Wyoming Construction Loan Financing Term Sheet

Description

How to fill out Construction Loan Financing Term Sheet?

If you need to comprehensive, down load, or produce legal document themes, use US Legal Forms, the greatest variety of legal varieties, which can be found online. Make use of the site`s simple and practical research to find the papers you require. A variety of themes for company and personal functions are categorized by groups and claims, or key phrases. Use US Legal Forms to find the Wyoming Construction Loan Financing Term Sheet in a number of mouse clicks.

If you are already a US Legal Forms buyer, log in to the bank account and then click the Obtain key to have the Wyoming Construction Loan Financing Term Sheet. You can also gain access to varieties you previously acquired inside the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for your proper town/nation.

- Step 2. Utilize the Preview method to check out the form`s content material. Don`t forget to see the information.

- Step 3. If you are unsatisfied with all the develop, make use of the Lookup discipline towards the top of the display screen to find other models in the legal develop template.

- Step 4. Upon having identified the shape you require, click the Buy now key. Pick the costs plan you prefer and add your qualifications to sign up to have an bank account.

- Step 5. Process the purchase. You may use your credit card or PayPal bank account to finish the purchase.

- Step 6. Choose the formatting in the legal develop and down load it on your product.

- Step 7. Comprehensive, edit and produce or indication the Wyoming Construction Loan Financing Term Sheet.

Every single legal document template you acquire is the one you have eternally. You have acces to every single develop you acquired with your acccount. Click the My Forms portion and decide on a develop to produce or down load once more.

Compete and down load, and produce the Wyoming Construction Loan Financing Term Sheet with US Legal Forms. There are many expert and status-specific varieties you can utilize for your personal company or personal needs.

Form popularity

FAQ

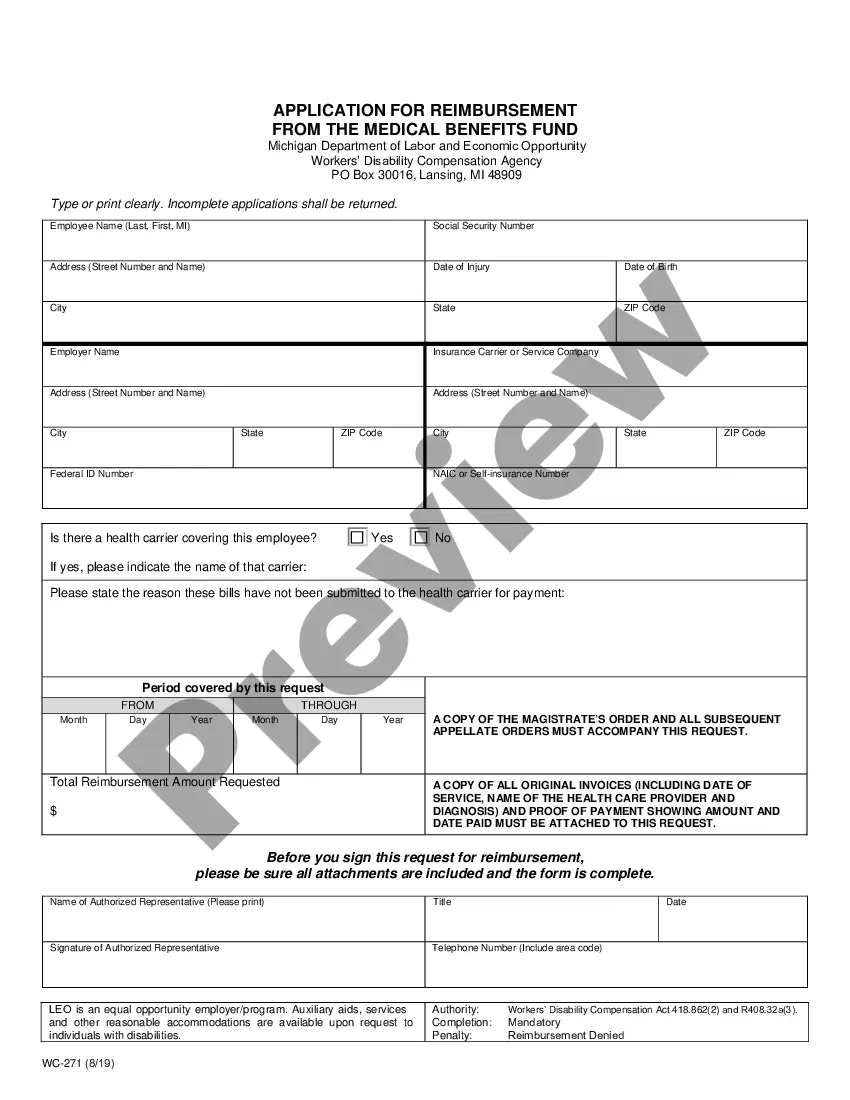

This includes the term, loan size, interest rate, and other financial matters common to debt. Risk mitigation preferences. The lender will often require specific conditions be met or specific information be provided on a recurring, timely manner.

The formula to calculate your monthly loan payment is P = a (r / n). Let's connect each of these letters to the following: P is your monthly loan payment. a is your principal.

You can calculate an approximate interest-only payment in the following way: Multiply the dollar amount advanced on the loan by the interest rate expressed as a decimal, and then divide that amount by 12.

With a construction loan, the lender typically agrees to loan a certain percentage (95%, for example) of the future home's appraised value. Then, they'll suggest a down payment equal to the difference between the approved loan amount and the construction costs.

With a construction loan, the lender typically agrees to loan a certain percentage (95%, for example) of the future home's appraised value. Then, they'll suggest a down payment equal to the difference between the approved loan amount and the construction costs.

As mentioned, construction loans are short-term loans, usually no longer than a year in length. On the other hand, traditional mortgages are long-term loans, with terms typically ranging from 15 ? 30 years. With a mortgage, the borrower receives the money in one lump sum.

Multiply the average amount of the loan during the time it takes to complete the building of the asset by the interest rate and the development time in years. Subtract any investment income that pertains to the interim investment of the borrowed funds.

Assuming that you're making the standard FHA down payment of 3.5 percent, the minimum credit score for a construction loan is 580. Otherwise, you can apply for a new construction FHA loan with a credit score as low as 500, but in that case, you'll need to make a 10 percent down payment.

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

Once you're certain the investors offering you a term sheet are a good match, go beyond the obvious. Investment dollars and valuation are critical, of course, but don't overlook important details like option pools, liquidation preferences and the composition of your board.