Wyoming Security Agreement - Long Form

Description

How to fill out Security Agreement - Long Form?

If you wish to total, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the site's simple and user-friendly search to locate the documents you need.

Various templates for business and personal use are sorted by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the payment plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your Мisa or Ьastercard or PayPal account to complete the transaction.

- Use US Legal Forms to acquire the Wyoming Security Agreement - Long Form in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and hit the Obtain button to get the Wyoming Security Agreement - Long Form.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

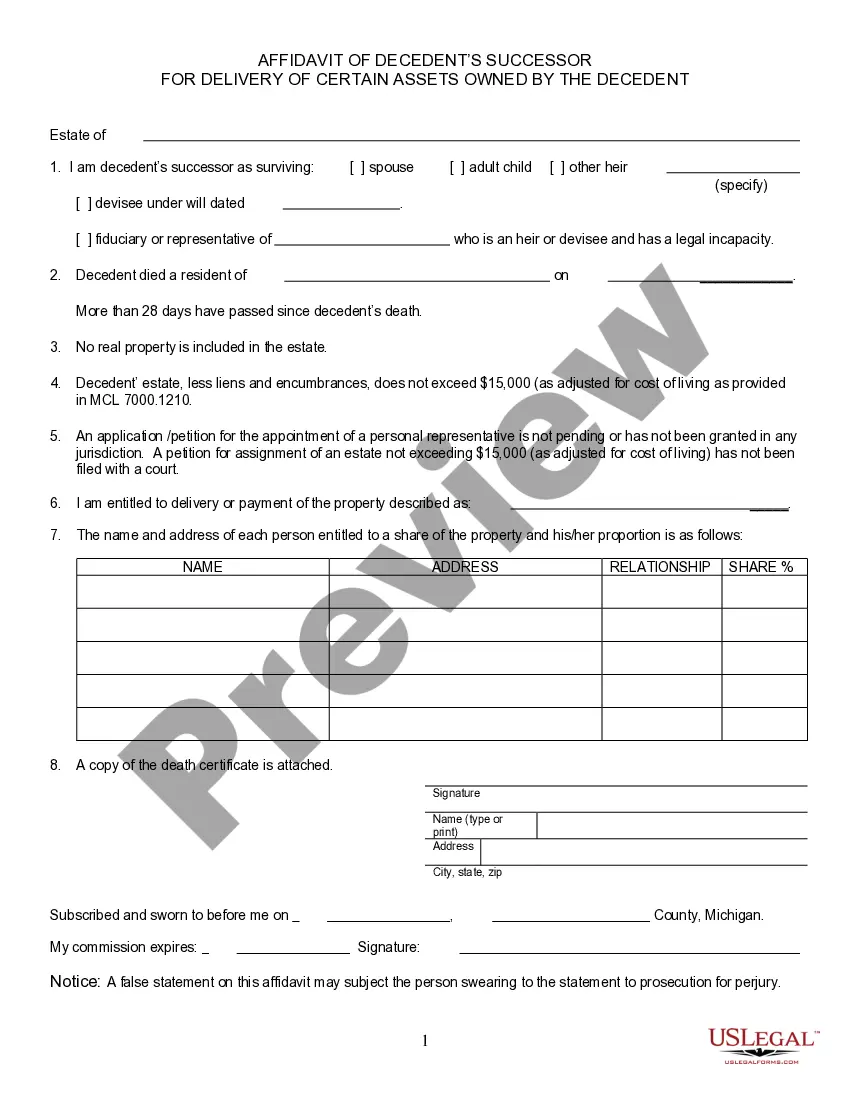

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to check the form's content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A Specific Security Agreement (formerly known as Chattel Mortgage) is an equipment financing option that allows businesses to own their equipment upon purchase. BOQ Equipment Finance Limited secures the loan by registering a charge over the goods.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

The debtor must authenticate the security agreement by signing a statement that announces the intention to grant a security interest in the property specifically outlined in the security agreement.

There are three requirements for attachment: (1) the secured party gives value; (2) the debtor has rights in the collateral or the power to transfer rights in it to the secured party; (3) the parties have a security agreement ?authenticated? (signed) by the debtor, or the creditor has possession of the collateral.

A statute of frauds within UCC Article 9 requires the security agreement be in writing. An exception to this requirement is when a security interest is pledged.

A security interest attaches to collateral when it becomes enforceable against the debtor with respect to the collateral, unless an agreement expressly postpones the time of attachment.

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.

Security Interest: An interest in personal property or fixtures -- i.e., improvements to real property -- which secures payment or performance of an obligation. Security Agreement: An agreement creating or memorializing a security interest granted by a debtor to a secured party.