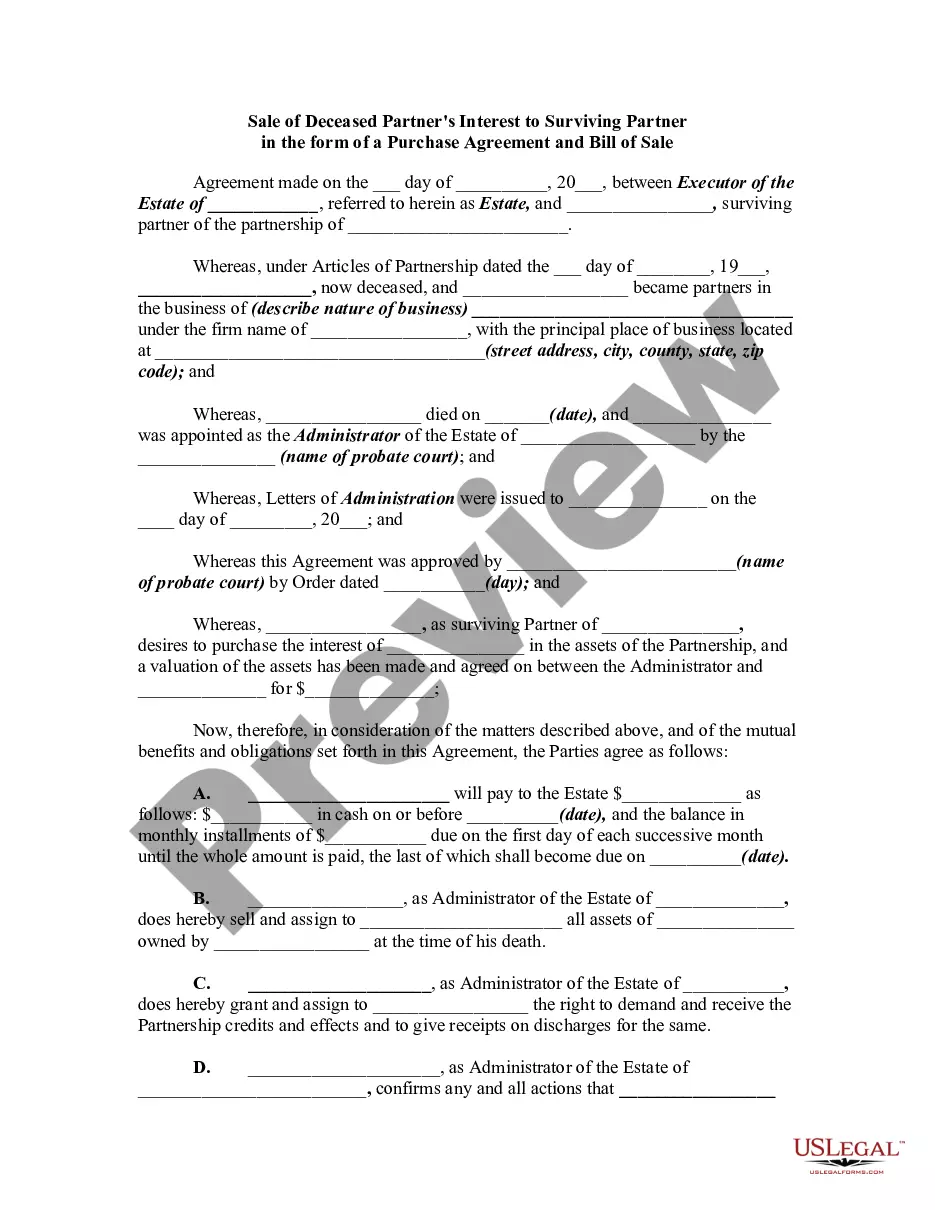

Wyoming Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

How to fill out Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

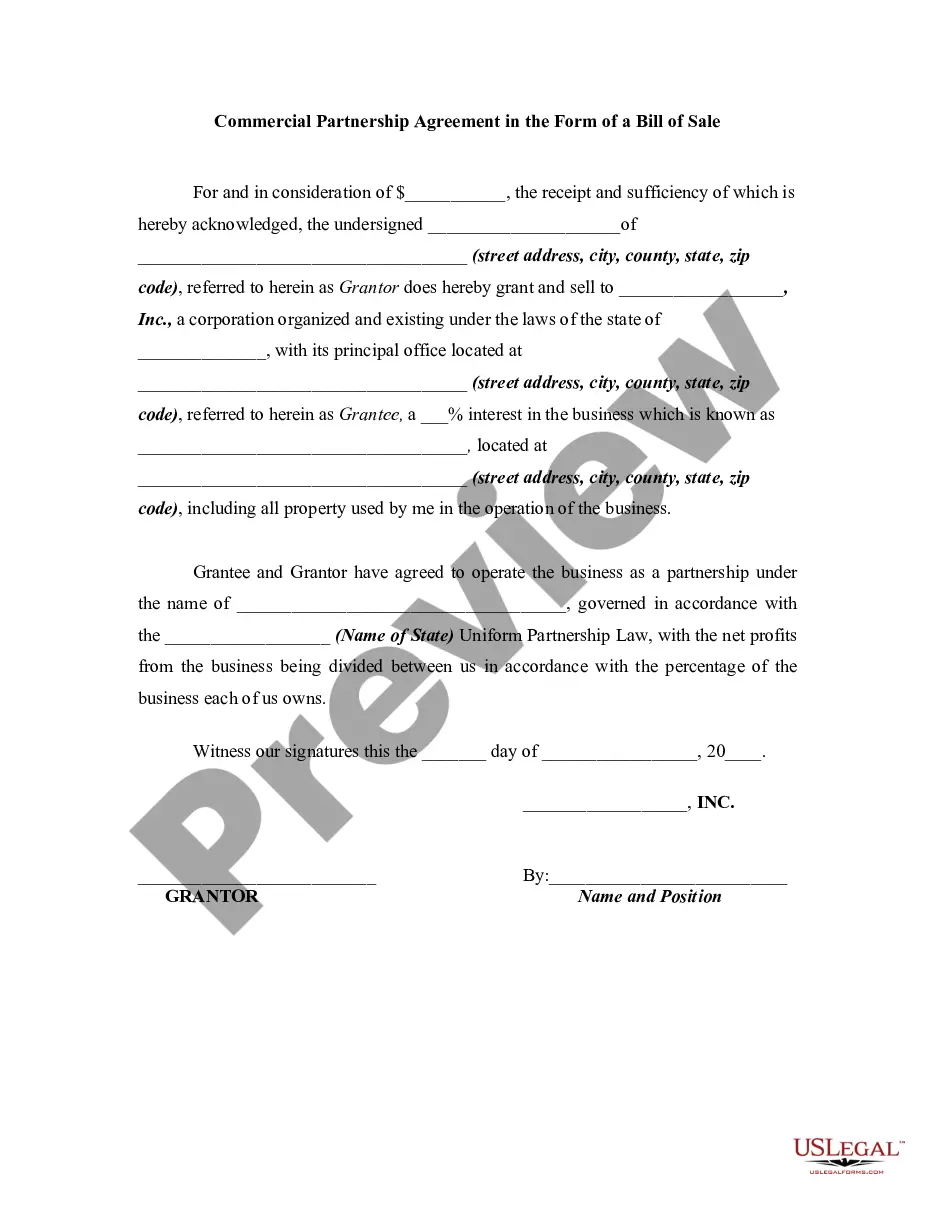

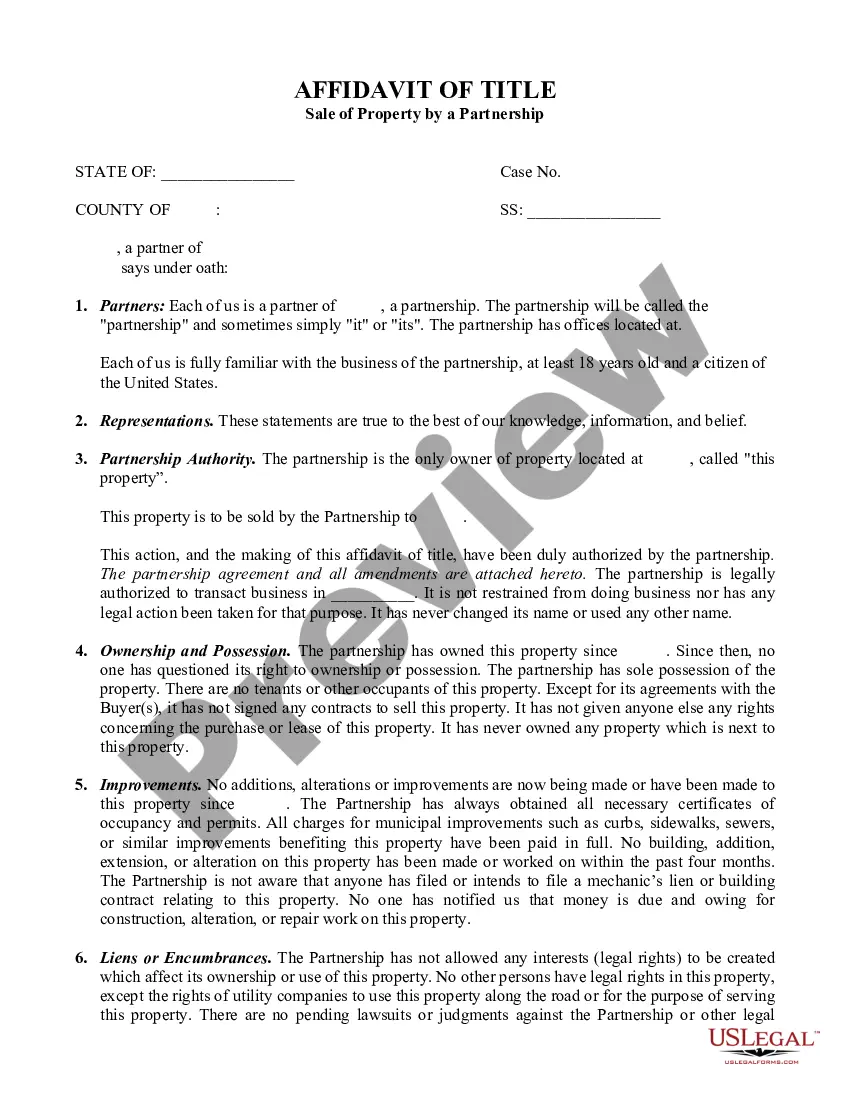

If you have to complete, down load, or produce legitimate record themes, use US Legal Forms, the biggest selection of legitimate kinds, that can be found on-line. Utilize the site`s easy and practical search to get the documents you want. Numerous themes for organization and specific functions are sorted by categories and suggests, or keywords. Use US Legal Forms to get the Wyoming Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale in just a couple of clicks.

Should you be previously a US Legal Forms client, log in in your account and then click the Obtain button to get the Wyoming Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale. You may also accessibility kinds you in the past downloaded from the My Forms tab of your account.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for your correct town/region.

- Step 2. Take advantage of the Review method to look through the form`s information. Do not forget to see the description.

- Step 3. Should you be not happy together with the type, utilize the Look for field on top of the screen to locate other types in the legitimate type format.

