US Legal Forms - one of many biggest libraries of lawful types in the USA - provides an array of lawful record web templates it is possible to obtain or produce. Using the site, you may get thousands of types for company and individual functions, sorted by types, suggests, or keywords.You will discover the latest variations of types much like the Wyoming Application and Loan Agreement for a Business Loan with Warranties by Borrower within minutes.

If you already possess a registration, log in and obtain Wyoming Application and Loan Agreement for a Business Loan with Warranties by Borrower from your US Legal Forms local library. The Acquire option will show up on every single kind you see. You gain access to all in the past downloaded types within the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, here are straightforward instructions to help you get started:

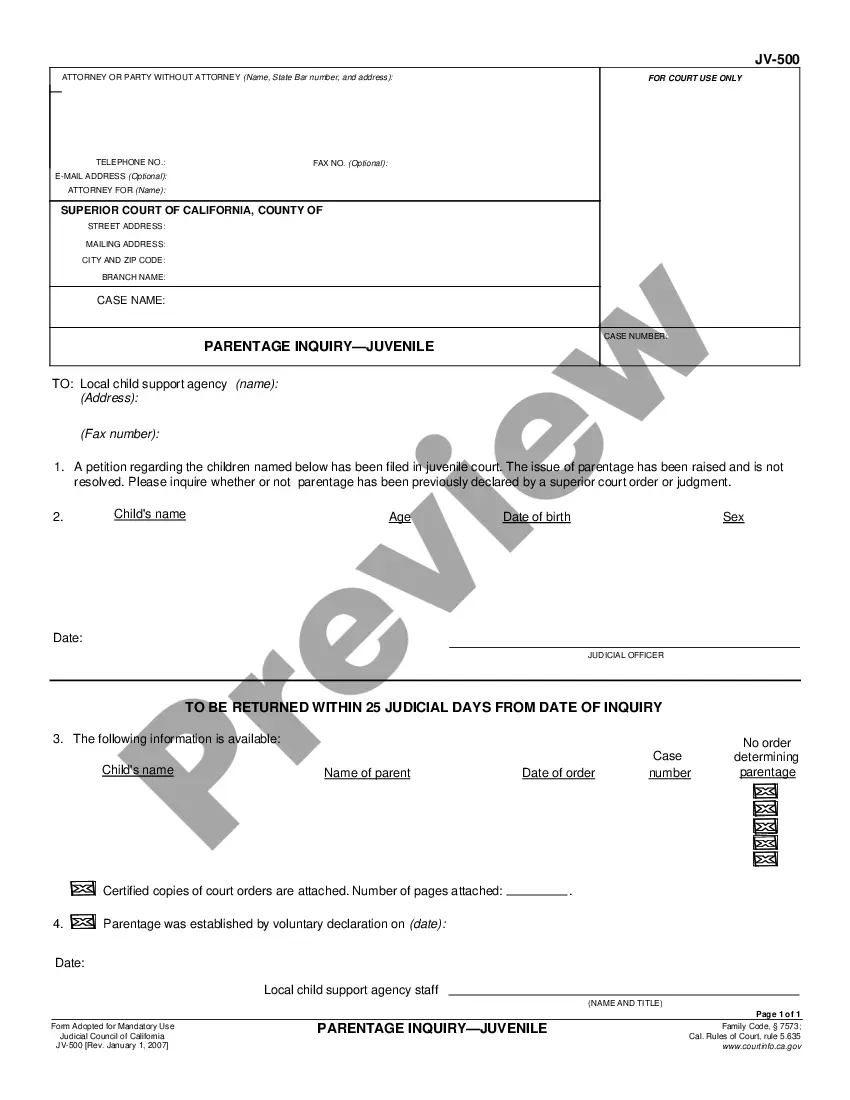

- Be sure you have picked out the right kind for your personal metropolis/area. Select the Preview option to analyze the form`s information. Look at the kind outline to ensure that you have chosen the appropriate kind.

- If the kind does not match your needs, utilize the Research industry on top of the display screen to find the one that does.

- In case you are happy with the shape, affirm your option by simply clicking the Acquire now option. Then, pick the rates strategy you like and offer your qualifications to register for the bank account.

- Procedure the financial transaction. Make use of your credit card or PayPal bank account to finish the financial transaction.

- Find the format and obtain the shape on your own system.

- Make adjustments. Fill out, change and produce and indication the downloaded Wyoming Application and Loan Agreement for a Business Loan with Warranties by Borrower.

Every web template you put into your bank account does not have an expiration particular date and is the one you have eternally. So, in order to obtain or produce an additional backup, just visit the My Forms portion and then click in the kind you will need.

Get access to the Wyoming Application and Loan Agreement for a Business Loan with Warranties by Borrower with US Legal Forms, one of the most extensive local library of lawful record web templates. Use thousands of professional and state-particular web templates that satisfy your small business or individual demands and needs.