Wyoming Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

How to fill out Self-Employed Independent Contractor Consulting Agreement - Detailed?

Have you ever been in a situation where you need to have documents for various company or personal activities regularly.

There are numerous authentic document templates accessible online, but obtaining versions you can trust is not simple.

US Legal Forms provides a vast collection of form templates, such as the Wyoming Self-Employed Independent Contractor Consulting Agreement - Detailed, which are designed to comply with state and federal regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Wyoming Self-Employed Independent Contractor Consulting Agreement - Detailed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for the correct area/state.

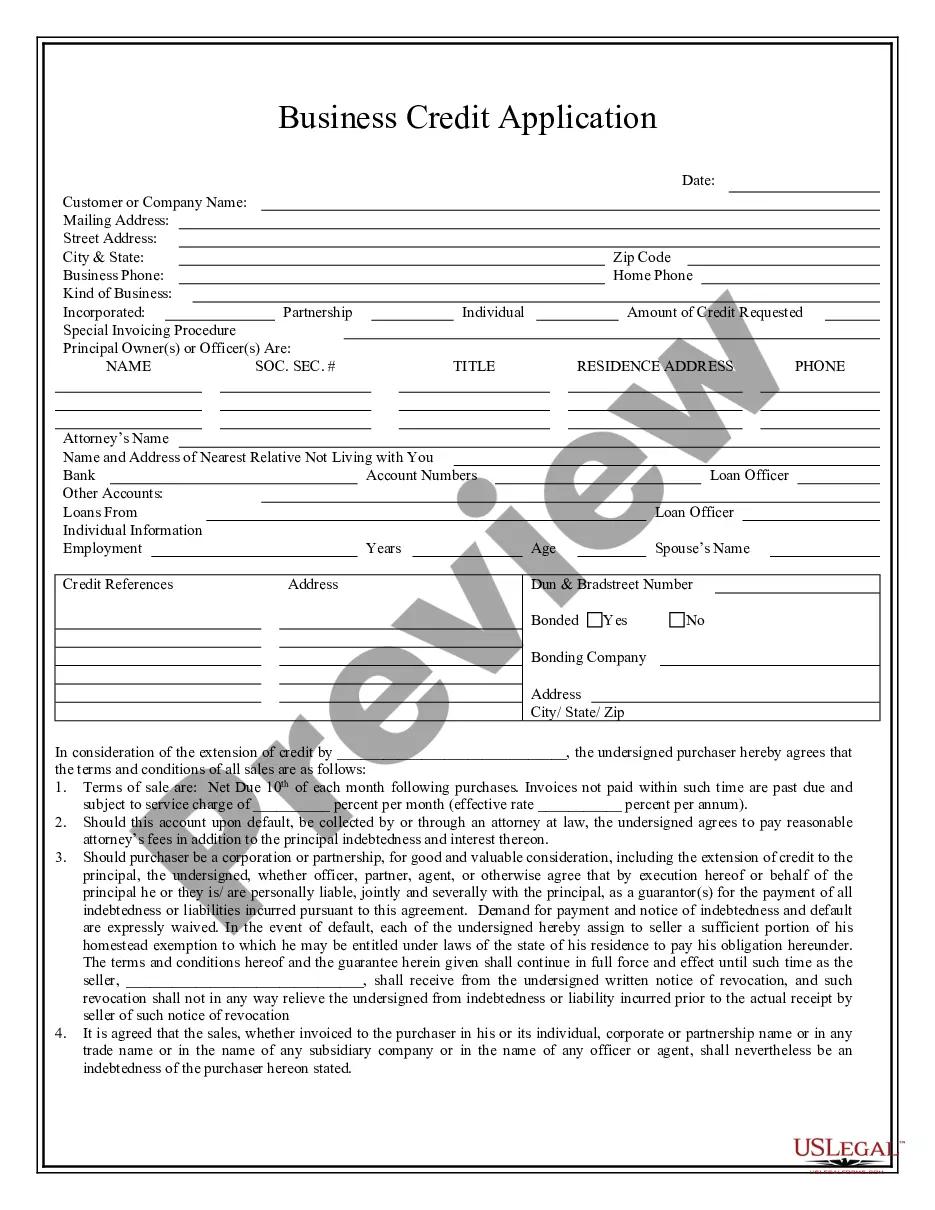

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Lookup section to find the form that meets your needs and requirements.

Form popularity

FAQ

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?