Wyoming Renewable Performance Bond

Description

How to fill out Renewable Performance Bond?

Choosing the right legitimate file design can be a have difficulties. Of course, there are a lot of themes available on the net, but how would you get the legitimate type you want? Use the US Legal Forms website. The assistance offers thousands of themes, like the Wyoming Renewable Performance Bond, that you can use for business and personal needs. All of the varieties are checked out by pros and meet up with federal and state needs.

If you are already authorized, log in to your bank account and then click the Obtain option to find the Wyoming Renewable Performance Bond. Make use of bank account to check with the legitimate varieties you have bought formerly. Visit the My Forms tab of your bank account and have yet another backup of the file you want.

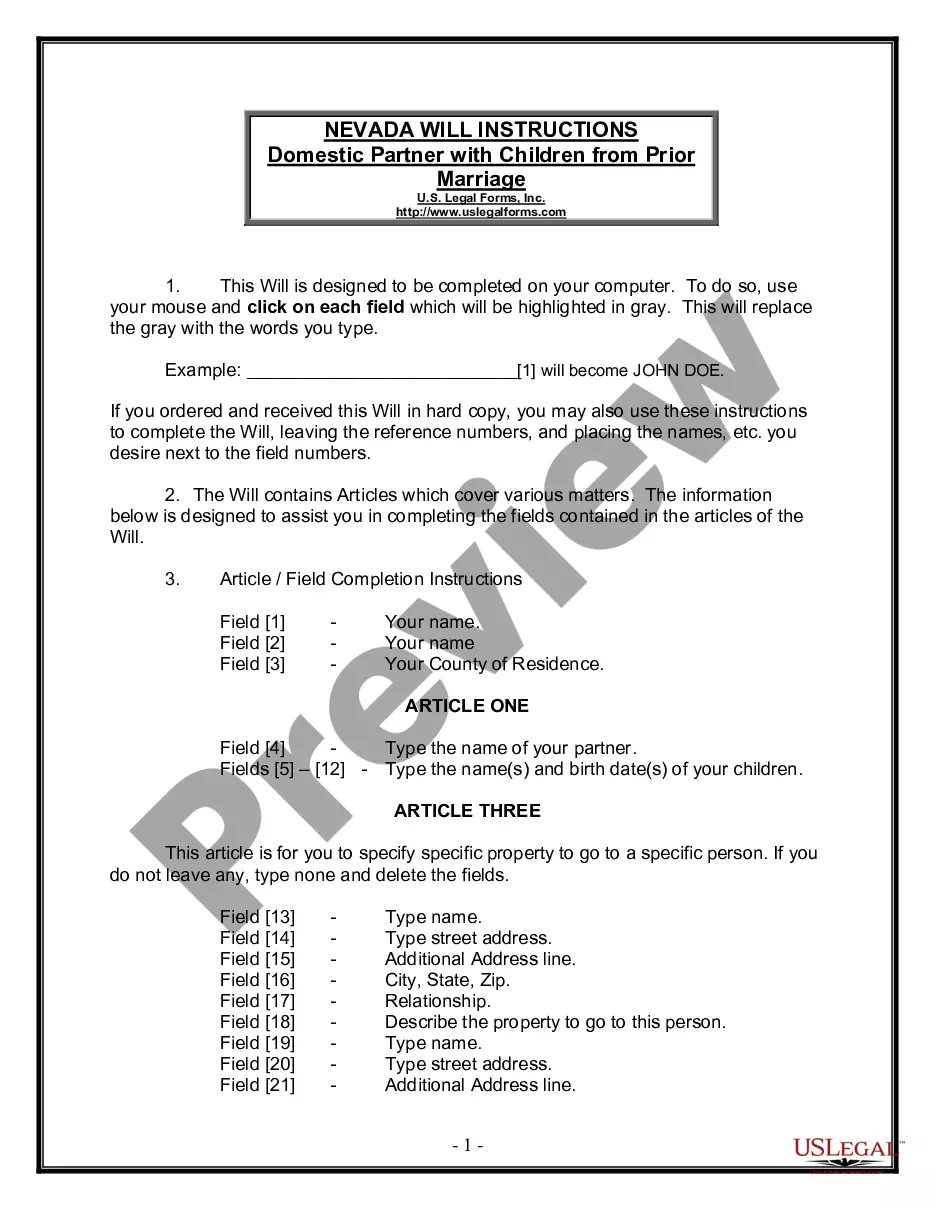

If you are a fresh user of US Legal Forms, allow me to share easy directions that you can stick to:

- Initial, ensure you have chosen the right type for the city/state. You are able to look over the form while using Review option and study the form description to ensure it is the best for you.

- When the type is not going to meet up with your needs, make use of the Seach industry to discover the appropriate type.

- Once you are certain the form is proper, go through the Get now option to find the type.

- Select the pricing strategy you need and enter in the essential information and facts. Design your bank account and pay money for an order using your PayPal bank account or charge card.

- Choose the data file file format and acquire the legitimate file design to your device.

- Complete, edit and print and signal the acquired Wyoming Renewable Performance Bond.

US Legal Forms is definitely the biggest catalogue of legitimate varieties that you can find different file themes. Use the company to acquire expertly-created papers that stick to status needs.

Form popularity

FAQ

Surety bonds are, in general terms, a legal contract that promises you will abide by the terms of another contract in Wyoming. A surety can also be thought of as a mix between an insurance instrument and a credit instrument.

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

A performance bond is a financial guarantee that the terms of a contract will be honored. If one party to a contract cannot complete their obligations, the bond is paid out to the other party to compensate for their damages or costs.

Being bonded means that an insurance and bonding company has procured funds that are available to the customer contingent upon them filing a claim against the company. If you are a contractor or other type of business owner, you may have good reason to explore what it means to be surety bonded.

A performance bond, which can be either conditional or unconditional, is a form of security usually issued by a bank or insurance company, guaranteeing a contractor's obligations towards the employer.

Surety bonds also come with the following cons for contractors: A bonded contractor must pay for the bond and will also be responsible for paying valid bond claims. A lapse in a bond can result in a license suspension or the invalidation of a contract. Required renewals can add ongoing expenses.

Potential Risks of Surety Bonds If the principal defaults on the bond's terms, they are liable to reimburse the surety for any claims paid. This can lead to significant financial liability for the principal.

Simply put, a fidelity bond indemnifies a loss whereas a faithful performance bond guarantees the faithful performance of duties. Faithful performance of duties also, necessarily, includes fidelity and honesty to the public entity. A faithful performance bond covers the same dishonesty as a fidelity bond.