Wyoming Wholesale Agreement between Lincoln Life and Annuity Co. of New York, Lincoln Financial Advisors Corp. and Delaware Distributors, LP

Description

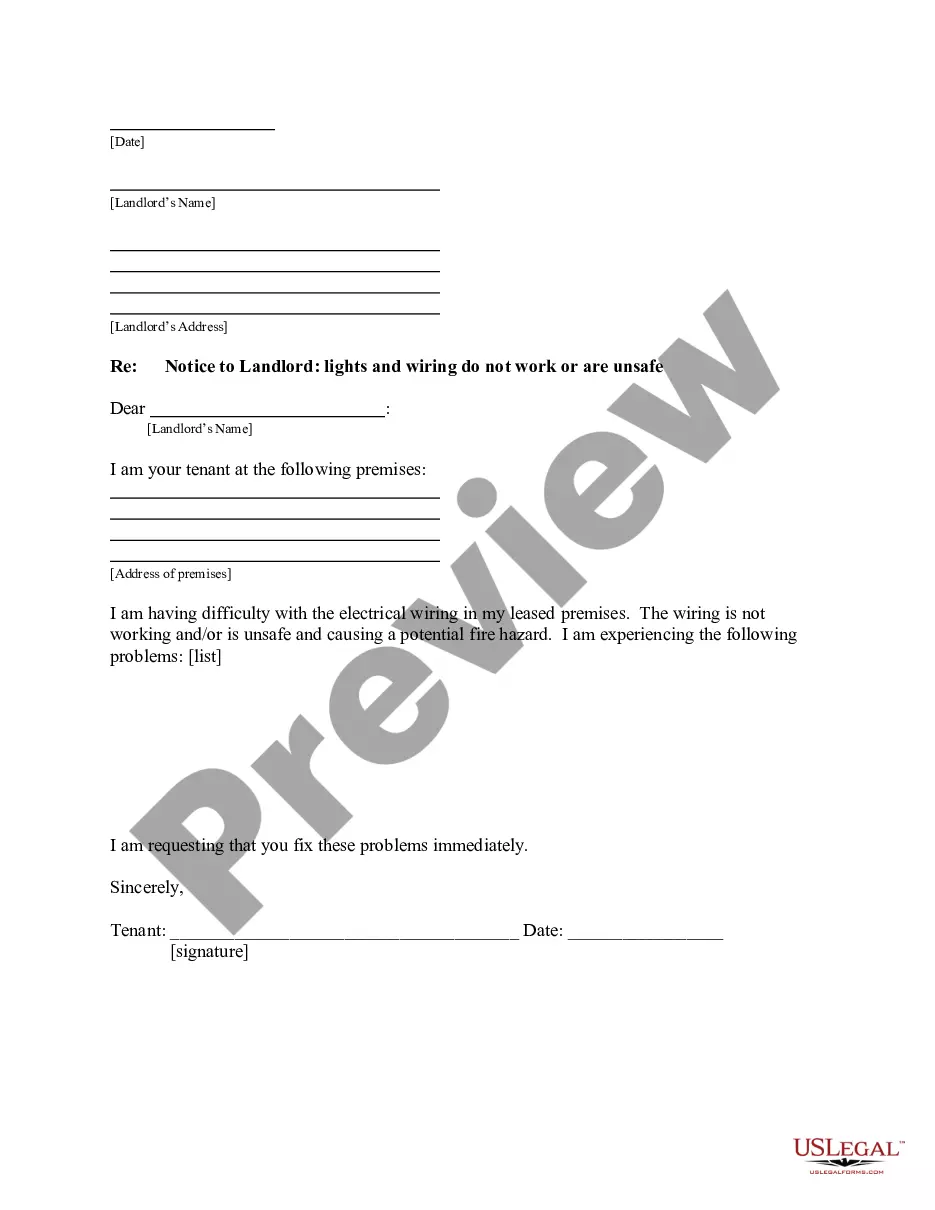

How to fill out Wholesale Agreement Between Lincoln Life And Annuity Co. Of New York, Lincoln Financial Advisors Corp. And Delaware Distributors, LP?

