This due diligence form lists certain documents, items and information which are required in order to complete the due diligence investigation with respect to the company's risk management procedures in business transactions.

Wyoming Insurance and Liability Coverage Due Diligence Request List

Description

How to fill out Insurance And Liability Coverage Due Diligence Request List?

Are you currently in a situation where you frequently require documentation for both business or personal purposes.

There are numerous authentic template documents accessible online, but finding trustworthy versions is challenging.

US Legal Forms provides an extensive collection of form templates, including the Wyoming Insurance and Liability Coverage Due Diligence Request List, crafted to comply with federal and state regulations.

Once you find the correct form, click on Buy now.

Choose your payment plan, enter the necessary information to set up your payment, and finalize the purchase using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you’ve purchased in the My documents menu. You can retrieve another copy of the Wyoming Insurance and Liability Coverage Due Diligence Request List at any time if needed by selecting the required form to download or print the template. Use US Legal Forms, the most extensive collection of authentic forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Wyoming Insurance and Liability Coverage Due Diligence Request List template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct area/state.

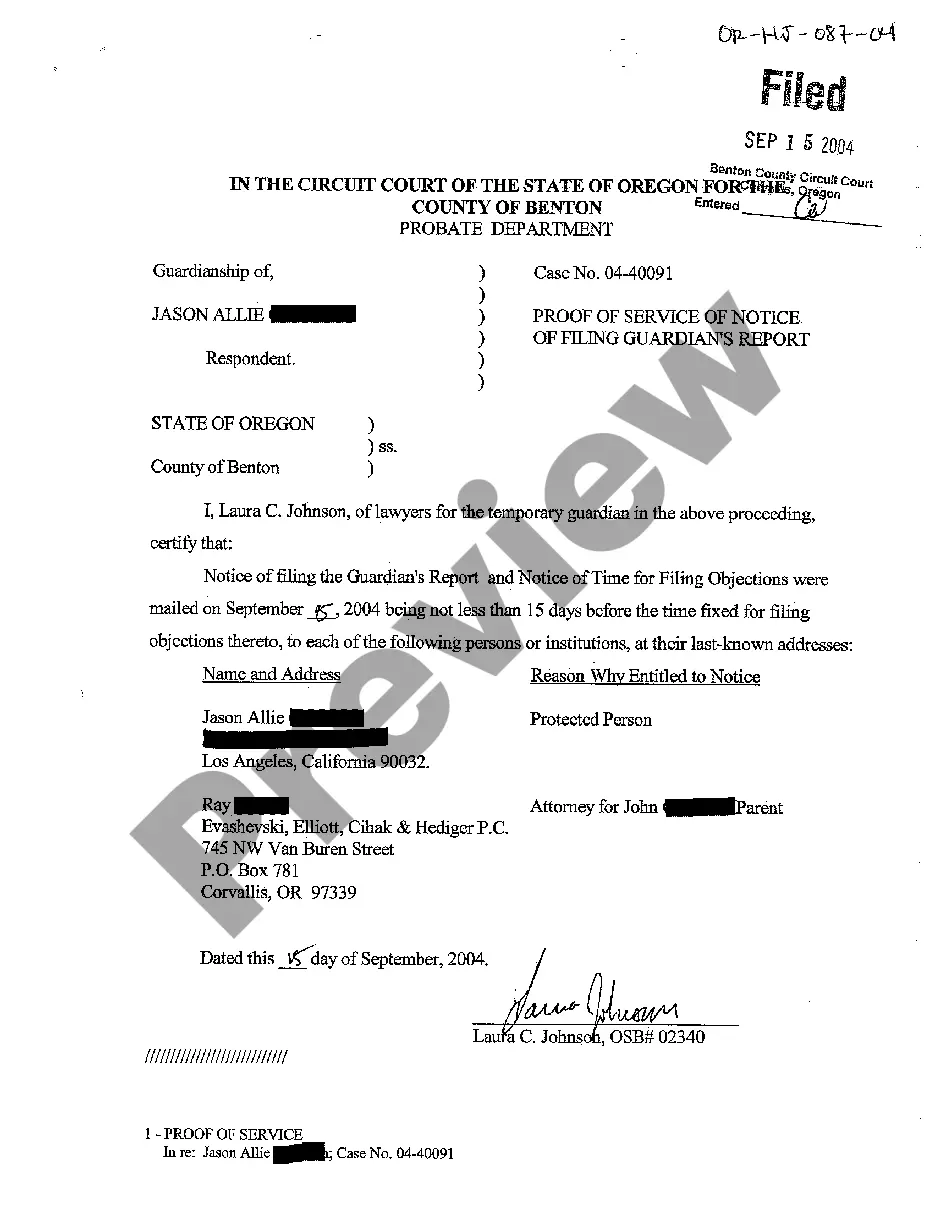

- Utilize the Review button to examine the form.

- Read the details to guarantee you have selected the appropriate form.

- If the form does not meet your requirements, use the Search box to find the form that matches your needs.

Form popularity

FAQ

Due diligence documents include any paperwork, research, or information needed for the due diligence process. For example, stockholder agreements, government audits, trademarks, customer contracts, and license agreements are all different types of due diligence documents.

Insurance Due DiligencePinpoint key insurable risk exposures.Identify the target's insurance purchasing strategy.Establish the total cost of insurance.Assess the target's loss history.

A due diligence checklist is an organized way to analyze a company that you are acquiring through sale, merger, or another method. By following this checklist, you can learn about a company's assets, liabilities, contracts, benefits, and potential problems.

Documents Required During Company Due DiligenceMemorandum of Association.Articles of Association.Certificate of Incorporation.Shareholding Pattern.Financial Statements.Income Tax Returns.Bank Statements.Tax Registration Certificates.More items...

This term is commonly used to refer to the review of financial and legal documents in a merger or acquisition but is equally applicable to virtually any decision-making process, including whether to insure or self-insure, whether to form a captive insurance company, and a host of other risk management decisions.

50+ Commonly Asked Questions During Due DiligenceCompany information. Who owns the company?Finances. Where are the company's quarterly and annual financial statements from the past several years?Products and services.Customers.Technology assets.IP assets.Physical assets.Legal issues.

Due diligence documents are the research and analysis of a company or organization done in preparation for a business transaction (such as a corporate merger or purchase of securities). Due diligence documents typically include the following categories; legal, financial, sales and marketing, and human resources.

10 Strategies to Prepare for Due DiligenceBegin early.Use English.Pay attention to the details.Be mindful of NDAs.Sign an NDA.Build a virtual data room.Lean on a team of trusted advisors.Perform a self-audit.More items...?

Below, we take a closer look at the three elements that comprise human rights due diligence identify and assess, prevent and mitigate and account , quoting from the Guiding Principles.

During the due diligence process, an investor will request information about your company that will inform their investment decision moving forward. In addition to asking questions of you and key members of your management team during meetings or phone calls, they will provide you with a request list.