Wyoming Underwriter Agreement - Self-Employed Independent Contractor

Description

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

If you need to complete, acquire, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's user-friendly and convenient search feature to locate the documents you need.

A range of templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to locate the Wyoming Underwriter Agreement - Self-Employed Independent Contractor with just a few clicks.

Every legal document format you purchase is yours indefinitely. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Stay competitive and download, and print the Wyoming Underwriter Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to obtain the Wyoming Underwriter Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

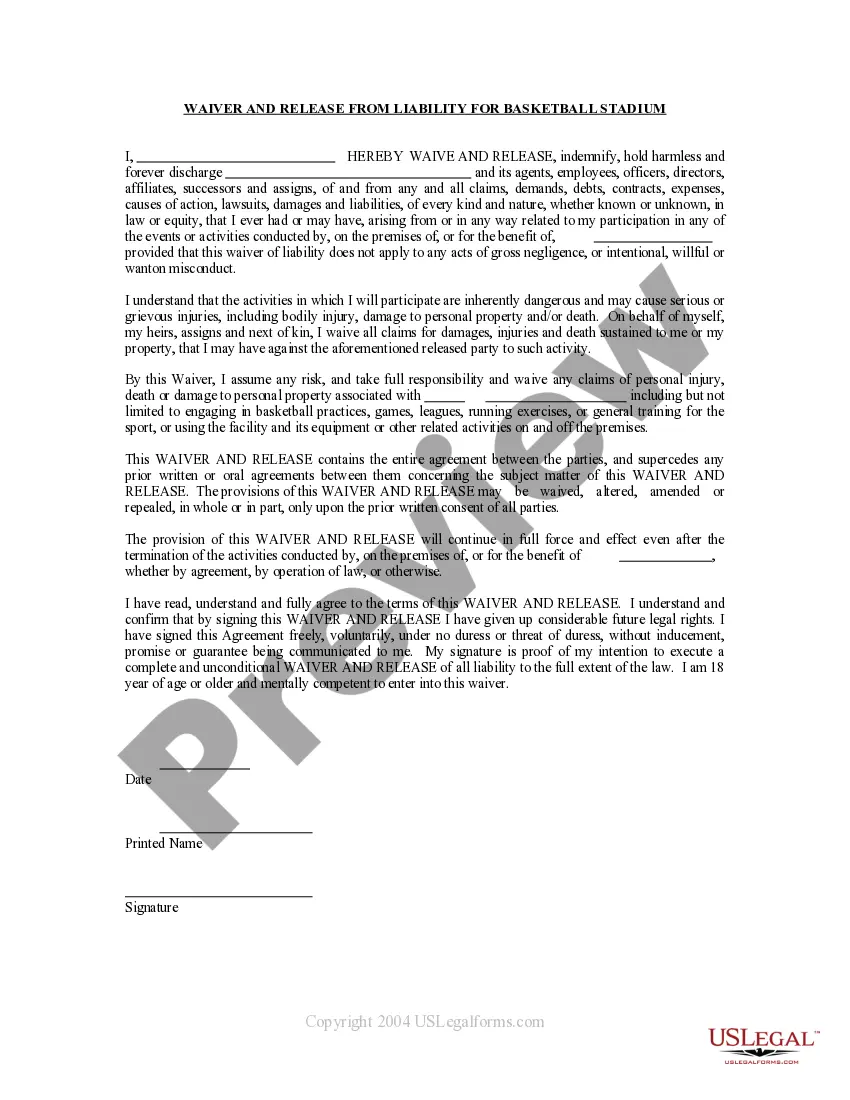

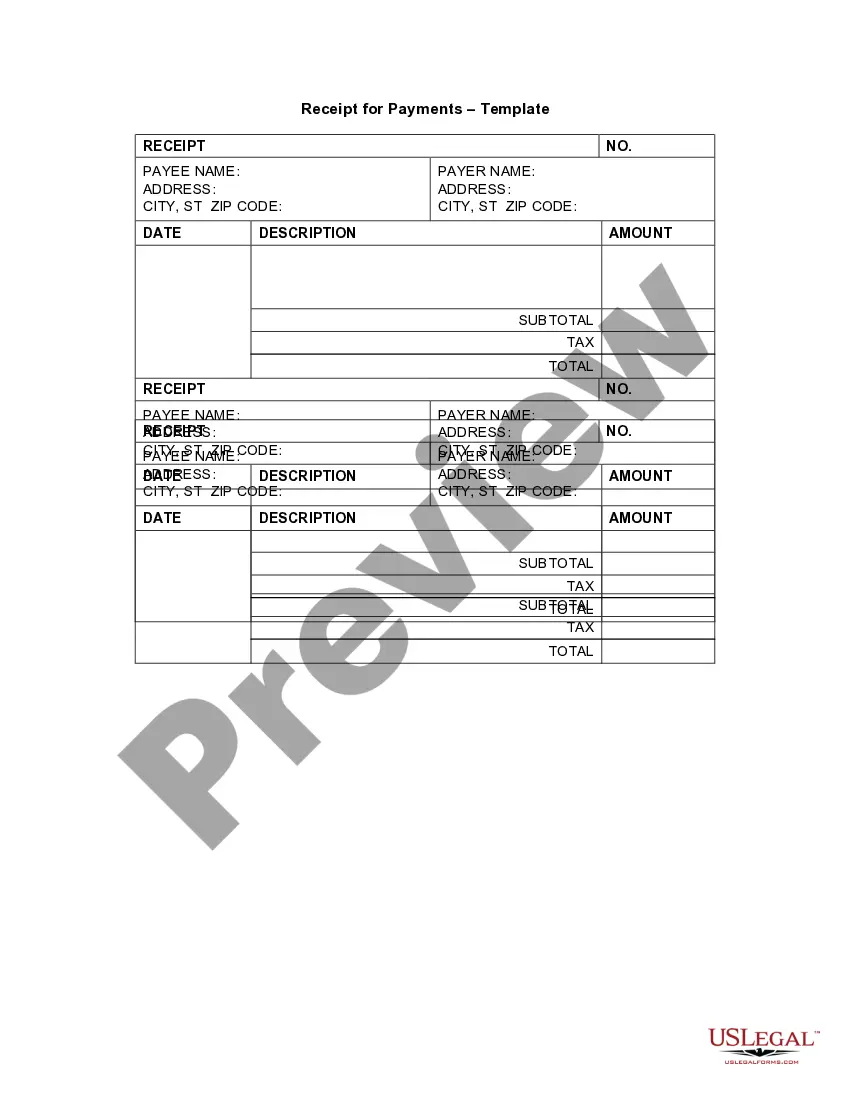

- Step 2. Use the Review feature to examine the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other forms in the legal document format.

- Step 4. Once you have found the form you need, click the Get now button. Select the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it onto your device.

- Step 7. Complete, modify, and print or sign the Wyoming Underwriter Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

To write an independent contractor agreement, begin with an introductory section that identifies the parties involved. Then, articulate the scope of work, payment terms, and deadlines clearly. It's also important to outline responsibilities, including any liability or insurance requirements. Consider utilizing the Wyoming Underwriter Agreement - Self-Employed Independent Contractor to guide you through these crucial components, ensuring you cover all necessary subjects.

Yes, independent contractors file as self-employed. This means they report their income and expenses on a Schedule C form when filing their taxes. It's critical to keep accurate records of all income and expenditures to ensure compliance with tax laws. Embracing the Wyoming Underwriter Agreement - Self-Employed Independent Contractor can help you understand your obligations and streamline your bookkeeping.

Filling out an independent contractor form involves entering your personal information, such as your name, address, and Social Security number. After that, provide details about the service you will deliver and the payment terms. Ensure you keep copies for your records and give the business a copy for their files. Using the Wyoming Underwriter Agreement - Self-Employed Independent Contractor can streamline this process and ensure you meet legal requirements.

