Wyoming Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest

Description

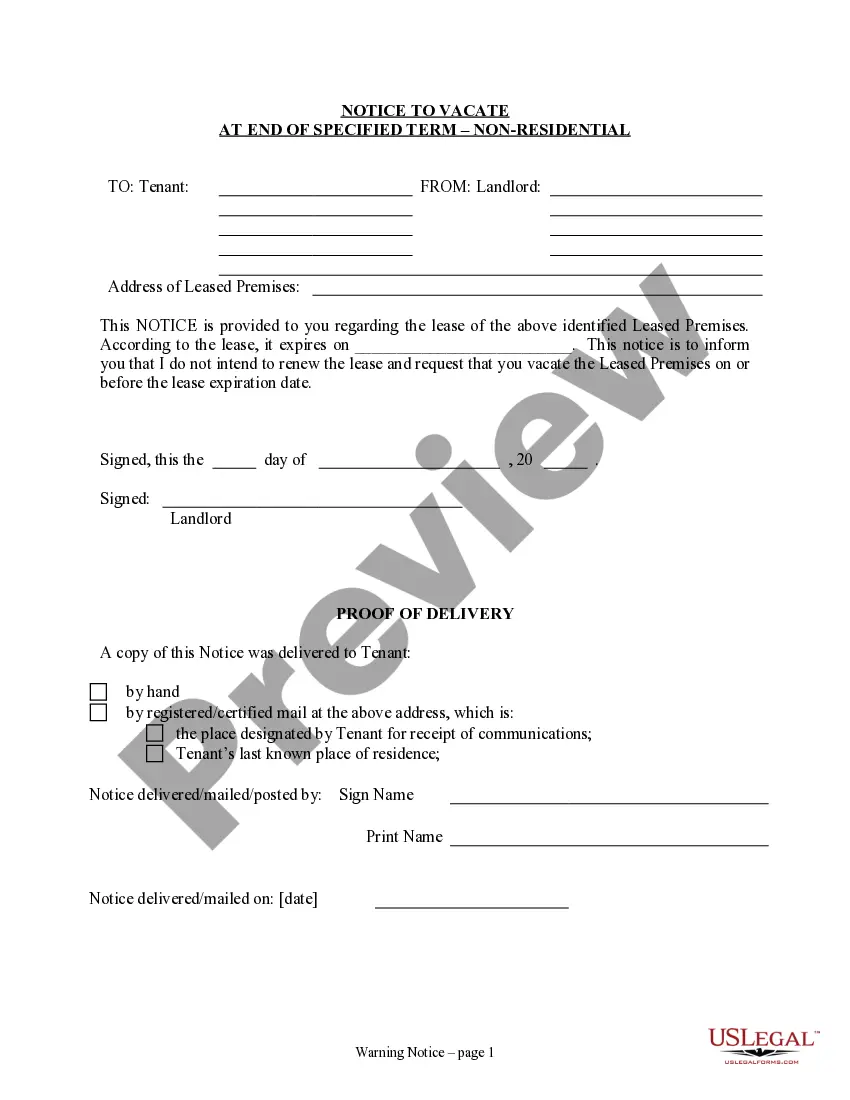

How to fill out Disclaimer And Quitclaim Of Interest In Mineral / Royalty Interest?

Finding the right legal papers web template can be a struggle. Obviously, there are tons of web templates available on the Internet, but how can you obtain the legal type you will need? Utilize the US Legal Forms web site. The support delivers a large number of web templates, like the Wyoming Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest, that can be used for business and personal requires. Every one of the varieties are inspected by experts and meet up with federal and state needs.

Should you be previously registered, log in in your accounts and then click the Obtain option to find the Wyoming Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest. Make use of your accounts to search from the legal varieties you possess bought formerly. Visit the My Forms tab of your respective accounts and obtain another version in the papers you will need.

Should you be a fresh customer of US Legal Forms, listed below are straightforward directions that you can comply with:

- First, make sure you have selected the appropriate type for your personal metropolis/area. You may examine the shape utilizing the Preview option and look at the shape information to make certain it is the best for you.

- If the type does not meet up with your expectations, take advantage of the Seach industry to get the proper type.

- When you are positive that the shape is suitable, click the Acquire now option to find the type.

- Pick the costs prepare you desire and enter the essential information and facts. Make your accounts and pay for your order using your PayPal accounts or credit card.

- Opt for the file formatting and down load the legal papers web template in your product.

- Complete, edit and print and signal the attained Wyoming Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest.

US Legal Forms will be the biggest local library of legal varieties that you can discover a variety of papers web templates. Utilize the company to down load skillfully-created papers that comply with express needs.

Form popularity

FAQ

Construction aggregate ? sand, gravel and crushed stone ? is the most valuable non-energy mineral commodity in the United States. It is also the most mined and widely used of natural resources in the world.

Transfer Your Mineral Rights Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

Wyoming has a number of mineral right laws, Wyoming Statutes 30-5-101 to 30-5-127 and also 30-5-401 to 30-5-410, which can be found online or by visiting the Wyoming Oil and Gas Commission website at wogcc.wyo.gov.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

If it has ?Coal and other minerals reserved to U.S.? then the government owns the rights including sand, gravel, and others. If not listed, the mineral rights may belong to the landowner; however, mineral rights are usually accompanied by a court-recorded ?mineral title opinion? to be valid.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

The royalty rate on State of Wyoming leased minerals is usually 16.66%, and has been since the 1980s. The royalty rate on new private mineral leases in the most productive parts of Campbell, Platte, Johnson, Converse and neighboring counties usually ranges from 17% to 20%.