Wyoming Documentation Required to Confirm Accredited Investor Status

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

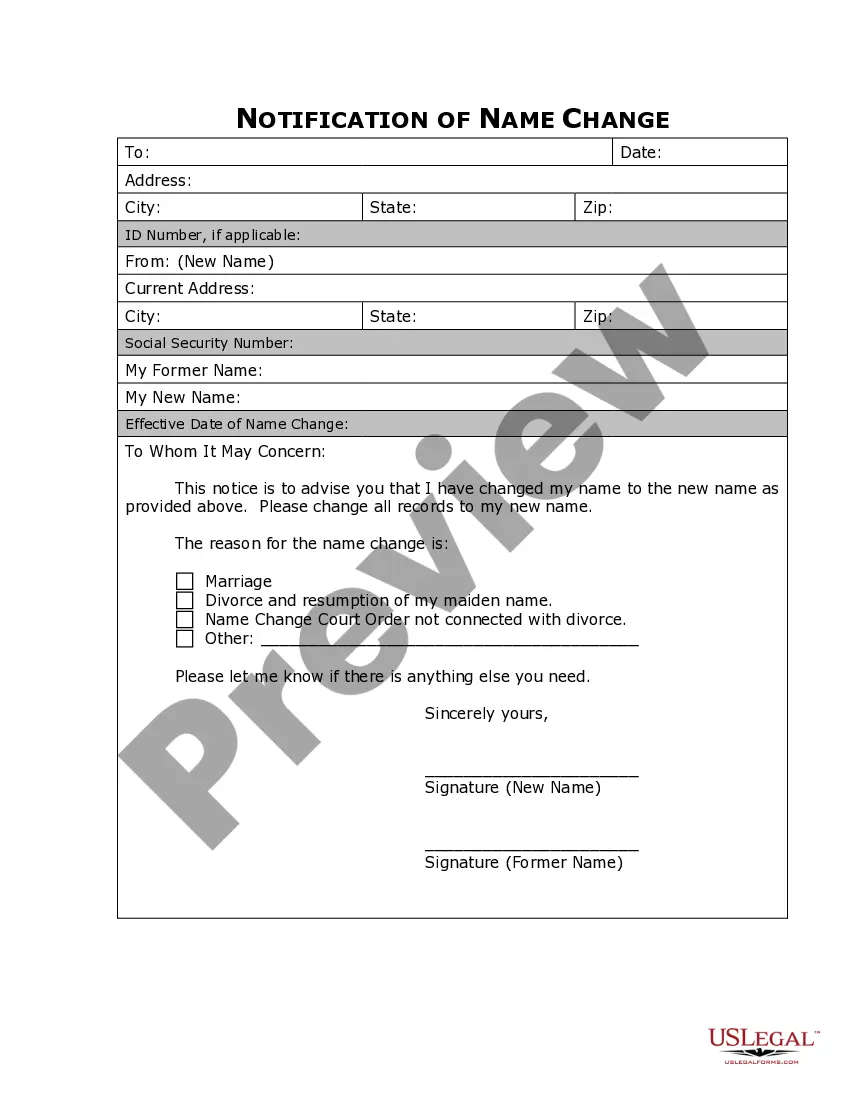

How to fill out Documentation Required To Confirm Accredited Investor Status?

If you wish to comprehensive, acquire, or print authorized record themes, use US Legal Forms, the biggest collection of authorized kinds, which can be found on-line. Utilize the site`s basic and practical search to find the paperwork you need. A variety of themes for company and person uses are categorized by categories and claims, or search phrases. Use US Legal Forms to find the Wyoming Documentation Required to Confirm Accredited Investor Status with a few mouse clicks.

In case you are currently a US Legal Forms client, log in in your bank account and click the Download key to have the Wyoming Documentation Required to Confirm Accredited Investor Status. You may also entry kinds you in the past downloaded from the My Forms tab of your bank account.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for that correct town/region.

- Step 2. Use the Review choice to look over the form`s content. Do not overlook to learn the explanation.

- Step 3. In case you are unhappy using the kind, use the Research discipline towards the top of the display to find other models from the authorized kind template.

- Step 4. After you have located the shape you need, click the Get now key. Pick the prices program you choose and put your references to register to have an bank account.

- Step 5. Method the financial transaction. You can utilize your bank card or PayPal bank account to perform the financial transaction.

- Step 6. Pick the formatting from the authorized kind and acquire it on your own device.

- Step 7. Comprehensive, modify and print or sign the Wyoming Documentation Required to Confirm Accredited Investor Status.

Each and every authorized record template you acquire is the one you have for a long time. You may have acces to each kind you downloaded with your acccount. Select the My Forms area and pick a kind to print or acquire once more.

Contend and acquire, and print the Wyoming Documentation Required to Confirm Accredited Investor Status with US Legal Forms. There are millions of specialist and status-specific kinds you may use for the company or person requirements.

Form popularity

FAQ

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Examples of supporting documents Latest statement from brokerage houses showing net personal assets For net equity of property: Title deeds free of encumbrances. Latest housing loan statement For income: Salary Slip.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.