This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare

Description

How to fill out Agreement Between Professional Corporation And Non-Profit Corporation To Treat People Who Cannot Afford Healthcare?

If you need to detailed, obtain, or print official document templates, utilize US Legal Forms, the largest selection of official forms, available on the internet.

Leverage the site's straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan that suits you and provide your information to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals who Cannot Afford Healthcare in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to receive the Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals who Cannot Afford Healthcare.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

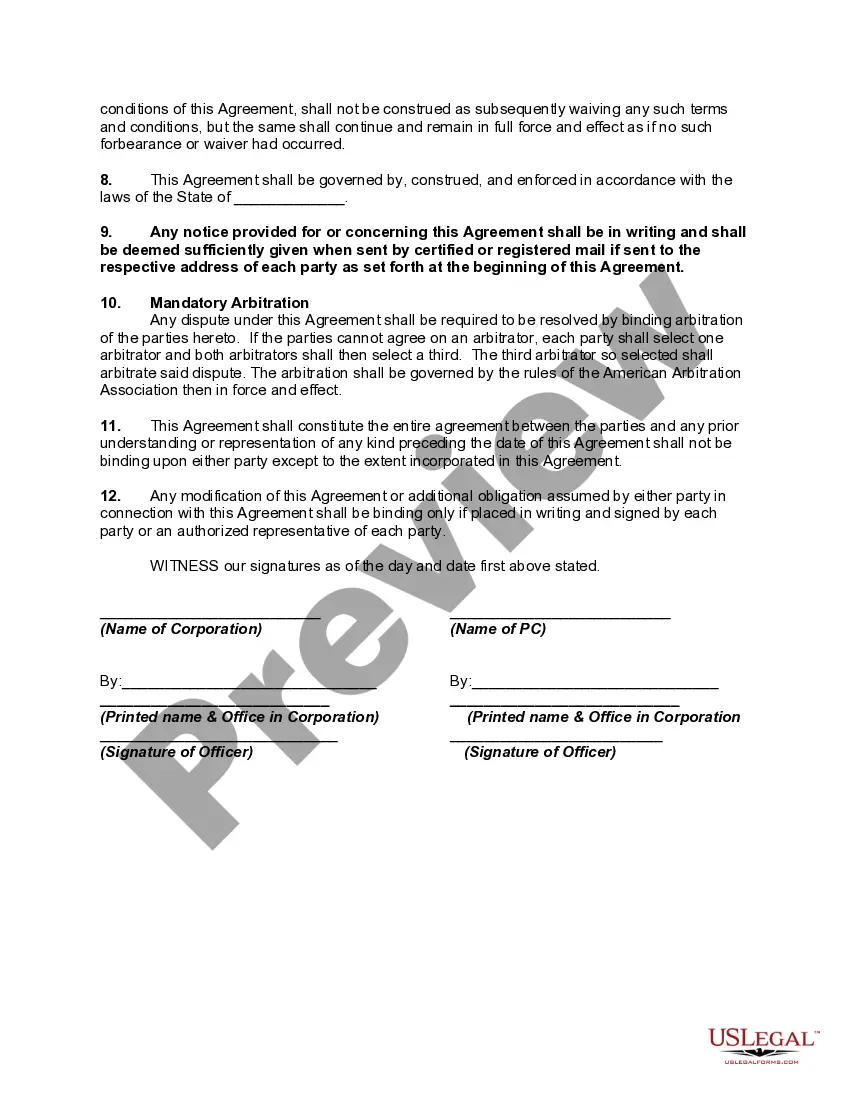

- Step 2. Use the Preview option to review the contents of the form. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The corporate practice of medicine refers to the legal doctrine that restricts the ability of non-physicians, including corporations, to practice medicine or employ physicians directly. This concept is vital in ensuring that health care services prioritize patient care over business interests. Understanding the Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare is essential for establishing a framework that allows collaborative efforts between medical professionals and charitable organizations. By integrating these two entities, you can help provide affordable healthcare solutions to underserved populations.

A nonprofit can own a corporation, often for strategic business reasons or to manage revenue-generating activities that align with its mission. This relationship allows for various business opportunities while maintaining the nonprofit's tax-exempt status. When structuring the Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, clarity on ownership can optimize operational effectiveness.

Yes, a non-profit can be a corporation, typically organized as a 501(c)(3) or similar structure. This designation allows the organization to operate legally and seek tax-exempt status. In the context of the Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, forming a nonprofit corporation can enhance credibility and operational legitimacy.

Section 17 16 821 of the Wyoming Business Corporation Act outlines the requirements for the management and governance of corporations in Wyoming. This section ensures transparency and sets standards that all corporations must follow. When forming a Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, understanding this section can guide compliance.

profit corporation is often referred to simply as a nonprofit. This type of organization aims to serve the public or a specific group without the intention of making profits for owners or shareholders. When establishing a relationship under the Wyoming Agreement Between Professional Corporation and NonProfit Corporation to Treat People who cannot Afford Healthcare, understanding the terminology helps foster clear communication.

The 33% rule for nonprofits states that an organization should not spend more than one-third of its total operating budget on management and fundraising costs. This guideline ensures that a significant portion of funds goes directly to the mission. When drafting agreements like the Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, maintaining fiscal responsibility is crucial.

States that allow the corporate practice of medicine include Wyoming, California, and New York, among others. These states permit professional corporations to hire physicians directly and employ them to provide medical services. Understanding the requirements is essential, especially when creating a Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare.

The best business structure for a non-profit usually involves forming a 501(c)(3) corporation, which allows for tax-exempt status. This structure enables the organization to pursue its mission effectively while attracting donations and grants. In the context of the Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, a 501(c)(3) can collaborate with other entities to address healthcare needs.

The terms 'nonprofit' and 'not for profit' are often used interchangeably, but there are distinctions. A nonprofit healthcare organization aims to fulfill a mission, often focusing on community service, while a not for profit may simply mean a business that does not distribute profits to owners. Understanding these differences is important in the context of the Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, as it defines organizational roles in providing health services.

Not for profit organizations and government entities are not automatically exempt from HIPAA. If they engage in activities that involve providing healthcare services or handling patient information, they must follow HIPAA regulations. The Wyoming Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare highlights the need for understanding these regulations to serve communities effectively.