Wyoming Due Diligence Field Review and Checklist

Description

How to fill out Due Diligence Field Review And Checklist?

US Legal Forms - one of the greatest libraries of legitimate types in the USA - offers an array of legitimate file layouts it is possible to obtain or print. Using the website, you can get thousands of types for business and specific purposes, categorized by types, suggests, or keywords and phrases.You can find the most recent types of types just like the Wyoming Due Diligence Field Review and Checklist within minutes.

If you already possess a registration, log in and obtain Wyoming Due Diligence Field Review and Checklist from your US Legal Forms collection. The Down load option will show up on every single form you see. You have accessibility to all earlier downloaded types in the My Forms tab of your profile.

If you want to use US Legal Forms the first time, allow me to share straightforward directions to help you get started off:

- Be sure you have chosen the best form for your personal city/region. Select the Preview option to examine the form`s content material. Browse the form description to ensure that you have selected the correct form.

- In case the form does not satisfy your needs, use the Research discipline towards the top of the monitor to obtain the one which does.

- When you are satisfied with the shape, verify your option by simply clicking the Buy now option. Then, choose the rates strategy you like and provide your accreditations to register for an profile.

- Approach the transaction. Use your credit card or PayPal profile to finish the transaction.

- Choose the format and obtain the shape on your system.

- Make modifications. Complete, revise and print and indicator the downloaded Wyoming Due Diligence Field Review and Checklist.

Each and every template you added to your money does not have an expiration particular date and is your own for a long time. So, if you would like obtain or print yet another version, just visit the My Forms segment and click on on the form you will need.

Gain access to the Wyoming Due Diligence Field Review and Checklist with US Legal Forms, probably the most comprehensive collection of legitimate file layouts. Use thousands of expert and express-distinct layouts that fulfill your small business or specific needs and needs.

Form popularity

FAQ

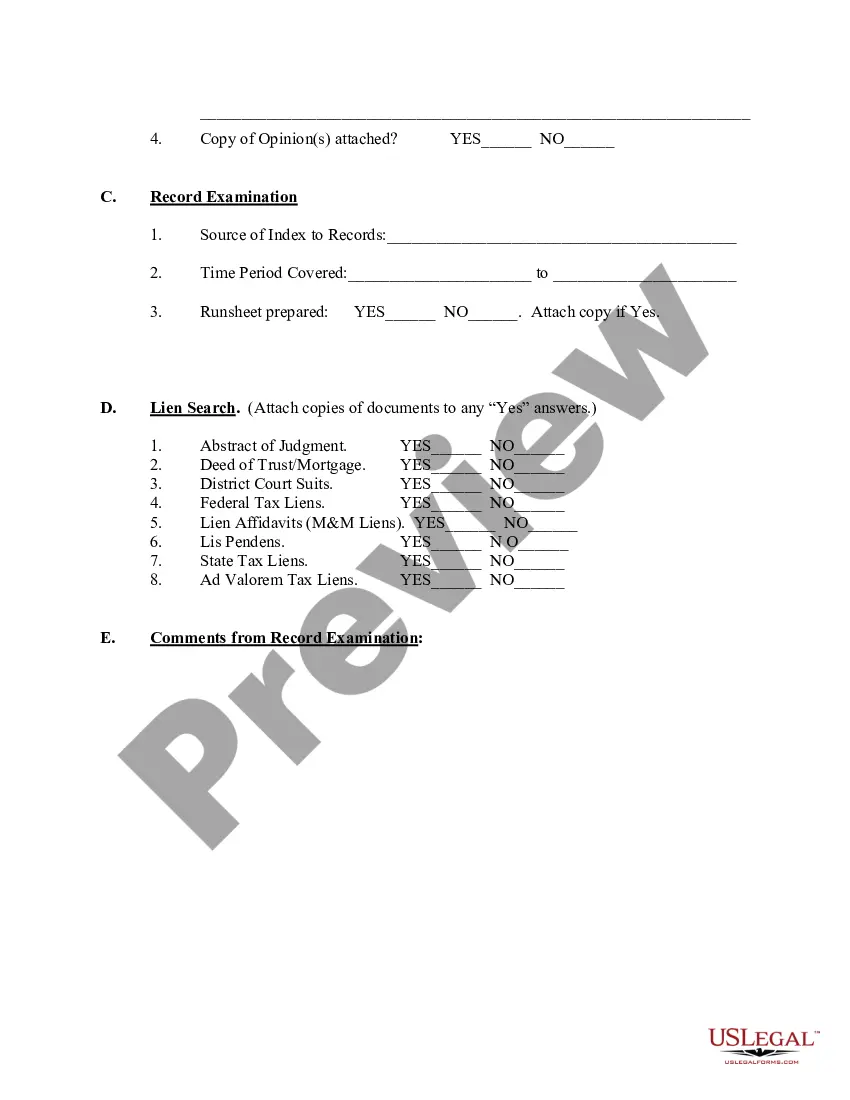

Complete Due Diligence Documents Checklist Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