If you wish to comprehensive, obtain, or printing authorized document templates, use US Legal Forms, the greatest selection of authorized forms, which can be found online. Take advantage of the site`s basic and handy look for to discover the documents you require. A variety of templates for business and specific uses are sorted by groups and states, or key phrases. Use US Legal Forms to discover the Wyoming Wholesale Agreement between Lincoln Life and Annuity Co. of New York, Lincoln Financial Advisors Corp. and Delaware Distributors, LP in just a handful of mouse clicks.

Should you be currently a US Legal Forms customer, log in in your bank account and click on the Acquire switch to get the Wyoming Wholesale Agreement between Lincoln Life and Annuity Co. of New York, Lincoln Financial Advisors Corp. and Delaware Distributors, LP. You can also accessibility forms you earlier downloaded from the My Forms tab of the bank account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for the correct metropolis/country.

- Step 2. Utilize the Review method to look over the form`s content material. Don`t overlook to read the explanation.

- Step 3. Should you be not satisfied using the develop, make use of the Lookup field at the top of the display to get other types of the authorized develop format.

- Step 4. After you have discovered the shape you require, click the Get now switch. Opt for the rates program you choose and add your credentials to register to have an bank account.

- Step 5. Method the purchase. You should use your bank card or PayPal bank account to complete the purchase.

- Step 6. Find the format of the authorized develop and obtain it on the product.

- Step 7. Total, edit and printing or indication the Wyoming Wholesale Agreement between Lincoln Life and Annuity Co. of New York, Lincoln Financial Advisors Corp. and Delaware Distributors, LP.

Every single authorized document format you buy is your own property forever. You have acces to every develop you downloaded within your acccount. Click the My Forms segment and select a develop to printing or obtain once again.

Be competitive and obtain, and printing the Wyoming Wholesale Agreement between Lincoln Life and Annuity Co. of New York, Lincoln Financial Advisors Corp. and Delaware Distributors, LP with US Legal Forms. There are millions of specialist and express-specific forms you can utilize for the business or specific demands.

Form popularity

FAQ

Variable annuities are essentially an insurance contract combined with an investment product. Through a professionally managed "subaccount" (similar to a mutual fund portfolio) within your variable annuity, you invest in stocks, bonds or money market funds or a combination thereof. Annuities - Lincoln Investment lincolninvestment.com ? ReferenceLibrary lincolninvestment.com ? ReferenceLibrary

Lincoln Financial Group is headquartered in Strafford, Radnor Financial Center, 150 N Radnor Chester Rd, United States, and has 21 office locations. Lincoln Financial Group Headquarters and Office Locations - Craft.co craft.co ? lincoln-financial ? locations craft.co ? lincoln-financial ? locations

You may also speak with a Customer Care Professional by calling 800-487-1485 or emailing us at CustServSupportTeam@LFG.com. How do I make a payment? Life insurance resources - Lincoln Financial lincolnfinancial.com ? customerservice ? life... lincolnfinancial.com ? customerservice ? life...

Variable Annuity Disadvantages There are two big disadvantages to variable annuities that you should take into account when comparing annuity plans?the possibility of market loss and high management fees and account charges. You may also have IRS penalties and tax implications to consider.

Ellen G. Cooper is Chairman, President and Chief Executive Officer of Lincoln Financial Group. She is also President and serves on the Board of the principal insurance subsidiaries of Lincoln Financial Group.

Variable annuities come with tax advantages, but they can be expensive. Ideally, you should max out your contributions to your 401(k) and IRA before putting money in an annuity of any kind. That's because annuities are much more advanced products, which makes them better as secondary savings options.

Traditional fixed annuities offer tax-deferred earnings with an initial interest rate guaranteed for a set number of years. Upon renewal, interest rates may be subject to change. You have access to your cash values, if any, and may be subject to surrender charges during the contract's early years.

Our parent company, Lincoln National Corporation, and its affiliates operate under the marketing name of Lincoln Financial Group.

A variable annuity is a contract between you and an insurance company, under which the insurer agrees to make periodic pay- ments to you, beginning either immediately or at some future date. You purchase a variable annuity contract by making either a single purchase payment or a series of purchase payments.

Lincoln Level Advantage® is a long-term investment product that offers tax-deferred growth, access to a lifetime income stream and death benefit protection. Lincoln Level Advantage lincolnfinancial.com ? variableannuities ? le... lincolnfinancial.com ? variableannuities ? le...