Wyoming Revocable Trust for Grandchildren

Description

How to fill out Revocable Trust For Grandchildren?

Selecting the appropriate authorized document template can be somewhat challenging.

Of course, there are numerous templates available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Wyoming Revocable Trust for Grandchildren, suitable for both business and personal purposes.

If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are certain that the form is suitable, select the Purchase now option to download the form. Choose the pricing plan you require and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained Wyoming Revocable Trust for Grandchildren. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download meticulously crafted papers that comply with state regulations.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Wyoming Revocable Trust for Grandchildren.

- Use your account to look through the legal forms you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, make sure you have selected the correct form for your city/state. You can review the form using the Review option and read the form description to ensure this is the right one for you.

Form popularity

FAQ

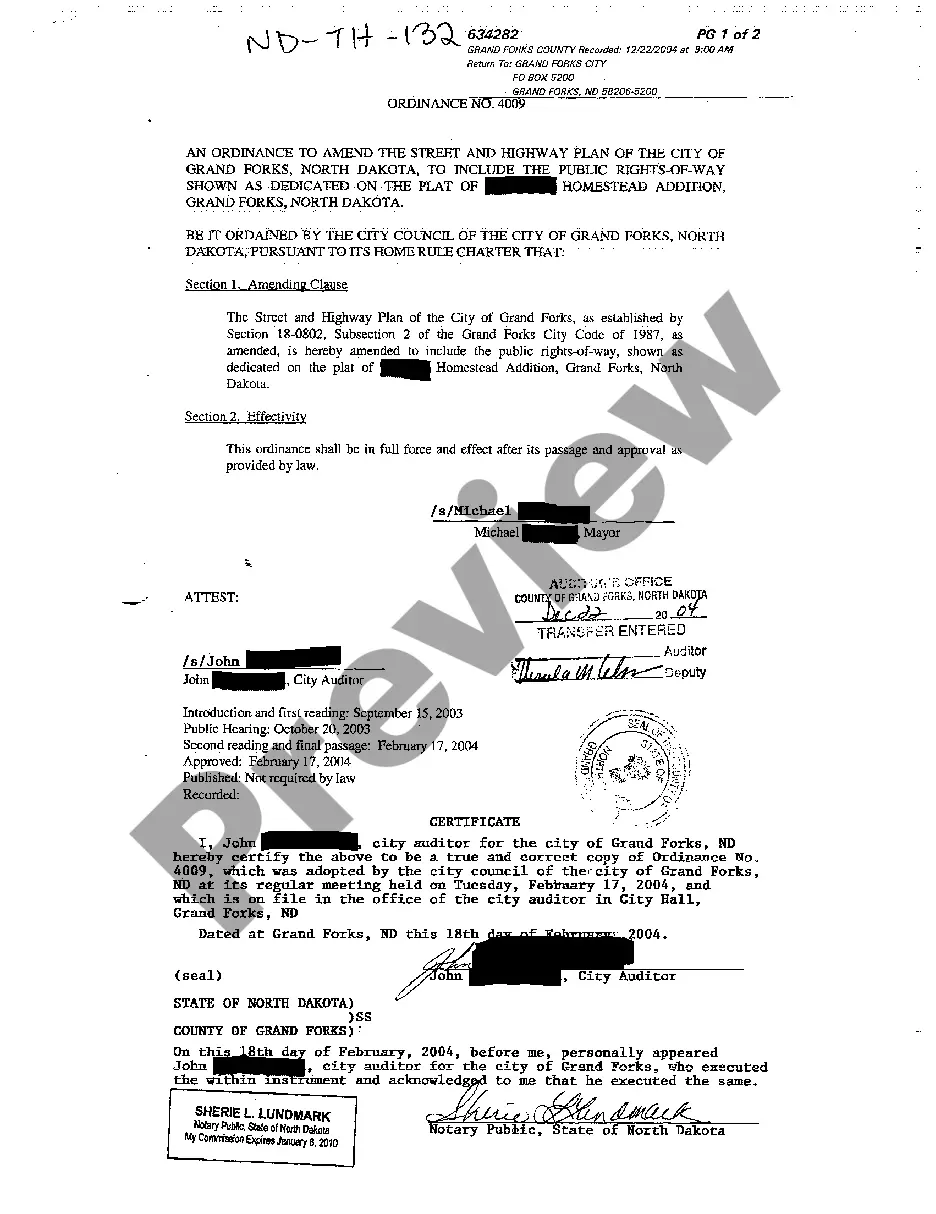

Yes, a Wyoming Revocable Trust for Grandchildren generally needs to be notarized to ensure its validity. Notarization involves having a notary public witness the signature of the trust creator. This step provides an extra layer of authenticity, helping prevent future disputes. Utilizing platforms like US Legal Forms can simplify the process, offering templates and guidance to create a notarized trust efficiently.

Typically, assets that cannot be placed in a Wyoming Revocable Trust for Grandchildren include personal items with subjective value, such as family heirlooms or sentimental items, as well as certain types of retirement accounts like 401(k)s. Additionally, vehicles should be titled in the trust's name to avoid complications. It's essential to consider how your assets will interact with the trust, so consulting with a legal expert can help clarify these matters.

To list a Wyoming Revocable Trust for Grandchildren as a beneficiary, you first need to obtain the official name of the trust as specified in the trust documents. Fill out the beneficiary designation forms provided by your financial institution or insurance company. Make sure to include any necessary details, such as the trust's tax identification number, to ensure smooth processing. Keeping your trust's beneficiary information updated can help you manage your estate effectively.

Starting a trust in Wyoming involves several key steps. First, decide on your goals and identify what you want to include in your Wyoming Revocable Trust for Grandchildren. After that, draft the trust document or use a trusted platform like US Legal Forms, which provides templates and guidance tailored to your needs. Lastly, ensure you transfer the chosen assets into the trust to make it effective.

Many people choose to set up a trust in Wyoming due to its favorable laws and privacy protections. A Wyoming Revocable Trust for Grandchildren can offer tax advantages and ease of management compared to other states. Additionally, Wyoming does not impose state income tax, which can further benefit your heirs. Trusts also protect assets from probate, ensuring a smoother transition for your grandchildren.

To establish a Wyoming Revocable Trust for Grandchildren, begin by drafting a trust agreement. You should clearly outline your intentions, including the assets and how they will be distributed among your grandchildren. It is advisable to consult with legal or financial professionals to ensure compliance with Wyoming laws. Finally, fund the trust by transferring assets into it, making sure to follow the necessary procedures.

One downside of setting up a trust is the potential for reduced control over assets during your lifetime. However, a Wyoming Revocable Trust for Grandchildren allows you to maintain control and amend the trust as needed. It's important to weigh these factors carefully, ensuring the trust aligns with your overall estate goals.

Wyoming does not impose a state income tax on trusts, making it an appealing option for creating a Wyoming Revocable Trust for Grandchildren. This tax advantage allows for greater asset growth over time. Establishing a trust in Wyoming can help preserve more wealth for future generations, allowing your grandchildren to reap the benefits.

Setting up a trust can introduce various challenges, such as improper funding or failure to update the trust as life changes occur. One smart move is to create a Wyoming Revocable Trust for Grandchildren that reflects current wishes, avoiding potential pitfalls. Regularly reviewing and adjusting the trust helps keep it aligned with your family's needs.

While a family trust provides asset protection, it can also lead to complications when dealing with tax implications. A Wyoming Revocable Trust for Grandchildren may expose assets to estate taxes if the trust is not properly set up. Additionally, if not well-communicated, family dynamics may suffer due to misunderstandings about the trust’s purpose.