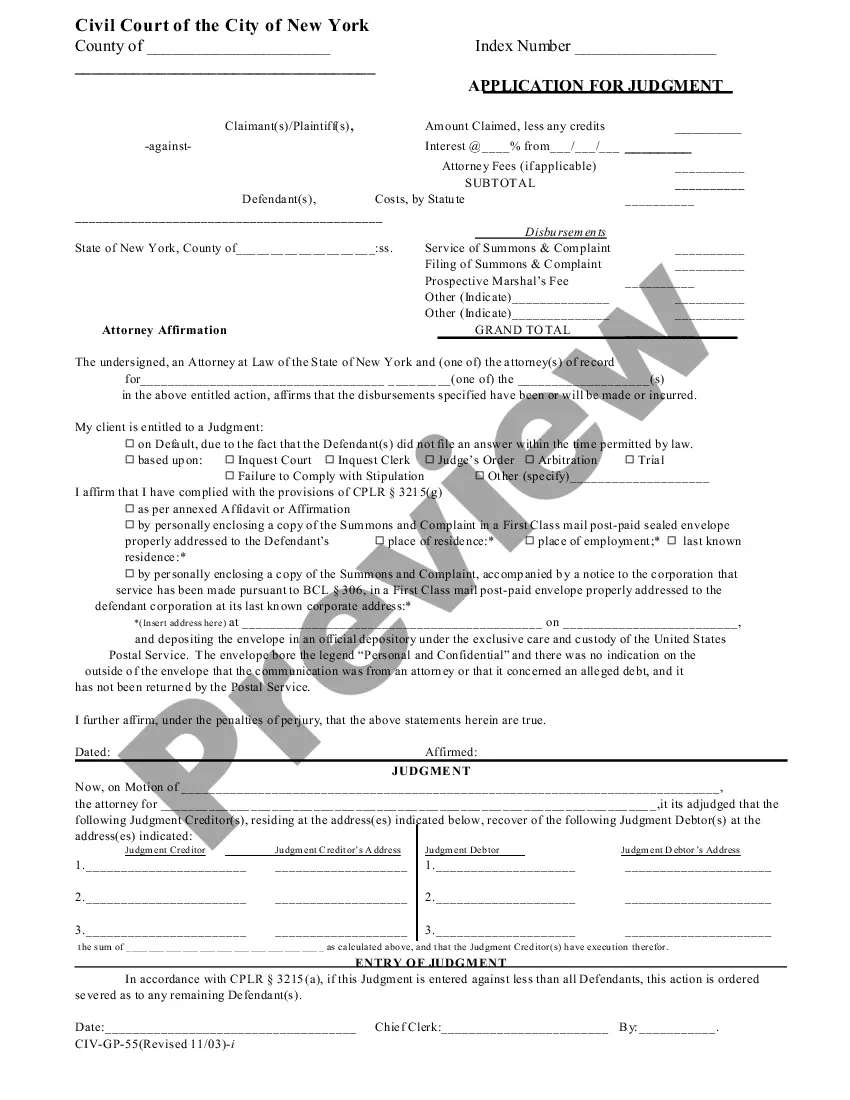

Quick Answer. In real estate, due diligence is the period of time between an accepted offer and closing. It gives you, the buyer, time to get an appraisal, a title search, perform property inspections and more, so you know you're getting what you're paying for.

