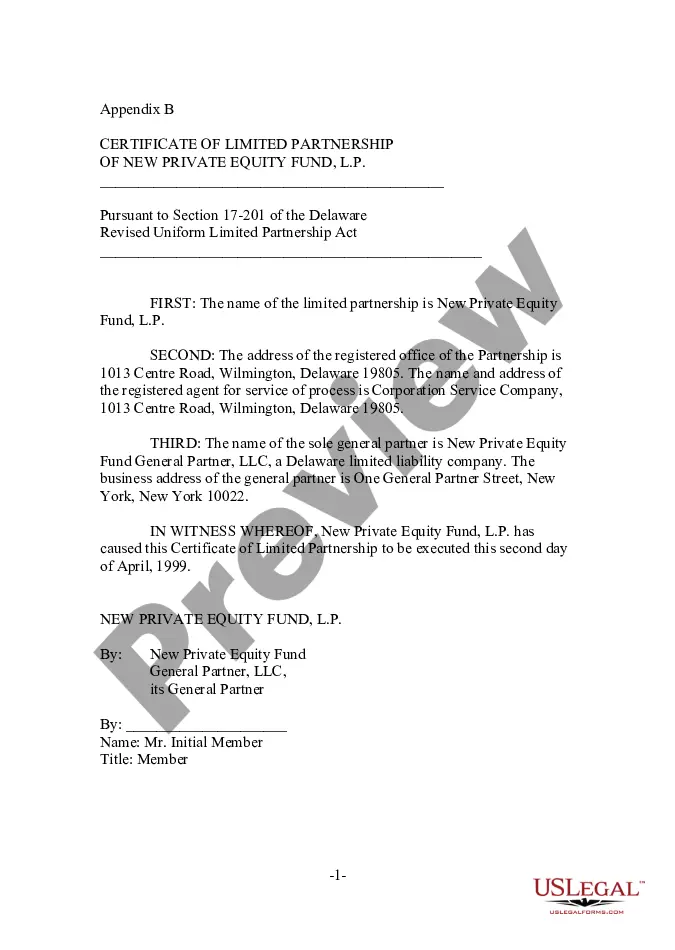

Connecticut Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Certificate Of Limited Partnership Of New Private Equity Fund?

You are able to spend hours on the web searching for the legal document format that fits the federal and state specifications you need. US Legal Forms offers thousands of legal kinds which can be reviewed by pros. You can easily acquire or print the Connecticut Certificate of Limited Partnership of New Private Equity Fund from our services.

If you already possess a US Legal Forms bank account, you may log in and then click the Download switch. After that, you may full, modify, print, or sign the Connecticut Certificate of Limited Partnership of New Private Equity Fund. Each and every legal document format you acquire is yours forever. To have one more version for any bought kind, visit the My Forms tab and then click the related switch.

If you use the US Legal Forms website the first time, follow the simple directions below:

- First, make certain you have selected the correct document format for your state/area that you pick. Browse the kind description to make sure you have selected the right kind. If available, use the Preview switch to search with the document format as well.

- If you wish to get one more variation of your kind, use the Research area to get the format that meets your needs and specifications.

- After you have located the format you would like, click on Purchase now to move forward.

- Choose the pricing plan you would like, enter your references, and register for a free account on US Legal Forms.

- Complete the financial transaction. You may use your bank card or PayPal bank account to purchase the legal kind.

- Choose the structure of your document and acquire it to your product.

- Make alterations to your document if required. You are able to full, modify and sign and print Connecticut Certificate of Limited Partnership of New Private Equity Fund.

Download and print thousands of document templates utilizing the US Legal Forms Internet site, which offers the largest selection of legal kinds. Use skilled and condition-particular templates to handle your small business or individual needs.

Form popularity

FAQ

A PLLC can opt to be treated like an S corp in the eyes of the IRS. It is important to note the following: You will have to file a Form 2553 to make changes to your tax status. Any S class PLLC will file a Form 1120S tax return for corporations to report earned income, costs, and other important business information.

How to form a Connecticut General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

