Wyoming Registration of Foreign Corporation or LLC

Description

How to fill out Wyoming Registration Of Foreign Corporation Or LLC?

Out of the great number of services that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms prior to buying them. Its complete library of 85,000 templates is grouped by state and use for simplicity. All the forms available on the platform have already been drafted to meet individual state requirements by certified legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the template, click Download and access your Form name from the My Forms; the My Forms tab keeps your saved forms.

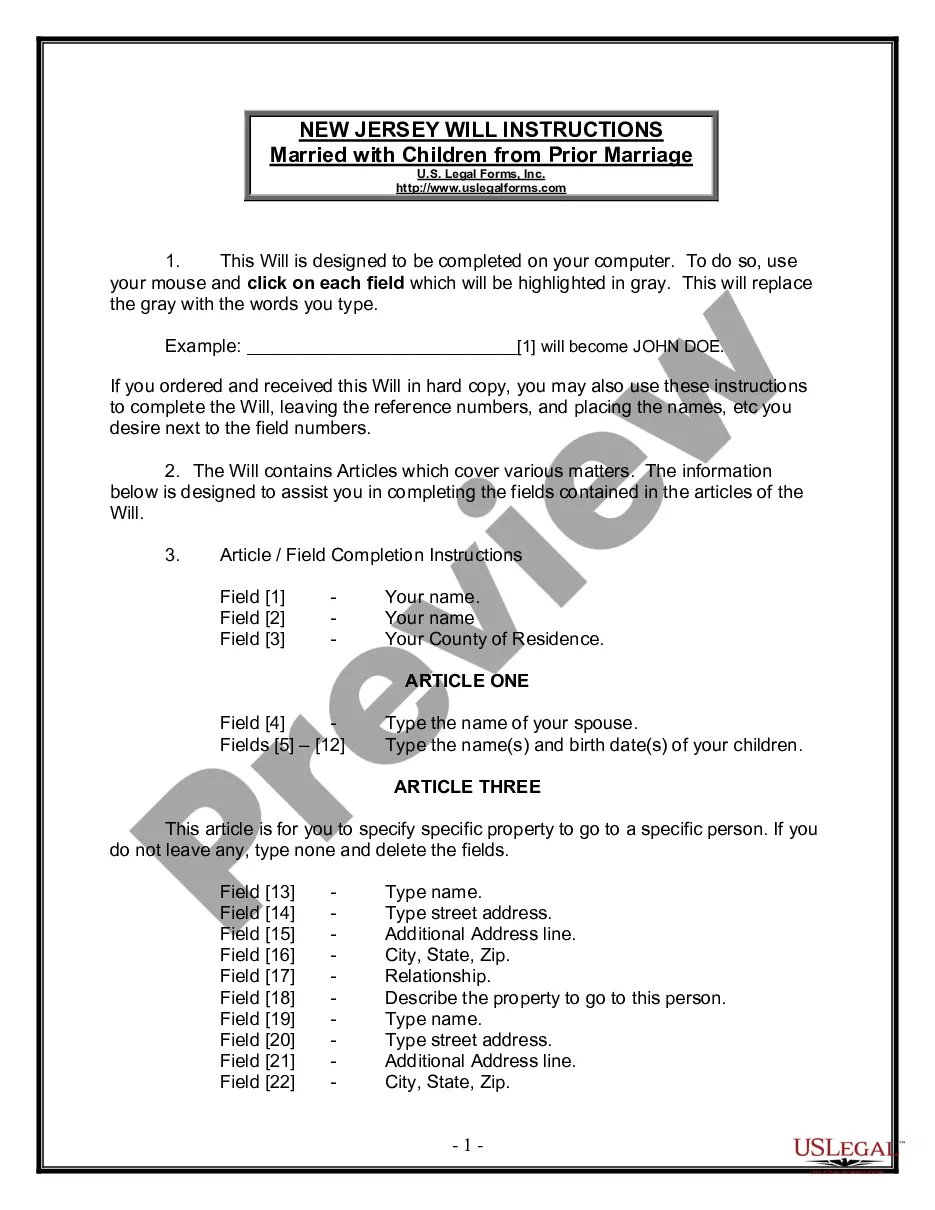

Follow the tips listed below to get the form:

- Once you find a Form name, make certain it is the one for the state you need it to file in.

- Preview the form and read the document description before downloading the template.

- Look for a new template using the Search field if the one you’ve already found isn’t proper.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

When you’ve downloaded your Form name, you can edit it, fill it out and sign it in an web-based editor that you pick. Any document you add to your My Forms tab might be reused many times, or for as long as it remains to be the most up-to-date version in your state. Our service provides fast and easy access to templates that suit both lawyers as well as their customers.

Form popularity

FAQ

Has 2 LLC filings to maintain (a Domestic Wyoming LLC and a Foreign California LLC) has 2 state filing fees. has to meet annual requirements and fees in both states. may have increased Registered Agent fees.

First, the tax climate in the state is incredibly business-friendly. Wyoming does not have a corporate income tax, nor does it have an individual income tax or gross receipts tax.Of all fifty States, Wyoming has one of the best records of business survival.

There are significant benefits to forming an LLC in Wyoming such as unparalleled limited liability protection, fewer corporate formalities, no state taxes, and privacy. Member and/or Manager names are never required on public record for an LLC in Wyoming.

Delaware. Delaware takes one of the top spots as the best state to form LLC. More than 50% of all U.S. publicly-traded companies and roughly 63% of Fortune 500 companies are incorporated in Delaware.

Yes. California registered LLC may operate internationally. No California laws restrict international operation.

Answer. A business is pretty much free to form a limited liability company (LLC) in any old state. But you may still need to qualify your LLC to do business in your home state -- and this means you'll have to file additional paperwork and pay additional fees.

Anyone can form a Limited Liability Company (LLC) in the USA; you do not need to be a US citizen, or a US company. Foreign citizens and foreign companies can form an LLC in the USA. The steps to form your Foreigner-Owned LLC are: Select a State.

California law allows an international corporation to own an LLC. An international corporation can own a single-member LLC, or it can run the business with individuals, LLCs, or other corporations.

To register the foreign LLC, you will need the information from the Articles of Organization and you will need a copy of the official LLC document from the state. Next, determine if you are "doing business" in another state and are thus required to register as a foreign LLC in that state.