Wyoming Oil, Gas and Mineral Deed - Individual to Two Individuals

Description

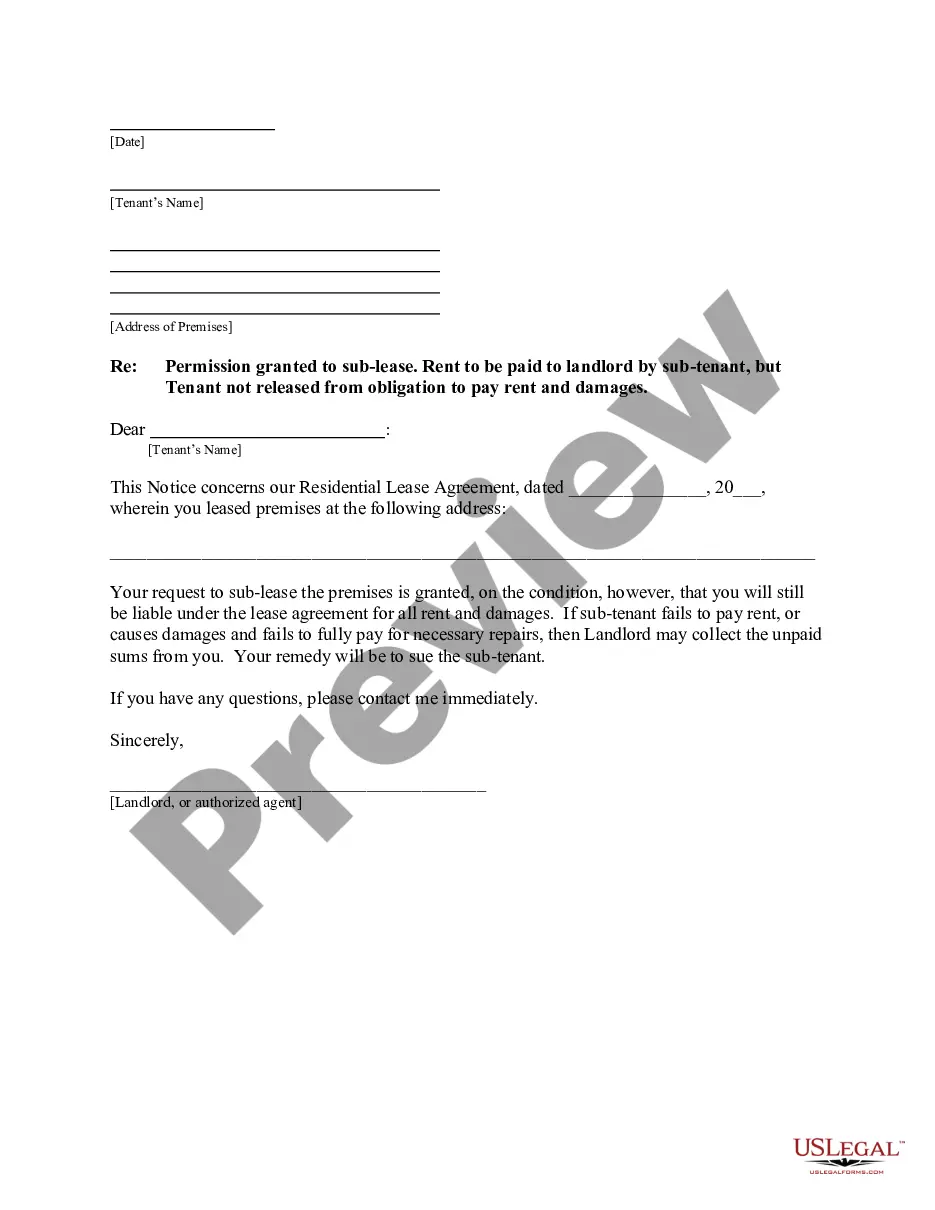

How to fill out Oil, Gas And Mineral Deed - Individual To Two Individuals?

If you have to comprehensive, down load, or print out legal document themes, use US Legal Forms, the most important selection of legal kinds, that can be found on-line. Use the site`s simple and easy practical lookup to discover the paperwork you will need. Numerous themes for enterprise and specific uses are sorted by categories and suggests, or search phrases. Use US Legal Forms to discover the Wyoming Oil, Gas and Mineral Deed - Individual to Two Individuals in just a number of click throughs.

Should you be previously a US Legal Forms consumer, log in to your accounts and click the Acquire option to have the Wyoming Oil, Gas and Mineral Deed - Individual to Two Individuals. You can also entry kinds you in the past acquired from the My Forms tab of your own accounts.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for the appropriate area/land.

- Step 2. Utilize the Review choice to look through the form`s content. Don`t forget about to read the description.

- Step 3. Should you be not happy using the develop, make use of the Research field towards the top of the screen to get other types of your legal develop design.

- Step 4. Once you have found the shape you will need, click on the Buy now option. Opt for the pricing plan you favor and put your references to sign up for an accounts.

- Step 5. Process the purchase. You should use your bank card or PayPal accounts to accomplish the purchase.

- Step 6. Choose the structure of your legal develop and down load it on your system.

- Step 7. Comprehensive, edit and print out or indication the Wyoming Oil, Gas and Mineral Deed - Individual to Two Individuals.

Every legal document design you acquire is your own permanently. You possess acces to each and every develop you acquired with your acccount. Click on the My Forms area and select a develop to print out or down load once again.

Remain competitive and down load, and print out the Wyoming Oil, Gas and Mineral Deed - Individual to Two Individuals with US Legal Forms. There are thousands of expert and condition-specific kinds you can use for your personal enterprise or specific requires.

Form popularity

FAQ

Mineral rights can be divided by specific mineral commodities. For example, one company can own the mineral rights to coal, while another company owns the oil and gas rights. Consequently, it is important to know which minerals are included in a mineral deed. Some deeds specify that ?all minerals? are included.

Owning mineral rights (often referred to as a "mineral interest" or a "mineral estate") gives the owner the right to exploit, mine, and/or produce any or all minerals they own. Minerals can refer to oil, gas, coal, metal ores, stones, sands, or salts.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

Transfer Your Mineral Rights Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

If it has ?Coal and other minerals reserved to U.S.? then the government owns the rights including sand, gravel, and others. If not listed, the mineral rights may belong to the landowner; however, mineral rights are usually accompanied by a court-recorded ?mineral title opinion? to be valid.

No, questions about mineral rights are best left to an oil and gas attorney. If a buyer wants to be sure they are getting the mineral rights they will need to hire an oil and gas attorney. An agent should never try to determine if the purchaser will get the mineral rights.

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.