To fill out an independent contractor agreement, start by clearly stating the names and addresses of both parties. Next, outline the terms of the engagement, including services provided, payment details, and duration of the contract. Make sure to include any confidentiality agreements, as well as the termination conditions. If you are a self-employed independent contractor, consider using the Wyoming Underwriter Agreement to simplify this process.

Receiving a 1099 form generally indicates that you are self-employed. This form is commonly issued to independent contractors and freelancers for tax purposes. By utilizing the Wyoming Underwriter Agreement - Self-Employed Independent Contractor, you can ensure you correctly interpret your employment status and understand your financial responsibilities.

Absolutely, an independent contractor counts as self-employed. This classification means they work for themselves and are responsible for their business decisions. The Wyoming Underwriter Agreement - Self-Employed Independent Contractor can guide you in establishing the correct terms and conditions of your self-employment.

Yes, independent contractors are typically considered self-employed individuals. They operate their own business and offer services to other companies under a contract. Understanding this relationship further through the Wyoming Underwriter Agreement - Self-Employed Independent Contractor can help you navigate your status effectively.

While Wyoming does not legally require an operating agreement for all business types, having one is highly recommended. An operating agreement outlines the management structure and operational guidelines of your business. Crafting a clear operating agreement aligned with the Wyoming Underwriter Agreement - Self-Employed Independent Contractor can significantly benefit your business.

The new federal rule clarifies the classification of independent contractors versus employees. It primarily focuses on the degree of control and independence workers have in their jobs. It's essential to be aware of these regulations, as the Wyoming Underwriter Agreement - Self-Employed Independent Contractor can provide necessary guidelines for compliance.

Being self-employed typically means you own your own business or work for yourself rather than for an employer. Self-employed individuals may work independently, as freelancers, or operate a small business. Understanding the nuances in the Wyoming Underwriter Agreement - Self-Employed Independent Contractor can help outline your status and obligations.