Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment

Description

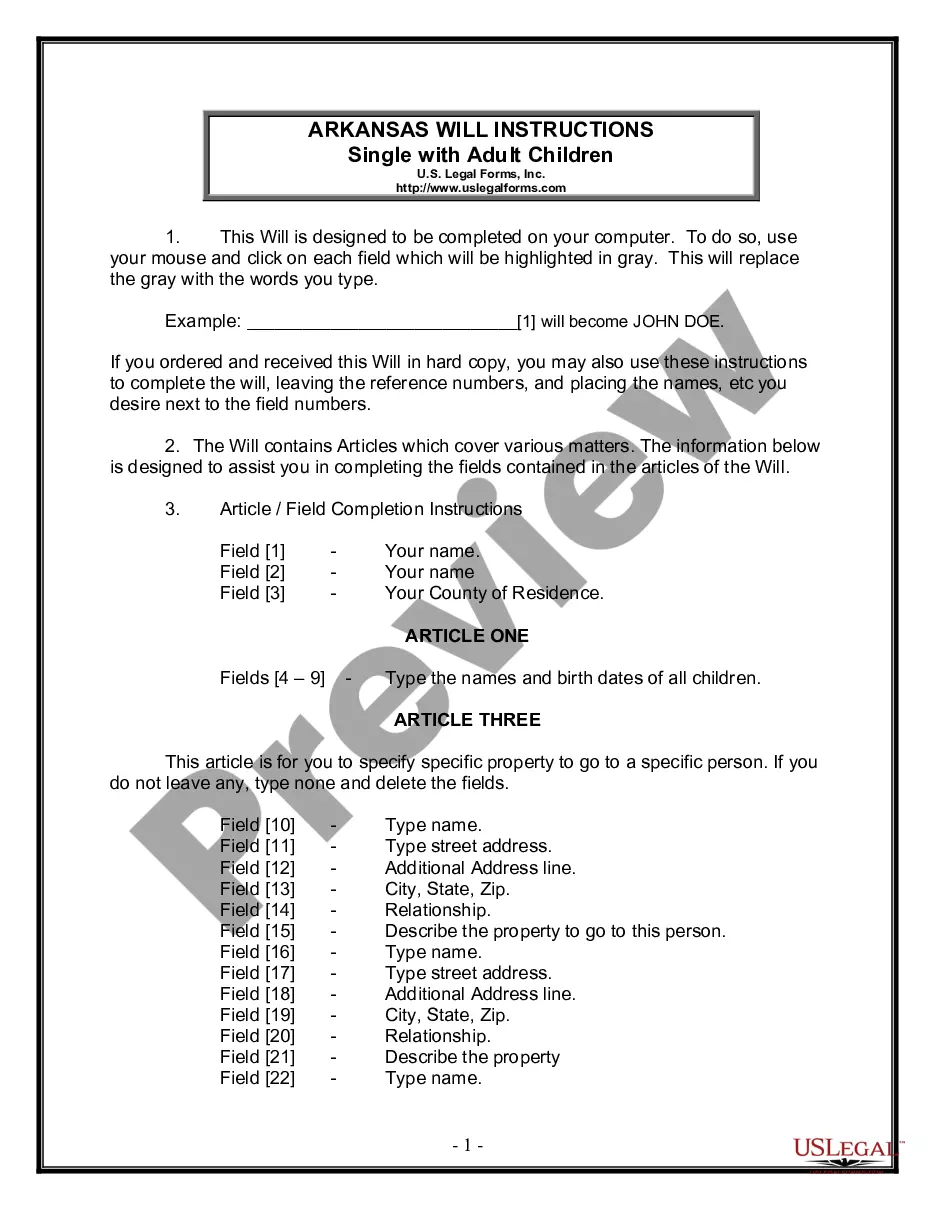

How to fill out Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

If you intend to finish, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal documents, accessible online.

Employ the site’s straightforward and user-friendly search to locate the forms you require.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. Each legal document template you purchase belongs to you indefinitely. You have access to every form you downloaded with your account. Click the My documents section and select a form to print or download again.

- Utilize US Legal Forms to discover the Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to retrieve the Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/region.

- Step 2. Utilize the Preview feature to review the form’s content. Do not forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the necessary form, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

A 351 transfer of partnership interest refers to a process under Internal Revenue Code Section 351, where no gain or loss is recognized during the transfer of property to a corporation in exchange for stock. This principle can also apply in partnership transactions, impacting how interests are reassigned. Utilizing a Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment helps navigate these complexities and maintain compliance.

Yes, exchanging a partnership interest is possible between partners, provided it adheres to the partnership agreement. This arrangement can sometimes involve various financial or equity terms to make the exchange equitable. A Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can simplify this process, ensuring all terms are documented and legally binding.

The sale of partnership interest can be accounted for by recording the transaction in the partnership’s financial statements. This includes recognizing any gain or loss from the sale based on the fair market value of the interest at the time of transfer. By implementing a Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, partners can ensure that their accounting practices align with legal requirements.

The form for the transfer of interest in a partnership typically includes a detailed agreement that outlines the specifics of the transaction. This agreement should detail the responsibilities of both parties and any conditions that may apply. Using a Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment ensures that the process is both clear and legally valid.

Yes, you can transfer a partnership interest, but there are specific legal procedures to follow. The partnership agreement often governs how this transfer occurs, which may involve consent from other partners. A Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment is beneficial in ensuring the transfer is compliant with legal standards.

The form for transferring partnership interest typically includes a written agreement outlining the terms of the transfer. This document should specify the parties involved, the interest being transferred, and any relevant payment arrangements. Utilizing a Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can streamline this process to meet legal requirements.

A transfer of partnership interest to another partner involves the current partner selling or assigning their stake in the partnership to another individual. This process can facilitate a change in partnership dynamics and often requires a Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. Doing so allows for a smooth transition and ensures all parties are legally protected.

To report a sale of partnership interest in Wyoming, you typically notify the partnership and update any necessary partnership agreements. Filing a Form 1065 with the IRS may also be required to reflect changes in ownership. Properly documenting this transaction with a Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment will help ensure clarity and compliance throughout the process.

Section 17-16-821 of the Wyoming Business Corporation Act addresses the authority of officers to manage day-to-day operations. This statute helps define the extent of their powers, ensuring accountability. For partnerships, leveraging a Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment ensures clear delineation of authority and responsibility among partners.

Section 17 of the Wyoming Corporation Act outlines the duties and powers of corporate directors. It provides guidelines on how directors must act in the best interests of the corporation and its shareholders. Understanding this section can help when creating partnership agreements, as a Wyoming Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can clarify the roles of all parties involved.