Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

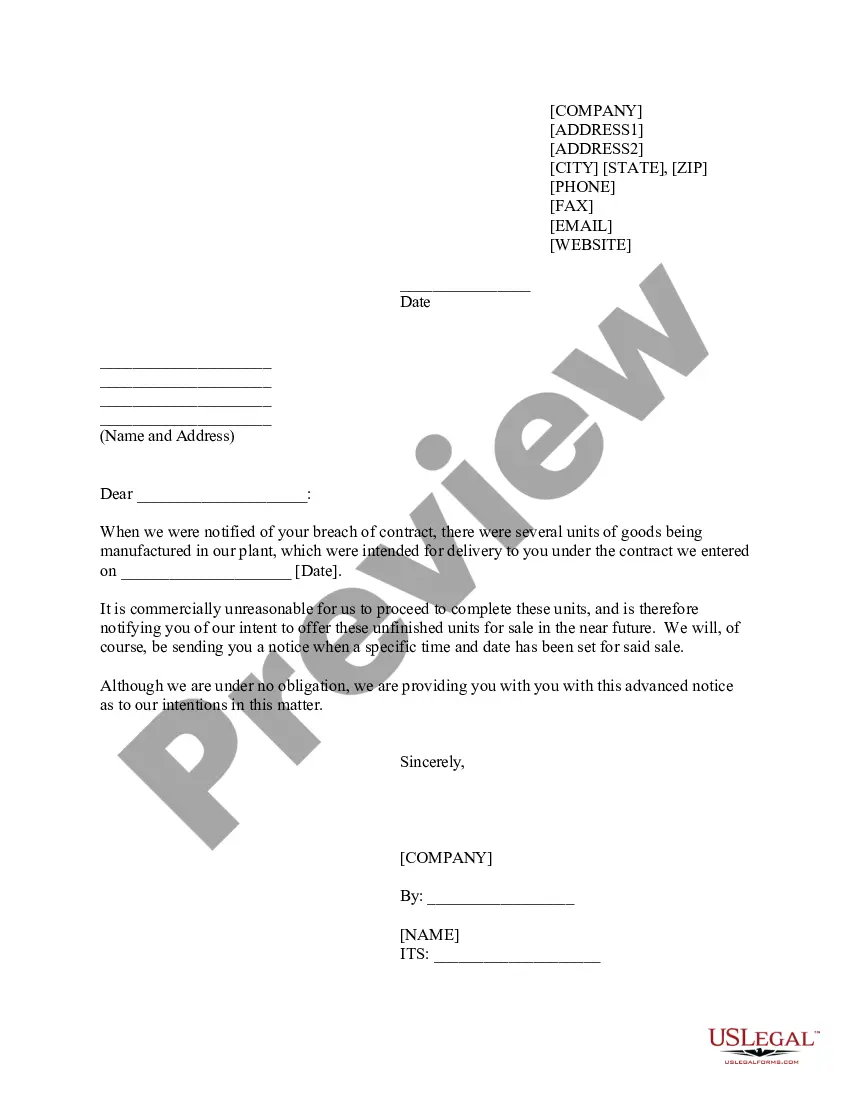

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

Selecting the appropriate legal document template can be challenging. Of course, there are numerous templates available online, but how do you locate the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant, which can be utilized for business and personal purposes. All forms are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to access the Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant. Use your account to search for the legal forms you have previously purchased. Navigate to the My documents tab of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have chosen the correct form for your location/state. You can browse the form using the Review button and read the form description to confirm it is suitable for you.

US Legal Forms hosts the largest collection of legal forms where you can find various document templates. Utilize the service to download well-crafted documents that adhere to state requirements.

- If the form does not meet your needs, utilize the Search field to find the appropriate form.

- Once you are sure the form is correct, click the Buy now button to obtain the form.

- Select the pricing plan you prefer and enter the required information.

- Create your account and complete the purchase using your PayPal account or Visa or Mastercard.

- Choose the document format and download the legal document template to your device.

- Complete, modify, print, and sign the received Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant.

Form popularity

FAQ

Upon the death of the annuitant, a Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant generally does not create any immediate tax consequences for heirs. However, any accrued income before the death may be subject to taxes during the annuitant's life. It's advisable to consult a financial advisor to clarify potential tax implications before establishing your annuity. Planning ahead is critical to ensure your estate is managed according to your wishes.

When an annuitant of a Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant dies, the payments stop as per the agreement terms. Typically, there are no remaining benefits for heirs unless a joint or survivor option was selected. Therefore, potential annuity holders should carefully consider their options and needs when setting up an annuity. Understanding the implications of the annuity upon the annuitant's death can aid in financial planning.

In a Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant, the primary settlement option is a life annuity. This means that payments cease once the annuitant passes away. It's important to understand that this option offers steady income during the annuitant's lifetime, providing financial security. However, beneficiaries will not receive any further payments after the annuitant's death.

A lifetime payout annuity is a financial product that provides regular payments to the annuitant for as long as they live. This product serves as a reliable income stream during retirement, ensuring that the annuitant does not outlive their resources. It is beneficial for those looking for long-term financial solutions. By utilizing a Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant, individuals can effectively plan for their financial future with confidence and security.

The certain period annuity payout option guarantees payments for a specified number of years, even if the annuitant dies earlier. After the guaranteed term, if the annuitant is still alive, payments will continue for their lifetime. This structure offers peace of mind, ensuring that beneficiaries receive a minimum level of payment regardless of the annuitant’s lifespan. With a Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant, you can secure both lifetime payments and a guaranteed period for financial stability.

A straight life annuity arrangement defines the settlement type where payments halt upon the death of the annuitant. This is crucial to consider when opting for a Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant, especially if beneficiaries need to account for continuing income post-annuitant’s lifetime.

A private annuity agreement is a unique contract typically between family members or close associates. In this scenario, one party transfers property to another in exchange for lifetime payment streams, similar to a Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant. This transaction helps with estate planning and tax strategies as well.

A private annuity operates by transferring ownership of an asset to another party in exchange for ongoing payments. This arrangement often involves family members or trusted individuals and can be established through a Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant, where the asset owner receives regular payments for the rest of their life.

The lifetime payout option in an annuity guarantees payments for the duration of the annuitant's life. A Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant exemplifies this, as it ensures that the agreed payments continue until the annuitant passes away, thus providing peace of mind for financial planning.

An annuity agreement is a contract between an individual and an insurance company, where the individual makes a lump-sum payment in exchange for regular income payments over time. In the context of a Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant, this arrangement ensures that you receive payments for the life of the annuitant, offering financial security during retirement.