Wyoming Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Auditor Agreement - Self-Employed Independent Contractor?

Are you currently in a situation where you frequently require documents for either business or personal purposes? There are numerous legal document templates available online, but finding ones you can trust is challenging. US Legal Forms offers thousands of form templates, including the Wyoming Auditor Agreement - Self-Employed Independent Contractor, which are designed to meet state and federal requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you can download the Wyoming Auditor Agreement - Self-Employed Independent Contractor template.

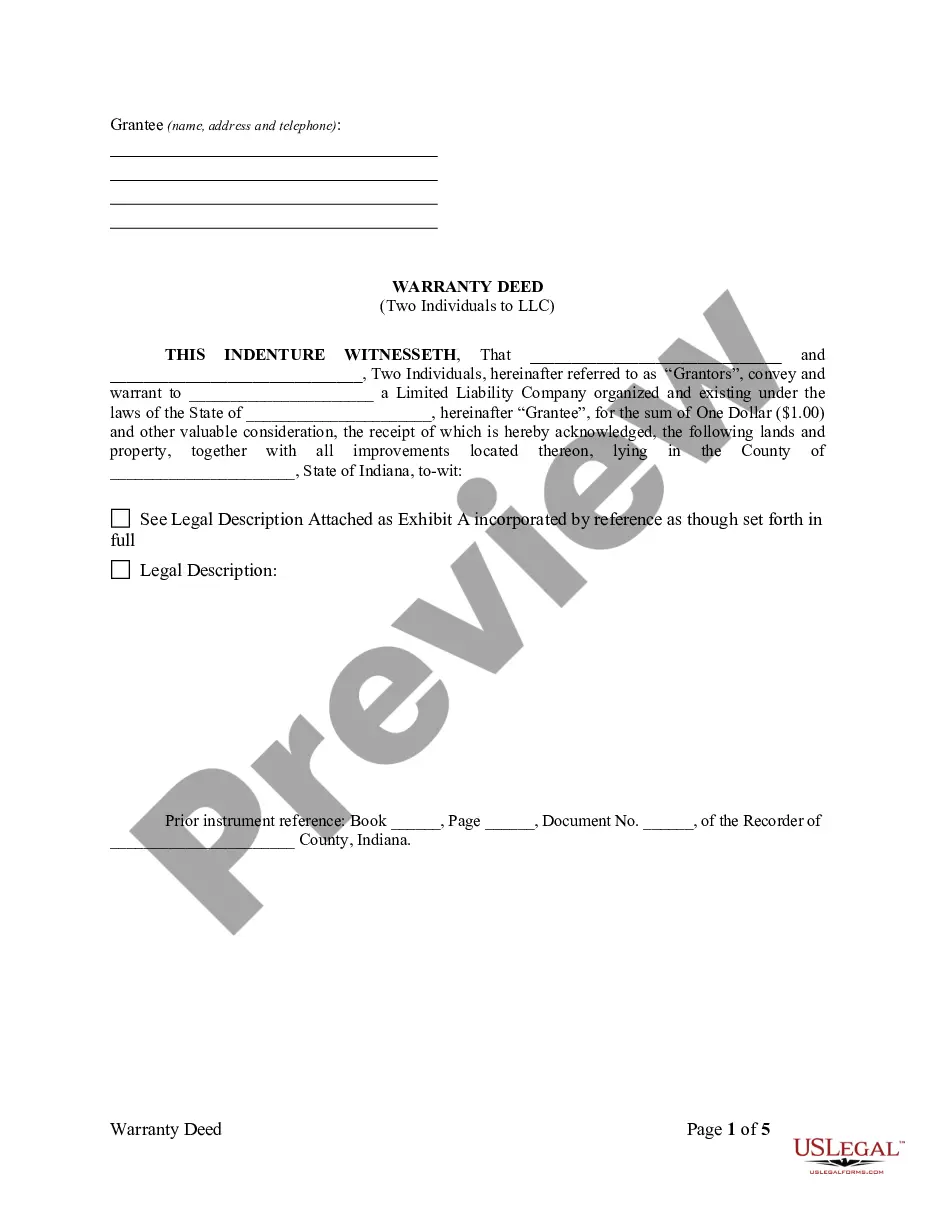

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for the correct city/region. Utilize the Preview option to review the form. Check the description to confirm that you have chosen the correct document. If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements. Once you find the right form, click Purchase now. Select the pricing plan you prefer, fill in the required information to create your account, and complete your order using PayPal or Visa or Mastercard. Choose a suitable document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Wyoming Auditor Agreement - Self-Employed Independent Contractor whenever necessary. Click on the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive selection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

