formation. For example, if your 'initial filing' date is May 15, your Annual Report is due May 1 of each year. Statutory Trust Annual Reports are due by January 1 of each year.