Wyoming Job Sharing Agreement Form

Description

How to fill out Job Sharing Agreement Form?

If you need to finalize, obtain, or produce legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site's straightforward and user-friendly search function to find the documents you require.

A variety of templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to access the Wyoming Job Sharing Agreement Form in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Get button to retrieve the Wyoming Job Sharing Agreement Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

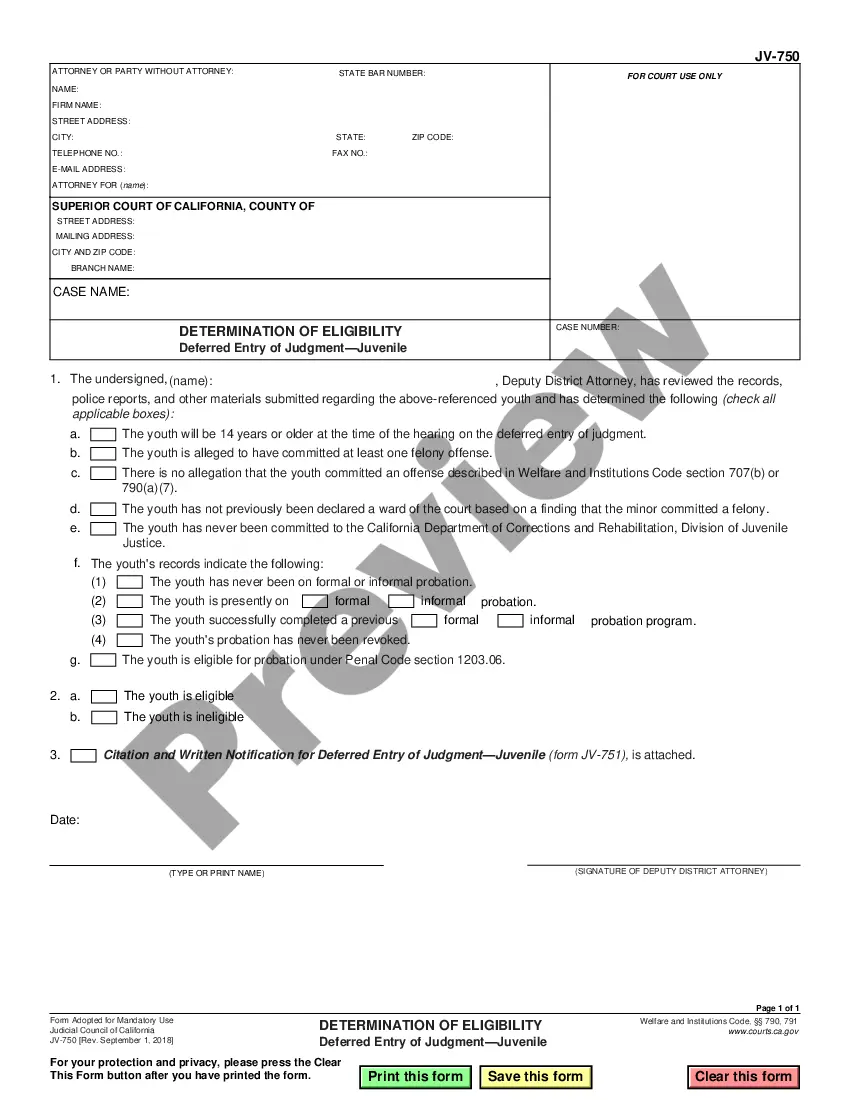

- Step 2. Use the Preview option to review the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the type, use the Search box at the top of the screen to find alternative types from the legal form template.

Form popularity

FAQ

Retention of valued employees: Job sharing keeps workers seeking reduced hours, such as working parents, from being forced to quit your company to get time off. It can greatly reduce expensive employee turnover, which is especially important in key positions.

A job share arrangement is a full-time job split between two individuals, each with responsibility for the success of the total job. Job sharing allows two staff members to share the responsibilities of one full-time position, typically with prorated salary and paid time off.

Step-by-Step Guide to Running Payroll in WyomingStep 1: Set up your business as an employer.Step 2: Register your business with the State of Wyoming.Step 3: Create your payroll process.Step 4: Have employees fill out relevant forms.Step 5: Review and approve timesheets.More items...?

How does workers' comp work in Wyoming? The goal of workers' compensation insurance is to help employees recover from a work injury and return to their job. It covers the cost of medical bills related to a workplace injury or occupational disease, and also covers part of their lost wages.

Job sharing is a flexible work option in which two or possibly more employees share a single job. For example, one person may work in a certain position Monday and Tuesday, and a second person may occupy that same position Thursday and Friday.

How to process payroll yourselfStep 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.

The advantages and disadvantages of job sharingMore diverse skills and experience being utilized in a single position (especially when they are complementary)Enhanced problem solving by having two people work on the task.Greater continuity and coverage of work during absences, decreased absenteeism.More items...?

Employer benefits For employers, the benefits of offering job share arrangements include: attracting a wider pool of applicants for new jobs. more part-time work available in the organisation. more skills and experience in a position (especially if employees have complementary skills)

10 Steps to Setting Up a Payroll SystemObtain an Employer Identification Number (EIN)Check whether you need state/local IDs.Independent contractor or employee.Take care of employee paperwork.Decide on a pay period.Carefully document your employee compensation terms.Choosing a payroll system.Running payroll.More items...

Job sharing means that two (or more) workers share the duties of one full-time job, each working part time, or two or more workers who have unrelated part-time assignments share the same budget line.