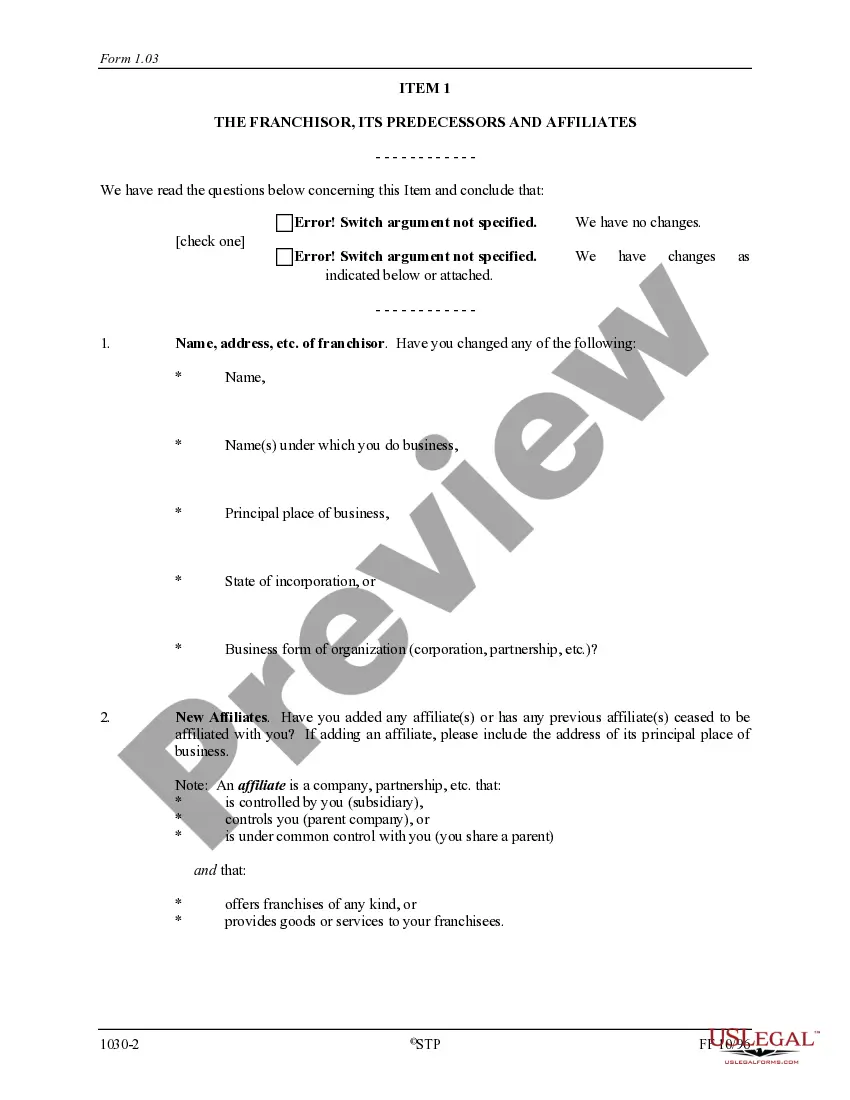

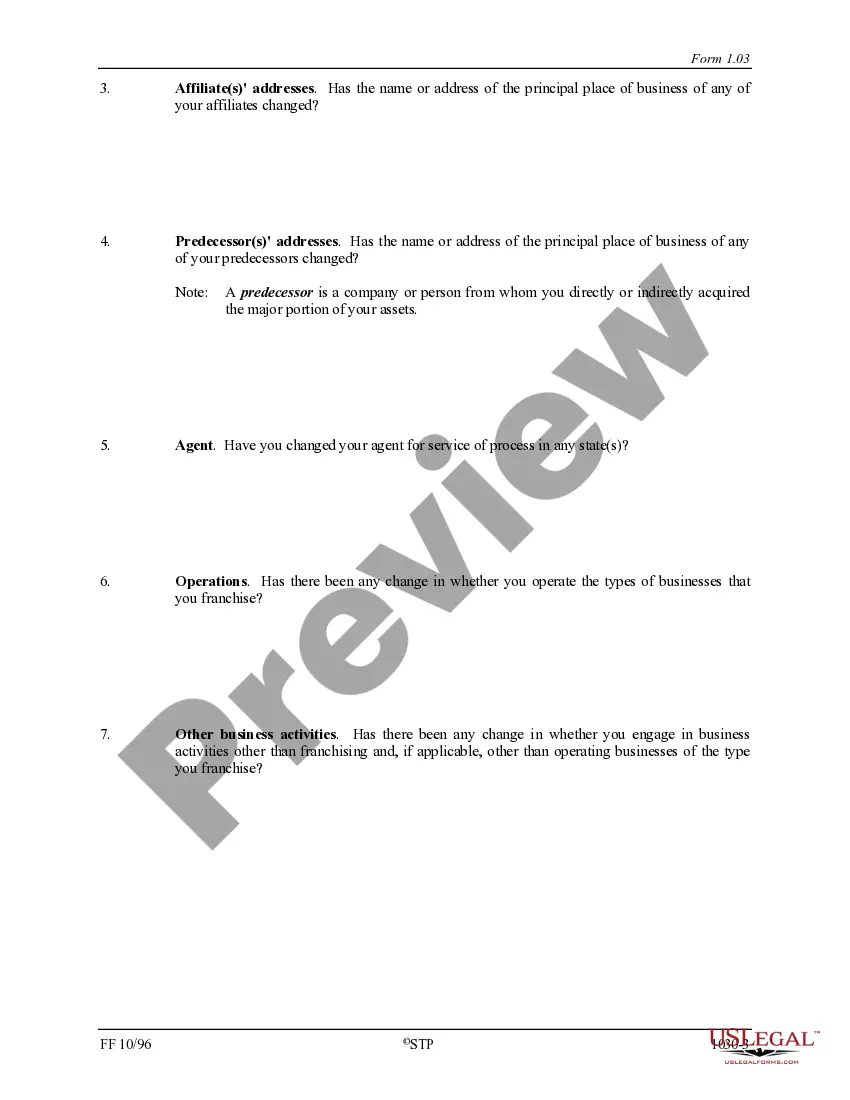

Wyoming Franchise Registration Renewal Questionnaire

Description

How to fill out Franchise Registration Renewal Questionnaire?

You may commit several hours on the Internet attempting to find the legitimate record design that suits the state and federal requirements you will need. US Legal Forms supplies 1000s of legitimate types that happen to be analyzed by specialists. It is possible to down load or printing the Wyoming Franchise Registration Renewal Questionnaire from our assistance.

If you have a US Legal Forms profile, you may log in and click the Obtain button. After that, you may total, change, printing, or indication the Wyoming Franchise Registration Renewal Questionnaire. Every legitimate record design you acquire is the one you have forever. To obtain an additional backup associated with a bought type, go to the My Forms tab and click the related button.

If you are using the US Legal Forms site the very first time, adhere to the straightforward instructions beneath:

- Initially, make sure that you have chosen the best record design for that state/city of your choice. Look at the type information to ensure you have picked the proper type. If offered, make use of the Preview button to appear throughout the record design also.

- In order to find an additional edition of your type, make use of the Search discipline to discover the design that fits your needs and requirements.

- When you have discovered the design you desire, click on Get now to proceed.

- Choose the prices program you desire, type in your references, and sign up for a free account on US Legal Forms.

- Complete the deal. You should use your bank card or PayPal profile to fund the legitimate type.

- Choose the format of your record and down load it for your gadget.

- Make changes for your record if possible. You may total, change and indication and printing Wyoming Franchise Registration Renewal Questionnaire.