Setting up as an independent contractor involves several key steps, including obtaining the necessary licenses and permits, establishing your business framework, and understanding your tax obligations. You should also consider drafting a Wyoming Auditor Agreement - Self-Employed Independent Contractor to formalize arrangements with clients. Platforms like uslegalforms offer templates and guidance, streamlining your setup process, so you can hit the ground running with confidence.

Independent contractors must adhere to specific rules to maintain their status. You must manage your taxes, insurance, and legal responsibilities, separate from those of an employer-employee relationship. The Wyoming Auditor Agreement - Self-Employed Independent Contractor can help you navigate these rules, providing templates and resources to ensure compliance. This clarity allows you to focus more on your work while fulfilling all necessary obligations.

To be classified as a self-employed independent contractor, you must have control over how you perform your work. This means you decide when, where, and how to complete your tasks. The Wyoming Auditor Agreement - Self-Employed Independent Contractor outlines these essential guidelines, ensuring both you and your client have clarity in the working relationship. Understanding these requirements helps establish a strong foundation for your freelance business.

Independent contractors can face audits just like any other business entity, particularly concerning their income. With a Wyoming Auditor Agreement - Self-Employed Independent Contractor, it is crucial to maintain accurate records of income and expenses to defend against potential audits. Keeping organized documentation can help demonstrate compliance with tax regulations. To help you navigate this process smoothly, check out the tools and resources available at USLegalForms.

Yes, an independent contractor is considered self-employed since they operate their own business and set their own schedule. In the context of a Wyoming Auditor Agreement - Self-Employed Independent Contractor, this classification affects tax obligations, eligibility for benefits, and liability. Being self-employed means you are responsible for managing your taxes, which differs from traditional employment situations. You can find useful resources and forms related to this classification on USLegalForms.

WS 27-3 Article 5 in Wyoming outlines the regulations for independent contractors, focusing on their classification and the implications for tax purposes. This law is essential for anyone entering a Wyoming Auditor Agreement - Self-Employed Independent Contractor, as it defines responsibilities in terms of taxation and social security. Understanding this regulation helps ensure compliance and avoids potential legal issues. For tailored solutions and forms related to this article, consider visiting USLegalForms.

In Wyoming, the self-employment tax applies to individuals who earn income as a self-employed independent contractor. This tax comprises Social Security and Medicare taxes, totaling 15.3% of your net earnings. Additionally, while filing your annual tax returns, you can deduct a portion of the self-employment tax when determining your adjusted gross income. If you are using a Wyoming Auditor Agreement - Self-Employed Independent Contractor, it’s wise to consult a tax professional to understand your specific obligations and potential deductions.

An independent contractor can serve as a subcontractor, but not all independent contractors fit this role. Generally, subcontractors work for another contractor rather than directly for a client. To clarify your working relationships, consider a Wyoming Auditor Agreement - Self-Employed Independent Contractor that outlines your specific duties and obligations.

Legal requirements for independent contractors include obtaining necessary licenses and adhering to tax obligations. You must also follow labor laws and any industry-specific regulations. Drafting a Wyoming Auditor Agreement - Self-Employed Independent Contractor can help ensure you meet all these requirements efficiently.

In Wyoming, the self-employment tax is generally 15.3%, which covers Social Security and Medicare. As a self-employed individual, you are responsible for this tax, so it’s wise to budget appropriately. Consider forming a Wyoming Auditor Agreement - Self-Employed Independent Contractor to help you keep track of your finances and tax obligations.