Wyoming Balloon Unsecured Promissory Note

Description

How to fill out Balloon Unsecured Promissory Note?

In the event you need to obtain, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal use are organized by categories and states, or by keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal document template.

Step 4. Once you have found the form you want, click the Download now button. Choose your preferred pricing plan and enter your information to register for an account.

- Utilize US Legal Forms to find the Wyoming Balloon Unsecured Promissory Note with just a few clicks.

- If you are currently a US Legal Forms member, sign in to your account and select the Download button to obtain the Wyoming Balloon Unsecured Promissory Note.

- You can also access documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, please follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

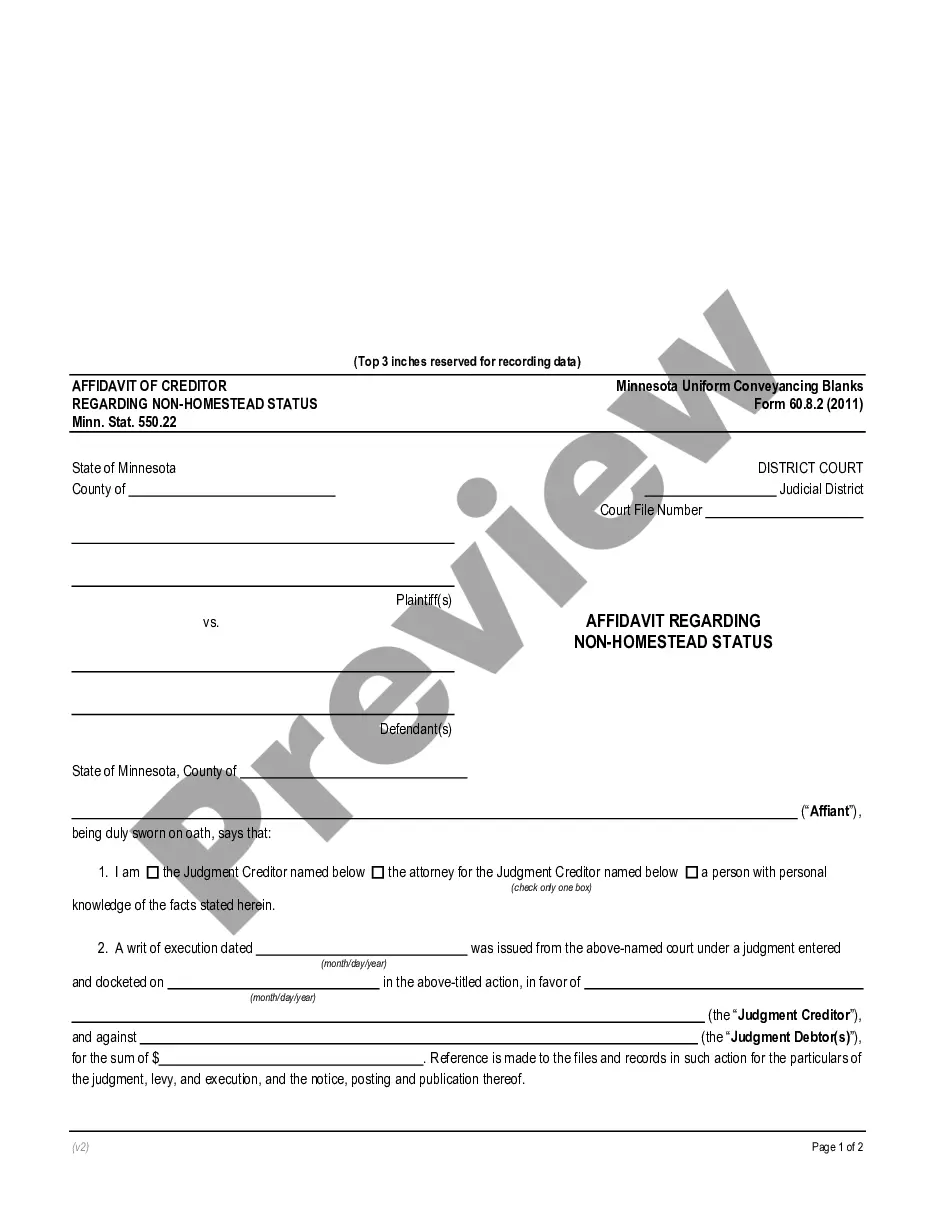

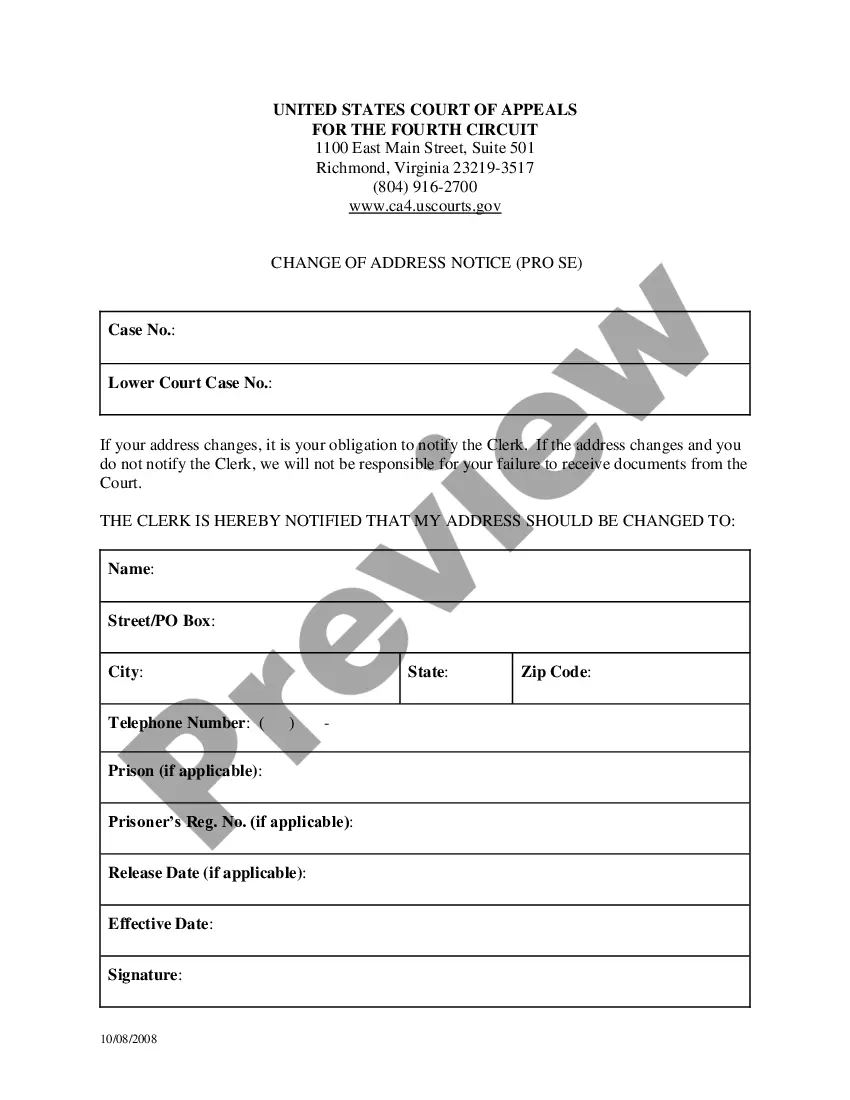

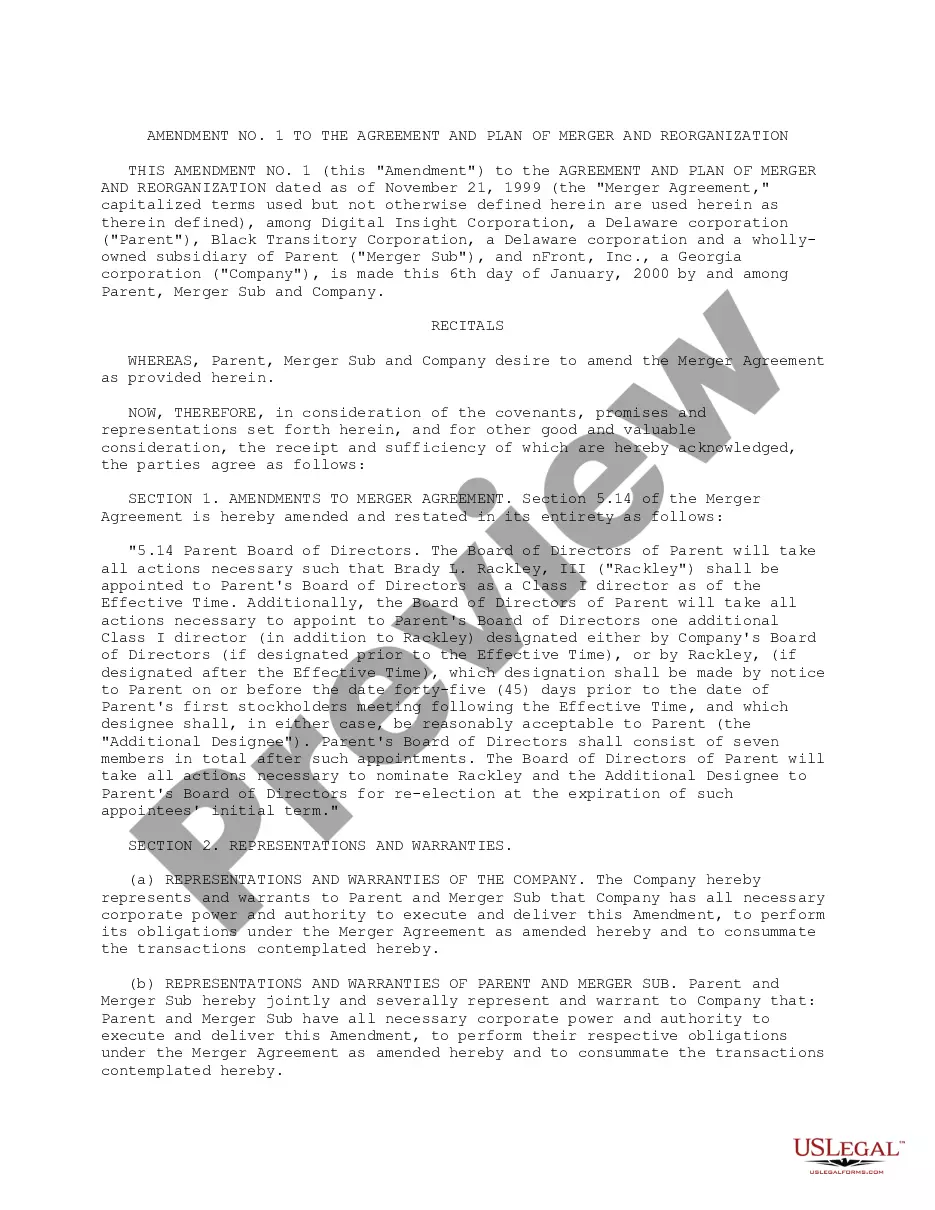

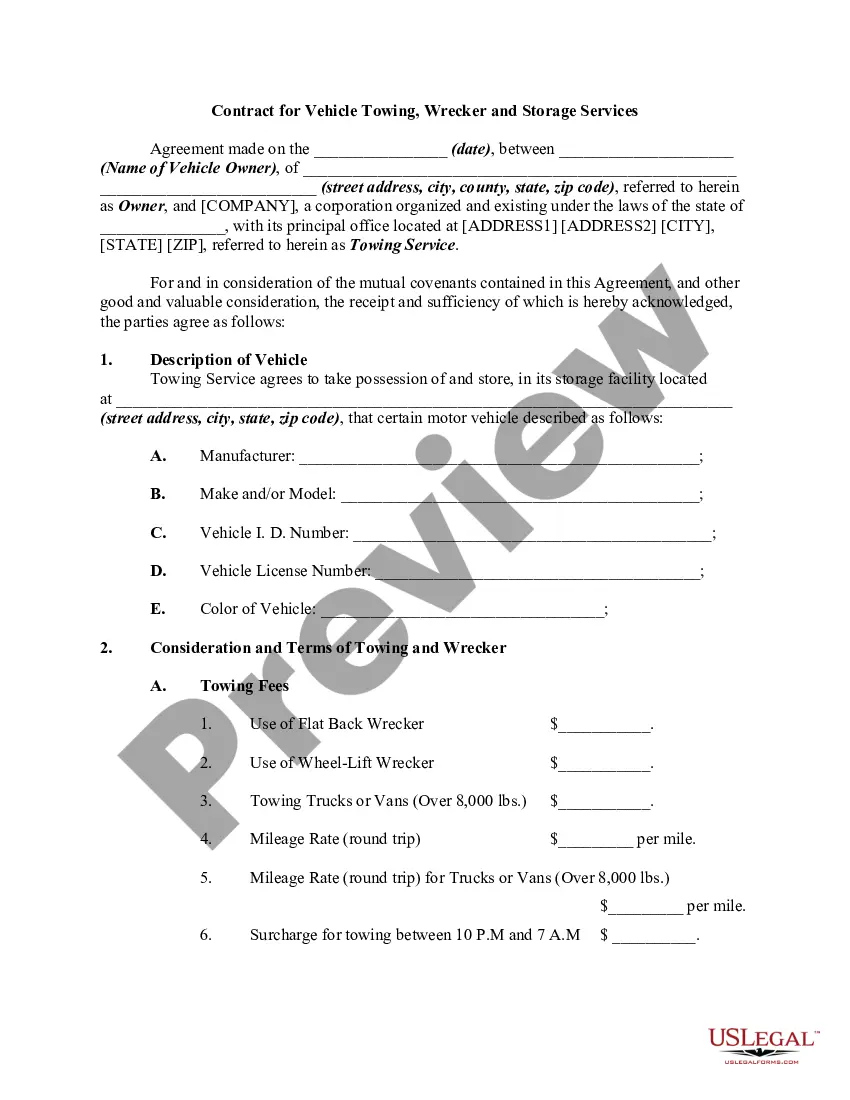