Obtain and printing 1000s of record templates using the US Legal Forms web site, that offers the largest selection of legitimate types. Use expert and express-certain templates to tackle your business or individual needs.

Form popularity

FAQ

Wyoming Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state.

Wyoming's charging order protection laws are effective for members to protect their LLC assets and ownership from creditors. However, that protection does not extend outside of Wyoming. Members living out of state will have to deal with different laws protecting their LLC assets from garnishment by creditors.

We commonly use the Wyoming Secretary of State's website to search for business filings. Their online portal allows you to see what company names are available, what filings have been accepted and provides a snapshot of each company's corporate history. Every company document can be searched, viewed and downloaded.

Annual LLC Fees Wyoming's LLC is required to pay an annual fee of $60 to the Secretary of State beginning the second year. There is again a $2 convenience fee for paying online. The annual report is technically calculated as the lesser of $60 or $60 for every $250k in assets in Wyoming.

An LLC taxed as a C-corp will pay the 21% federal corporate income tax, but because Wyoming does not have a state-level corporate income tax, you won't have to worry about added tax bills on corporate profits.

Limited Liability Companies: *Annual Report License tax is $60 or two-tenths of one mill on the dollar ($. 0002) whichever is greater based on the company's assets located and employed in the state of Wyoming.

Late Fees: Wyoming doesn't charge penalty fees for failing to file an annual report. However, your business will no longer be in good standing. Don't remember when you formed your business? You can find your anniversary month by searching the Wyoming Business Database.

To remain in good standing each business entity, domestic and foreign, is required to file an annual report and pay a fee based on its assets located and employed in Wyoming or is assessed a flat filing fee.