An agreement modifying a loan agreement and a deed of trust should be signed by both parties to the transaction and recorded in the office of the register of deeds and deeds of trust where the original deed of trust was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wyoming Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate

Description

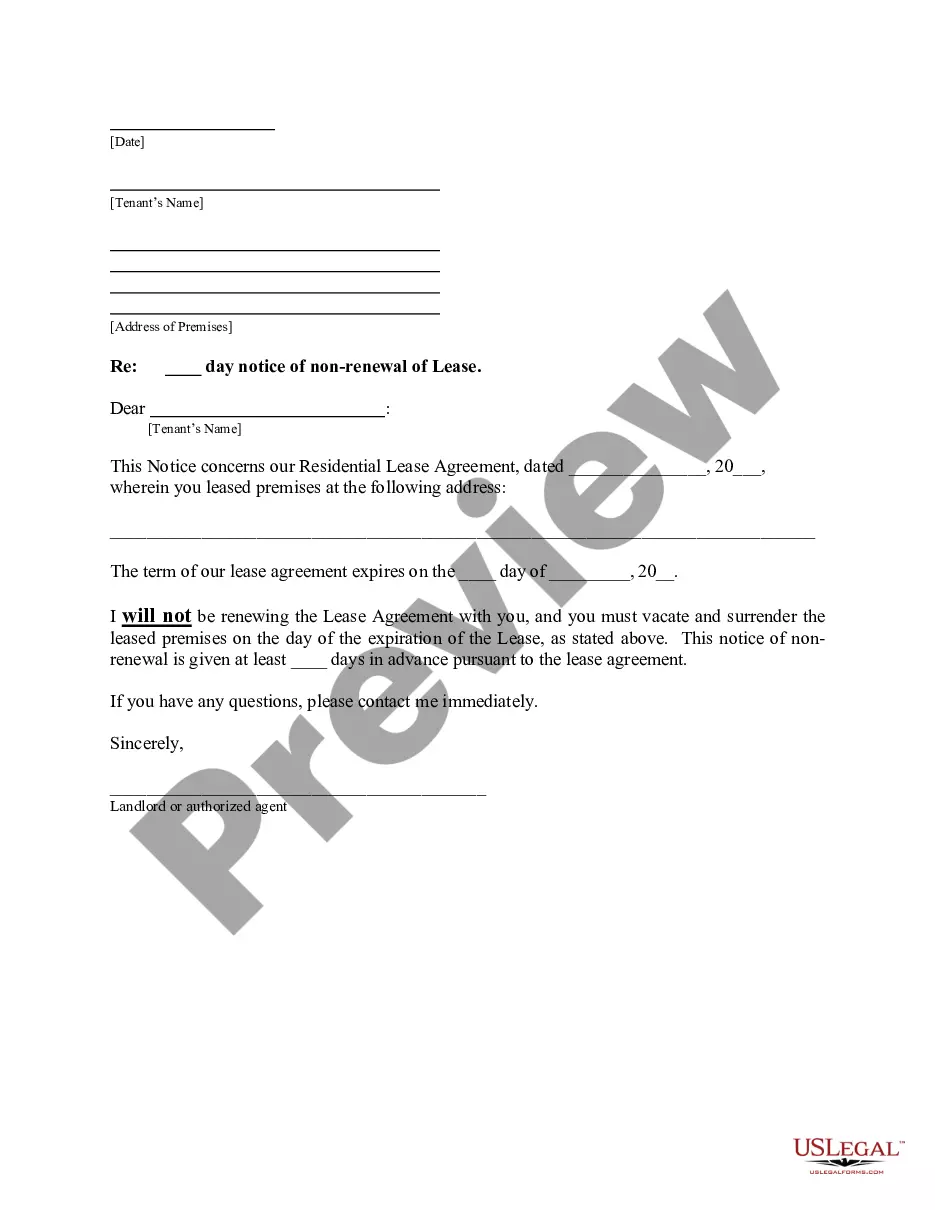

How to fill out Extension Of Loan Agreement Secured By A Deed Of Trust As To Maturity Date And Increase In Interest Rate?

Are you presently in a place the place you require papers for possibly organization or personal purposes just about every day time? There are a variety of lawful file themes accessible on the Internet, but finding kinds you can trust is not easy. US Legal Forms offers a huge number of type themes, like the Wyoming Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate , which are published to satisfy state and federal demands.

Should you be already knowledgeable about US Legal Forms site and get a free account, basically log in. After that, you are able to acquire the Wyoming Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate format.

Should you not have an account and need to start using US Legal Forms, adopt these measures:

- Find the type you will need and ensure it is for that proper area/area.

- Use the Preview key to check the shape.

- See the outline to ensure that you have chosen the appropriate type.

- If the type is not what you`re trying to find, make use of the Look for discipline to get the type that meets your requirements and demands.

- Whenever you get the proper type, simply click Buy now.

- Choose the costs plan you desire, complete the desired details to generate your bank account, and purchase an order using your PayPal or bank card.

- Pick a handy document formatting and acquire your version.

Find every one of the file themes you may have bought in the My Forms menus. You can obtain a extra version of Wyoming Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate at any time, if necessary. Just go through the required type to acquire or print the file format.

Use US Legal Forms, probably the most extensive variety of lawful kinds, to save lots of efforts and stay away from mistakes. The assistance offers skillfully made lawful file themes which can be used for a selection of purposes. Generate a free account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

A mortgage is the standard security instrument used. Deeds of trust are permitted but are rarely used because mortgages may contain a power of sale and foreclosures of deeds of trust, like mortgages, are subject to redemption rights.

The following shall apply: (i) Taxes upon real property are a perpetual lien thereon against all persons excluding the United States and the state of Wyoming. Taxes upon personal property are a lien upon all real property owned by the person against whom the tax was assessed subject to all prior existing valid liens.

Wyoming Statute 39-13-109(b)(i) requires persons wishing to contest their assessment to file not later than 30 days after the mail date a statement with the Assessor outlining their reason or disagreement with the assessment.

Section 39-13-105 - Exemptions. 39-13-105. Exemptions. (a) The following persons who are bona fide Wyoming residents for at least three (3) years at the time of claiming the exemption are entitled to receive the tax exemption provided by W.S. 39-11-105(a)(xxiv):

W.S. 39-15-103 imposes the tax on the sale of tangible personal property and certain services.

Who Qualifies? Veterans must be a Wyoming resident for 3 consecutive years in order to qualify. Veterans who have written discharge (DD-214 or equivalent) from active duty military service. Served during an armed conflict and received the Armed Forces Expeditionary Medal (AFEM) or equivalent.

Wyoming's legal interest rate is 7% per year. This rate can be changed in a contract or agreement or otherwise set by law, however.