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

Form popularity

FAQ

An unsecured promissory note, like the Wyoming Balloon Unsecured Promissory Note, typically does not fall under the category of securities. While it represents a debt obligation, it lacks the legal protections and registration requirements associated with securities. Therefore, it stays as a private contractual agreement between the parties involved.

An example of a promissory note might detail a borrower receiving $5,000 from a lender, agreeing to repay the principal amount plus 6% interest within one year. It would specify the payment intervals and any penalties for late payments. When discussing a Wyoming Balloon Unsecured Promissory Note, it’s vital to highlight that such notes may involve a larger balloon payment at the end of the term.

The standard format of a promissory note typically includes the title, date, parties' names, and addresses. Then, detail the principal amount, interest rate, and repayment schedule. You should also outline the consequences of defaulting, making sure to summarize this information clearly in the context of a Wyoming Balloon Unsecured Promissory Note, so all parties understand their commitments.

Investors, financial institutions, or private lenders often buy unsecured promissory notes. They may seek higher returns from the interest payments on such notes, despite the higher risk involved. If you have a Wyoming Balloon Unsecured Promissory Note, exploring potential buyers can open up different financing opportunities.

To retrieve your promissory note, contact the lender who issued it or check your email and physical files. If you used a platform like uslegalforms, ensure you have access to your completed document templates. Understanding the terms of your Wyoming Balloon Unsecured Promissory Note is essential for managing repayment effectively.

Yes, a properly drafted promissory note can hold up in court if disputes arise. To ensure its enforceability, it must include clear terms, signatures, and, in some cases, witness signatures. If you are considering a Wyoming Balloon Unsecured Promissory Note, using legally vetted templates can help strengthen your position.

If you lose your promissory note, you should notify your lender immediately. They may require you to complete a lost note affidavit or issue a replacement. In the context of a Wyoming Balloon Unsecured Promissory Note, it is crucial to act quickly to prevent complications with the agreement.

You can locate your master promissory note by checking the lender's website or contacting their customer service. If you received the promissory note electronically or via mail, search through your emails or files. For those with a Wyoming Balloon Unsecured Promissory Note, maintaining organized records is essential for tracking terms and payments.

To obtain a promissory note, you can create one using templates available online, or you may consult a legal professional. For specific cases, like a Wyoming Balloon Unsecured Promissory Note, using customized legal forms can ensure all necessary details are included. Platforms like uslegalforms provide templates that meet your state's legal requirements.