Wyoming Agreement to Sell Real Property Owned by Partnership to One of the Partners

Description

carry on as co-owners of a business for profit.

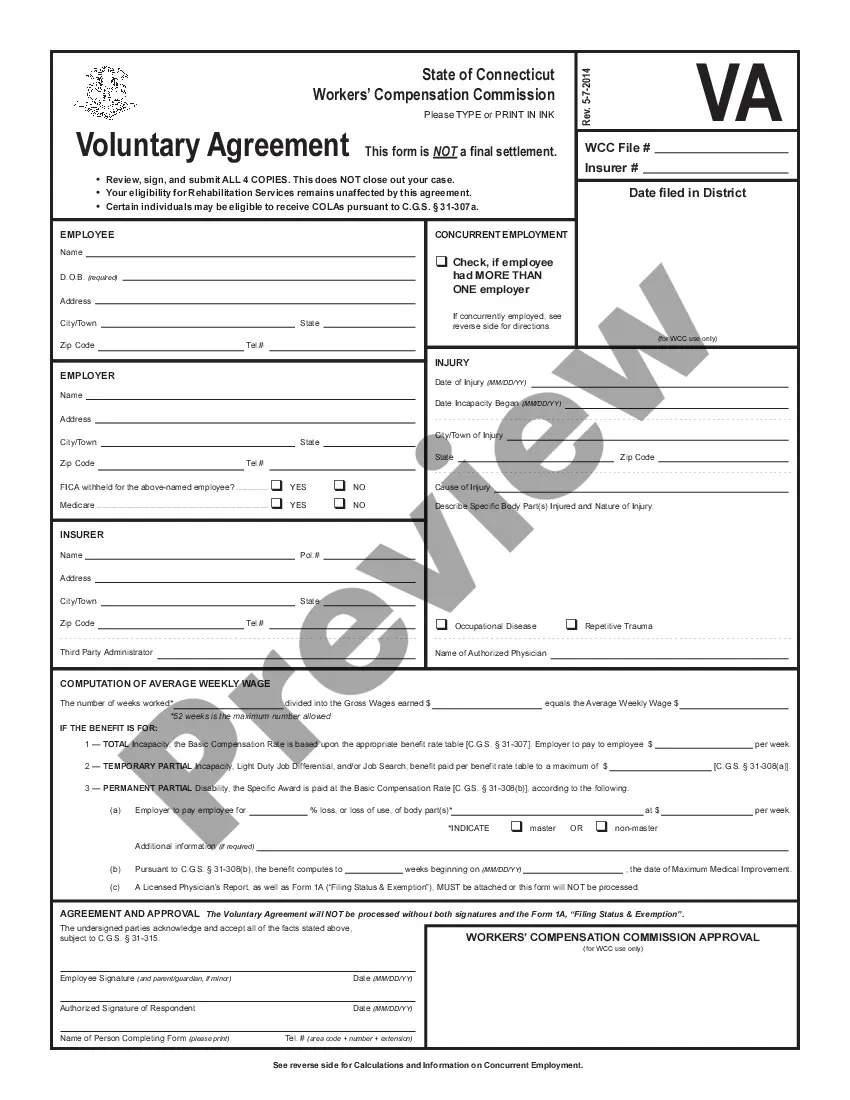

How to fill out Agreement To Sell Real Property Owned By Partnership To One Of The Partners?

If you require to completely, download, or create authentic document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for commercial and personal usage are categorized by types and states, or keywords and phrases.

Step 4. Once you have located the form you need, click on the Buy now button. Choose the payment plan you prefer and enter your credentials to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to discover the Wyoming Agreement to Sell Real Property Owned by Partnership to One of the Partners in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download option to access the Wyoming Agreement to Sell Real Property Owned by Partnership to One of the Partners.

- You can also retrieve forms you have previously acquired from the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have chosen the form for the correct city/region.

- Step 2. Take advantage of the Review feature to review the form's content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other variations in the legal form design.

Form popularity

FAQ

While Wyoming is not a tax-exempt state, it is known for its favorable tax climate, particularly for LLCs and partnerships. The absence of state income tax and low fees simplify financial obligations for businesses. As such, partnerships can thrive without the added pressure of high taxes. Your Wyoming Agreement to Sell Real Property Owned by Partnership to One of the Partners enhances your ability to capitalize on these benefits.

Of California prior to filing a Statement of Dissolution (Form GP-4). Fees: There is no fee for filing a Statement of Dissolution (Form GP-4).

Start now and decide later.Review and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

Company name, status, and duration.Liability of the partners.Number of owners/control of the business.Capital.Management, decision-making and binding the partnership.Dissolution.Death and disability.Transfer of partnership interests.More items...?

Importantly, a partnership comes to an end whenever there is a change in the people (or entities) making up the partnership. So, for example, if a new partner joins a partnership or an old partner leaves a partnership, the 'original partnership' ends and a 'new partnership' is formed.

A limited partner is a part-owner of a company whose liability for the firm's debts cannot exceed the amount that an individual invested in the company. Limited partners are often called silent partners.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

At its core, a real estate partnership agreement shows a commitment between two business partners. It will typically outline shared goals and a mission for the business; the purpose is to ensure both partners are consistently working towards the same thing.

If you are a limited partner, the initial basis is solely defined by the property and cash you contribute to the business.