Wyoming Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

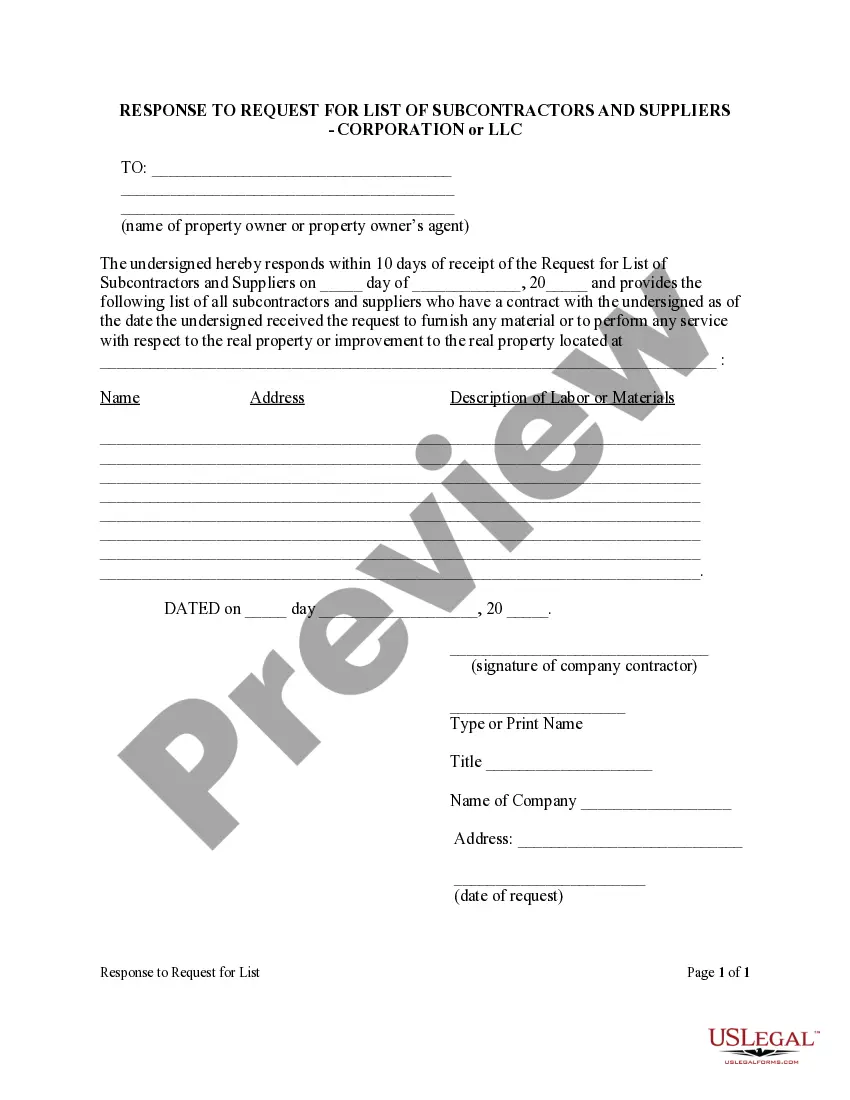

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

US Legal Forms - one of many largest libraries of legal varieties in America - gives a wide array of legal file templates you may acquire or print out. While using site, you can find 1000s of varieties for enterprise and personal purposes, categorized by classes, states, or search phrases.You can find the most recent models of varieties just like the Wyoming Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property in seconds.

If you currently have a monthly subscription, log in and acquire Wyoming Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property through the US Legal Forms catalogue. The Download option will appear on each and every develop you perspective. You have accessibility to all in the past downloaded varieties within the My Forms tab of your account.

If you would like use US Legal Forms initially, listed below are basic directions to help you started out:

- Ensure you have chosen the proper develop for your personal city/state. Click the Preview option to check the form`s articles. Browse the develop information to actually have chosen the right develop.

- If the develop does not fit your specifications, utilize the Look for field on top of the monitor to find the one who does.

- When you are content with the shape, verify your selection by clicking the Purchase now option. Then, select the pricing program you prefer and provide your qualifications to register to have an account.

- Approach the deal. Make use of credit card or PayPal account to perform the deal.

- Find the formatting and acquire the shape on your own device.

- Make modifications. Fill up, revise and print out and indicator the downloaded Wyoming Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property.

Every single web template you added to your money does not have an expiry date and is also yours for a long time. So, if you want to acquire or print out one more backup, just proceed to the My Forms area and click on about the develop you require.

Get access to the Wyoming Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property with US Legal Forms, one of the most considerable catalogue of legal file templates. Use 1000s of professional and state-distinct templates that meet your organization or personal demands and specifications.

Form popularity

FAQ

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

Key Takeaways. Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

Once you disclaim an inheritance, it's permanent and you can't ask for it to be given to you. If you fail to execute the disclaimer after the nine-month period, the disclaimer is considered invalid.

Answer: Just because you are nominated as executor of a Will does not mean that you must serve. You can renounce your rights as executor and decline to act by simply signing and having notarized a Renunciation of Nominated Executor form and filing it with the Surrogate's Court in the county in which your aunt resided.

Thus, disinheriting an extended relative can be as simple as just not mentioning them in your Will in the first place. If you've previously included them, though, you'll need to update language in your Will so anyone you wish to exclude is not noted as a Beneficiary.

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

Renouncing an estate is relatively simple. Your notary will ask you for the copies of the will searches and the death certificate and will then have you sign an estate renunciation deed. If one or several heirs or successors remain identifiable, the estate will belong to them de facto.