Wyoming Complex Will - Max. Credit Shelter Marital Trust to Children

Description

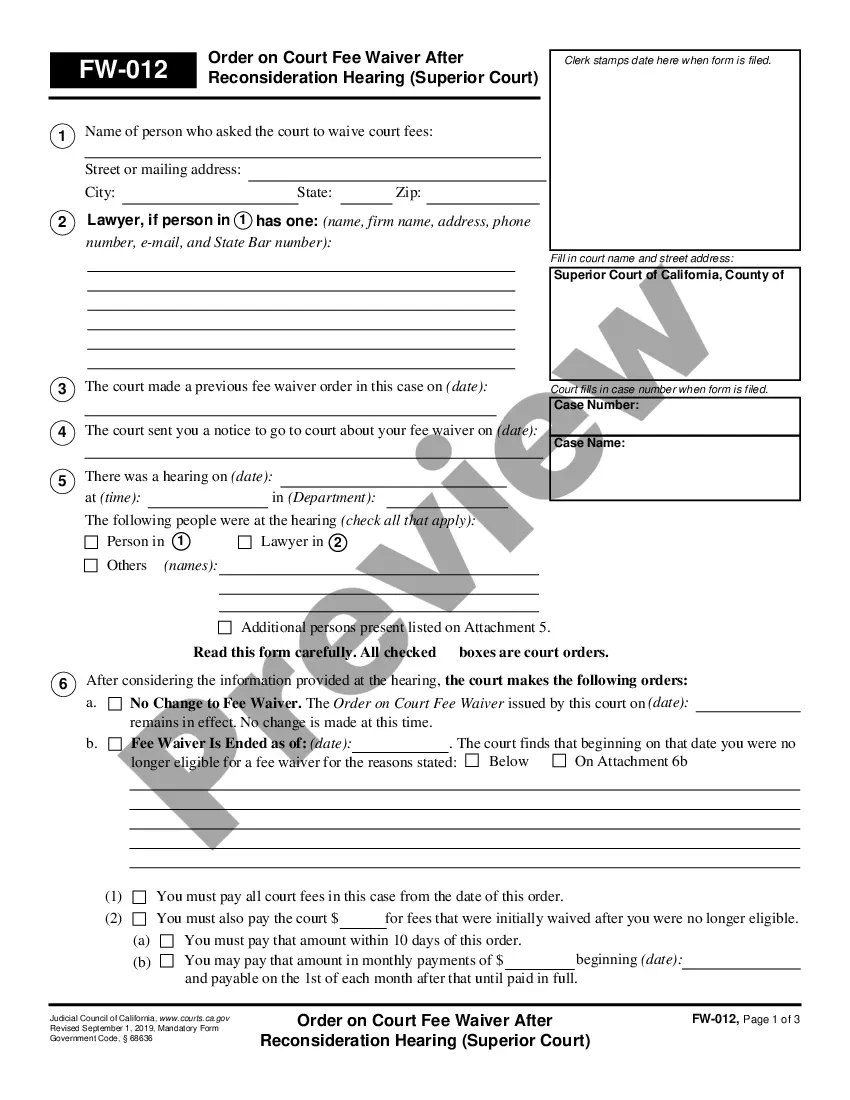

How to fill out Complex Will - Max. Credit Shelter Marital Trust To Children?

Finding the right authorized document web template can be a have difficulties. Naturally, there are a lot of web templates available on the net, but how can you get the authorized form you need? Make use of the US Legal Forms web site. The support provides a large number of web templates, including the Wyoming Complex Will - Max. Credit Shelter Marital Trust to Children, that can be used for enterprise and personal requires. All the kinds are checked out by pros and fulfill federal and state demands.

Should you be currently signed up, log in for your profile and click the Download key to obtain the Wyoming Complex Will - Max. Credit Shelter Marital Trust to Children. Make use of your profile to search from the authorized kinds you may have purchased in the past. Go to the My Forms tab of the profile and get yet another copy of the document you need.

Should you be a brand new customer of US Legal Forms, here are basic instructions that you should comply with:

- First, ensure you have chosen the appropriate form for your metropolis/area. You can check out the form while using Review key and study the form outline to make certain it is the right one for you.

- In case the form will not fulfill your expectations, utilize the Seach discipline to discover the appropriate form.

- When you are sure that the form is acceptable, click on the Get now key to obtain the form.

- Pick the rates prepare you desire and enter the needed information. Design your profile and buy the order utilizing your PayPal profile or charge card.

- Opt for the data file file format and acquire the authorized document web template for your device.

- Total, revise and printing and sign the attained Wyoming Complex Will - Max. Credit Shelter Marital Trust to Children.

US Legal Forms will be the biggest local library of authorized kinds where you will find numerous document web templates. Make use of the service to acquire professionally-manufactured documents that comply with condition demands.

Form popularity

FAQ

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

The primary benefit of CSTs is that the surviving spouse can use the trust's principal and income during the remainder of their lifetime, for example, for medical or educational expenses. The remaining assets then pass to the beneficiaries and are not subject to estate taxes.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.

The 5&5 Power allows the surviving spouse to request the greater of $5,000.00 and 5% of the trust principal every year to be used in any manner of the surviving spouse's choosing. The beauty of the Disclaimer Trust is that it is flexible.

Key Takeaways. A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.

Five by Five Power ? The ability for the beneficiary to take the greater of $5000 or 5% of the trust each calendar year; a 5% version of the Lifetime General Power. Some access translates to 5% of the income being taxable to the beneficiary, and 5% being included in the power holder's estate.