- Step 4. Upon having found the form you want, click the Buy now button. Choose the pricing program you prefer and include your credentials to sign up for an account.

- Step 5. Process the financial transaction. You may use your credit card or PayPal account to complete the financial transaction.

- Step 6. Select the format in the legitimate type and down load it in your product.

- Step 7. Comprehensive, modify and produce or indicator the Wyoming Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale.

Every legitimate record format you buy is yours forever. You may have acces to every type you downloaded within your acccount. Click on the My Forms portion and choose a type to produce or down load again.

Be competitive and down load, and produce the Wyoming Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale with US Legal Forms. There are thousands of expert and status-certain kinds you can utilize for your organization or specific requirements.

Form popularity

FAQ

W.S. 39-15-103 imposes the tax on the sale of tangible personal property and certain services.

(a) When a deed, contract or other document transferring legal or equitable title to real property, including instruments conveying ownership of structures on lands not owned by the transferring party, is presented to a county clerk for recording, the instrument shall be accompanied by a statement under oath by the ...

Who Qualifies? Veterans must be a Wyoming resident for 3 consecutive years in order to qualify. Veterans who have written discharge (DD-214 or equivalent) from active duty military service. Served during an armed conflict and received the Armed Forces Expeditionary Medal (AFEM) or equivalent.

Wyoming Statute 4-10-410 ?non-charitable Trust without Ascertainable Beneficiary? legislatively provides that a trust may be organized (i) without a definite or definitely ascertainable beneficiary, (ii) for a non-charitable but otherwise valid purpose; (iii) enforceable by a trust advisor, a trust protector, person ...

Wyoming Statute 39-13-109(b)(i) requires persons wishing to contest their assessment to file not later than 30 days after the mail date a statement with the Assessor outlining their reason or disagreement with the assessment.

Section 39-13-105 - Exemptions. 39-13-105. Exemptions. (a) The following persons who are bona fide Wyoming residents for at least three (3) years at the time of claiming the exemption are entitled to receive the tax exemption provided by W.S. 39-11-105(a)(xxiv):

The following shall apply: (i) Taxes upon real property are a perpetual lien thereon against all persons excluding the United States and the state of Wyoming. Taxes upon personal property are a lien upon all real property owned by the person against whom the tax was assessed subject to all prior existing valid liens.