Wyoming Bill of Sale For Equipment in Consideration of Buyer Assuming Plugging Obligation

Description

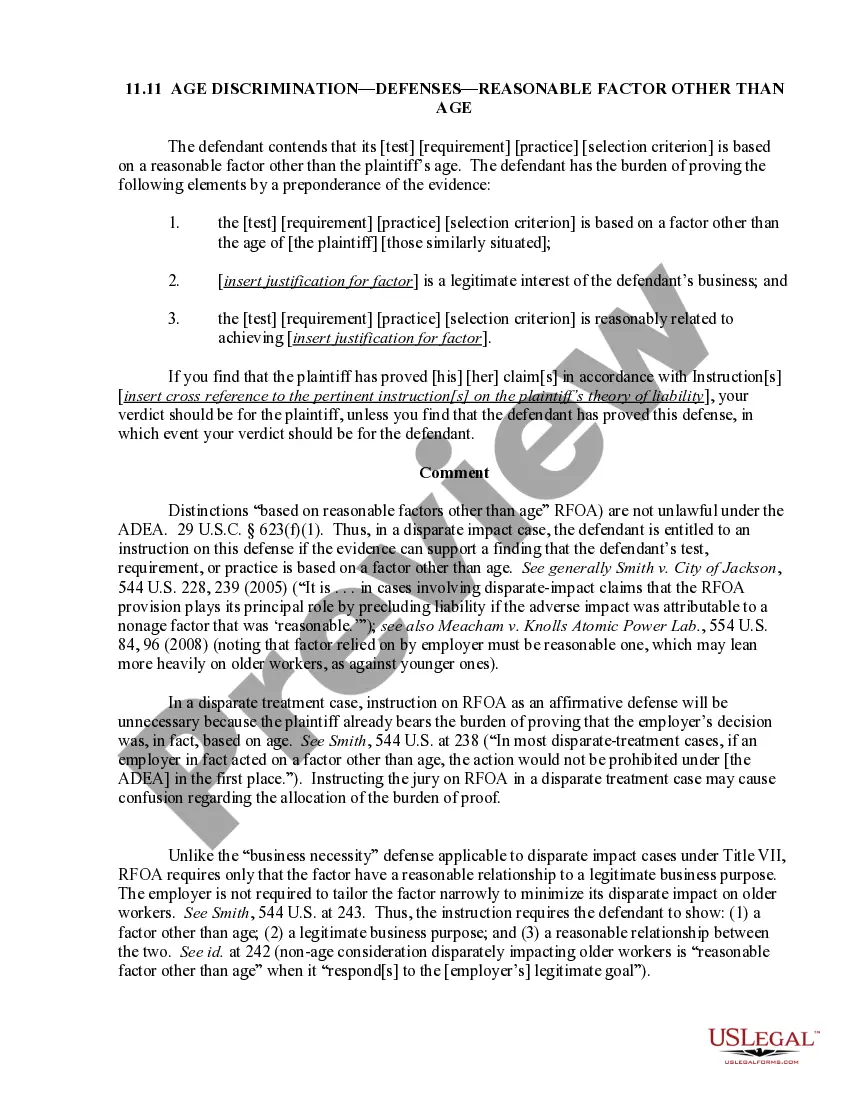

How to fill out Bill Of Sale For Equipment In Consideration Of Buyer Assuming Plugging Obligation?

Discovering the right legal document format can be a have a problem. Naturally, there are a variety of themes accessible on the Internet, but how will you discover the legal kind you need? Utilize the US Legal Forms website. The services provides thousands of themes, for example the Wyoming Bill of Sale For Equipment in Consideration of Buyer Assuming Plugging Obligation, that you can use for organization and private demands. Every one of the kinds are examined by specialists and meet up with federal and state demands.

When you are already authorized, log in to the account and then click the Obtain key to get the Wyoming Bill of Sale For Equipment in Consideration of Buyer Assuming Plugging Obligation. Make use of your account to look throughout the legal kinds you might have ordered formerly. Check out the My Forms tab of your respective account and obtain one more duplicate of the document you need.

When you are a whole new end user of US Legal Forms, here are simple recommendations for you to follow:

- Initial, make certain you have selected the right kind for your area/region. You may look over the shape making use of the Preview key and look at the shape description to guarantee it is the best for you.

- If the kind does not meet up with your requirements, make use of the Seach industry to get the proper kind.

- When you are certain the shape is suitable, select the Acquire now key to get the kind.

- Pick the costs prepare you would like and enter in the needed info. Design your account and purchase the transaction using your PayPal account or credit card.

- Select the file formatting and obtain the legal document format to the device.

- Full, change and printing and sign the obtained Wyoming Bill of Sale For Equipment in Consideration of Buyer Assuming Plugging Obligation.

US Legal Forms is the biggest collection of legal kinds for which you can discover numerous document themes. Utilize the service to obtain appropriately-produced papers that follow status demands.

Form popularity

FAQ

When you sell something like that, your bill of sale will include basic information like: Seller name and contact information. Buyer name and contact information. Description of the item(s) you're selling. Price of the item(s) you're selling. Date the sale was made. Space for the buyer and seller to sign.

An equipment bill of material (EBOM) lists all of the components of an asset, including its assemblies and subassemblies. With a reliable equipment bill of materials, a planner can determine exactly what parts are needed.

An Equipment Bill of Materials (BOM) identifies all the replacement spare parts for an equipment, so maintenance engineers can quickly identify the right part required, and locate it from inventory or put in a purchase request, using the part number and vendor details.

The purchase of equipment is not accounted for as an expense in one year; rather the expense is spread out over the life of the equipment. This is called depreciation. From an accounting standpoint, equipment is considered capital assets or fixed assets, which are used by the business to make a profit.