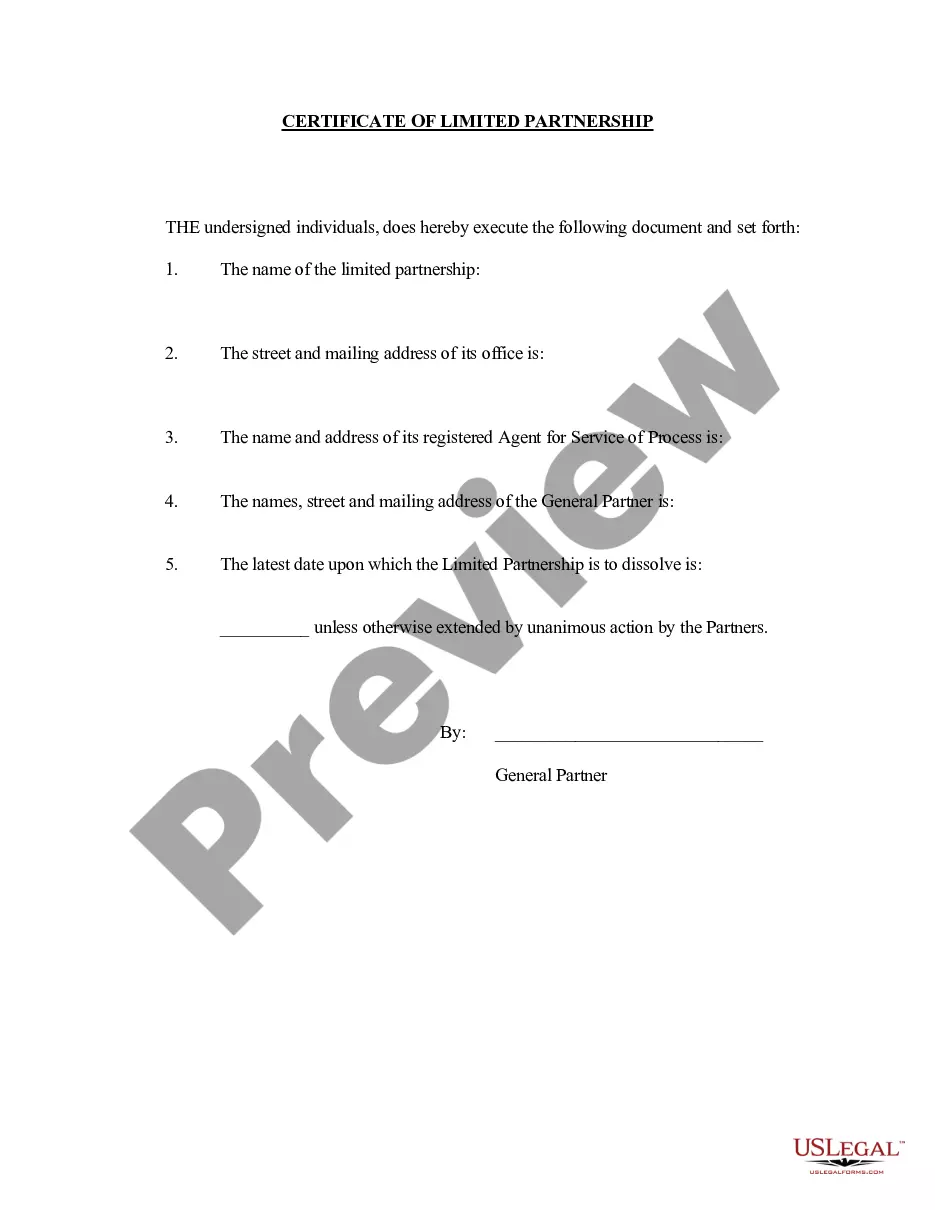

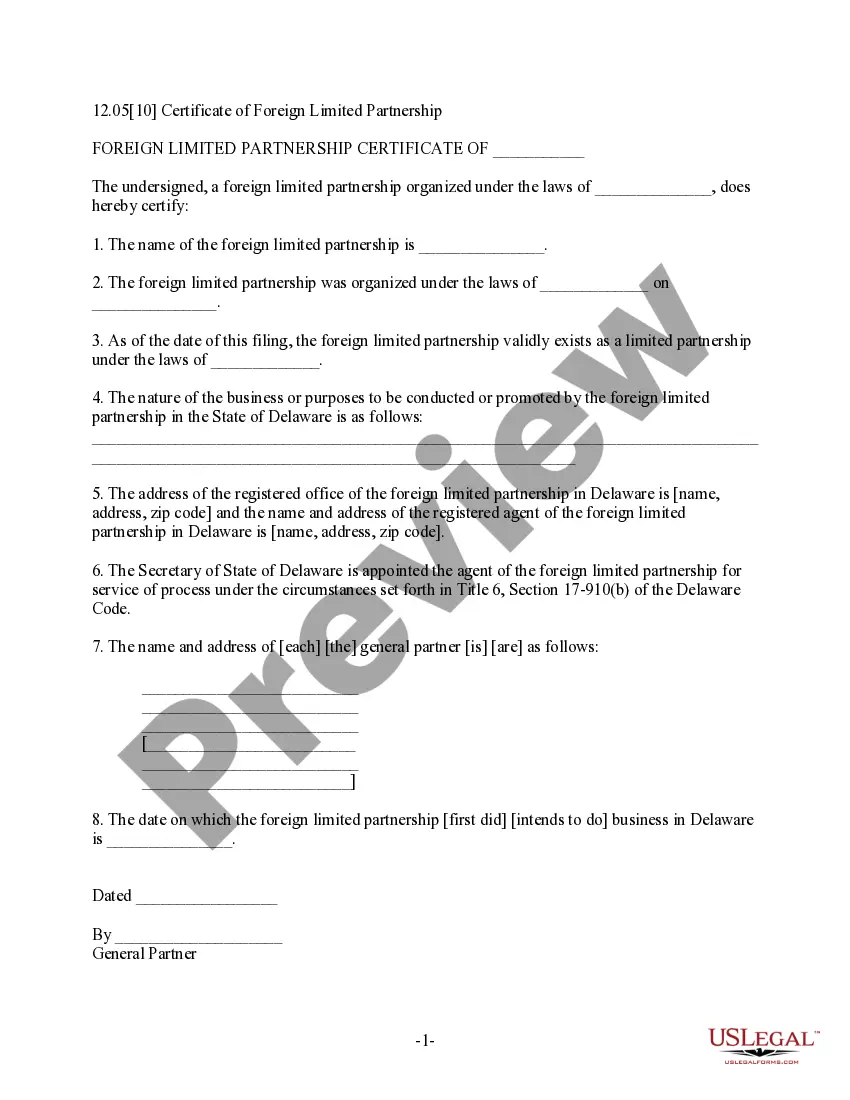

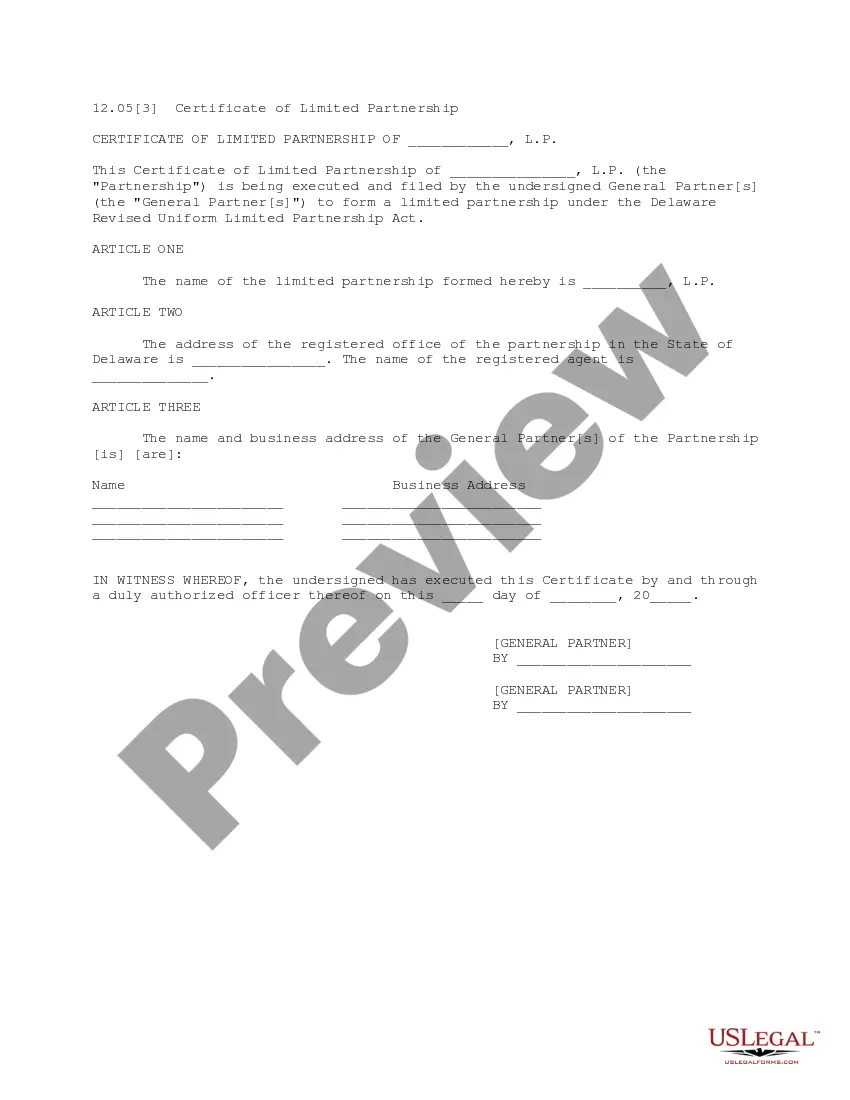

Some states only require that the certificate contains the name of the limited partnership, the name and address of the registered agent and registered office, and the names and addresses of all of the general partners.

Connecticut does not allow professionals, such as accountants, attorneys and physicians, to form a professional limited liability companies (PLLCs).. After forming a limited liability company (LLC) , you must undertake certain steps on an ongoing basis to keep your business in compliance.

Any company registered in Connecticut can order certified copies of its official formation documents from the Connecticut Secretary of the State. Processing time is typically 3-5 business days plus mailing time.

PLLCs in Connecticut have relatively simple formation and maintenance requirements, several options for how they want to be taxed, and flexible management. From one-person businesses to multi-member PLLCs with several owners, the PLLC is a popular choice for a reason.

With an LLC, anyone can be a member, or owner, of the business. State PLLC laws often provide that only licensed professionals can be members, or that a certain number of members must be licensed professionals. A PLLC cannot be used to shield the members from claims for malpractice.

Connecticut LLC Cost. Connecticut's state fee for LLC formation is $120. Connecticut LLCs also need to file an annual report every year, which costs $80. Depending on your industry and business needs, you might have additional expenses, such as licensing fees, business insurance, and registered agent fees.