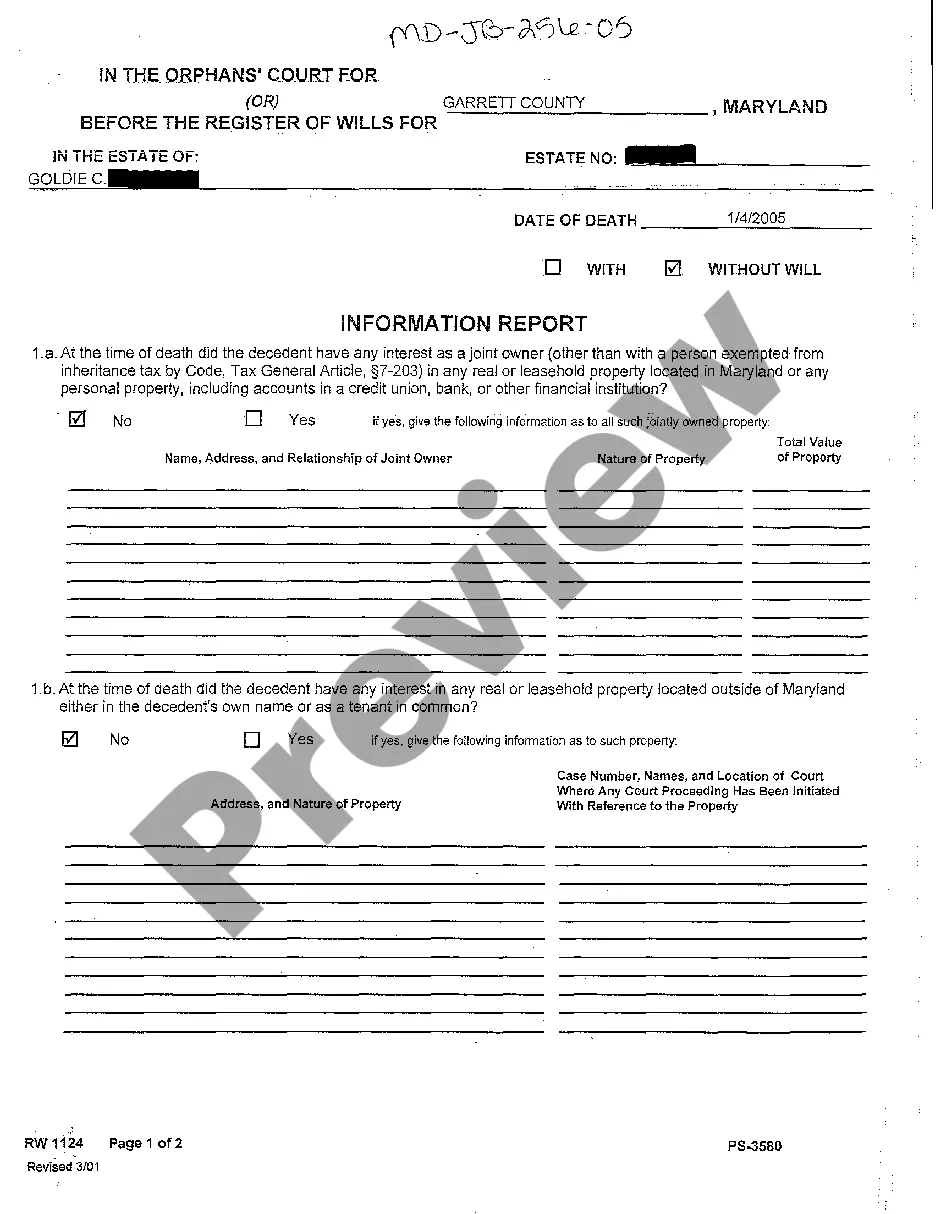

A due diligence check involves careful investigation of the economic, legal, fiscal and financial circumstances of a business or individual. This covers aspects such as sales figures, shareholder structure and possible links with forms of economic crime such as corruption and tax evasion.

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.

Post-offer due diligence includes hiring a building inspector, checking zoning laws, researching the title, getting an appraisal, and obtaining financing. If everything continues to check out with the property, the buyer can move to close the deal.

The process of due diligence ensures that potential acquirers gain an accurate and complete understanding of a company. It helps evaluate a company's strengths, weaknesses, risks, and opportunities. The creation of a due diligence checklist provides the detailed roadmap required to guide such an extensive analysis.

Unless the buyer is purchasing ?as is? (usually not the case) the buyer has a ?DUE DILIGENCE PERIOD? ? typically somewhere between 7 and 14 days. During that time the buyer can terminate the contract for any reason or no reason at all.

A legal due diligence report typically includes the following information: Company structure and governance. ... Contracts and agreements. ... Litigation history. ... Intellectual Property. ... Compliance documents. ... Real estate and land use. ... Data privacy and security. ... Taxation.