Wyoming Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering

Description

How to fill out Form - Stock Purchase Agreement For Strategic Investment Made At Time Of Initial Public Offering?

If you want to full, download, or produce lawful document templates, use US Legal Forms, the biggest assortment of lawful forms, that can be found on the Internet. Utilize the site`s easy and practical look for to discover the papers you want. Different templates for company and specific uses are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to discover the Wyoming Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering with a handful of mouse clicks.

In case you are already a US Legal Forms customer, log in in your bank account and then click the Download button to find the Wyoming Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering. Also you can entry forms you formerly downloaded within the My Forms tab of the bank account.

If you work with US Legal Forms the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for that appropriate city/land.

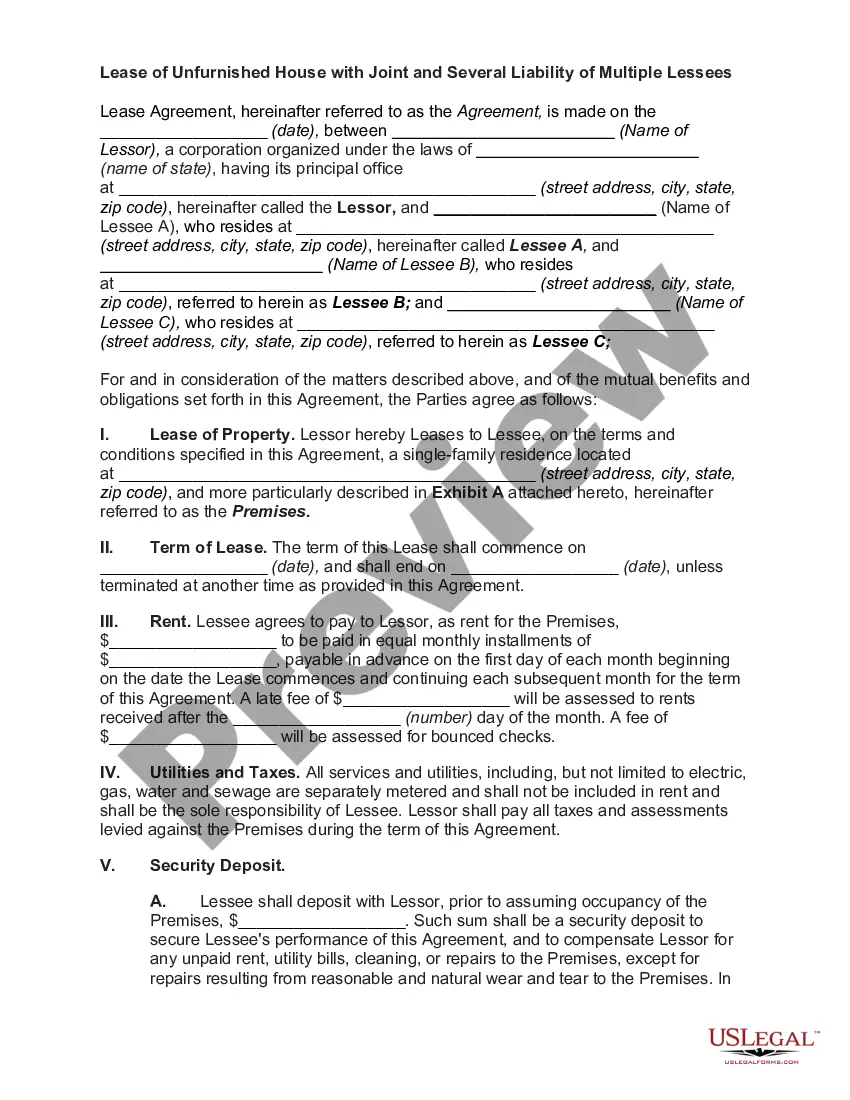

- Step 2. Take advantage of the Preview choice to examine the form`s information. Do not neglect to see the outline.

- Step 3. In case you are unhappy with all the kind, take advantage of the Look for industry at the top of the display screen to locate other models of your lawful kind design.

- Step 4. Once you have identified the shape you want, select the Buy now button. Opt for the pricing strategy you like and put your references to sign up to have an bank account.

- Step 5. Procedure the deal. You can use your charge card or PayPal bank account to complete the deal.

- Step 6. Choose the structure of your lawful kind and download it on your own device.

- Step 7. Complete, modify and produce or indication the Wyoming Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering.

Each lawful document design you buy is the one you have forever. You possess acces to every single kind you downloaded in your acccount. Click on the My Forms portion and select a kind to produce or download once again.

Be competitive and download, and produce the Wyoming Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering with US Legal Forms. There are thousands of expert and condition-certain forms you can utilize for your personal company or specific needs.

Form popularity

FAQ

It details specific information about the stock transfer, including warranties, dispute resolution measures, allocation of costs, etc. It is a binding agreement that ensures the stock transfer will proceed. The buyer and seller can review the agreement and get a clear understanding of the transaction in advance. What is a Stock Purchase Agreement and how important is it? propelx.com ? blog ? what-is-a-stock-pur... propelx.com ? blog ? what-is-a-stock-pur...

The buyer's lawyers will generally prepare the first draft of the share purchase agreement (SPA). However, in addition to precedents which assume that the drafter is acting for the buyer, we also provide precedents for drafters acting for the seller (either preparing a first draft or marking up the buyer's draft).

No liabilities for debts ? this is to the advantage of the seller who at the point of completion, transfers all debts to the buyer. No third-party involvement ? A share purchase can be completed without the involvement of a third party. What is a Share Purchase Agreement? hutchinsonthomas.com ? what-is-a-share-purchase... hutchinsonthomas.com ? what-is-a-share-purchase...

This agreement allows the founders to document their initial ownership in the Company, including standard transfer restrictions and any vesting provisions with respect to their shares.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

A purchase agreement is the final document used to transfer a property from the seller to the buyer, while a purchase and sale agreement specifies the terms of the transaction. Parties will sign a purchase agreement after both parties have complied with the terms of the purchase and sale agreement. What is a Purchase and Sale Agreement? Know the Basics ironcladapp.com ? journal ? contracts ? purchase-... ironcladapp.com ? journal ? contracts ? purchase-...

Most buyers prefer asset deals due to the tax advantages they can secure. For example, if they're purchasing a company with assets that are highly depreciated, the buyer can ?step up? the tax value of those assets and depreciate or amortize them. If there's goodwill in the transaction, this can also be amortized. Asset Purchase vs. Stock Purchase: How to Make the Right Choice melcap.com ? asset-purchase-vs-stock-purchase-m... melcap.com ? asset-purchase-vs-stock-purchase-m...

A stock purchase agreement is a contract signed by two parties when they buy or sell stock in a corporation in the US. Small firms that sell stock frequently use these agreements. Stock can be sold to buyers by either the corporation or its shareholders.