This office lease provision states that it is an unpermitted assignment for partners to have a change in their share of partnership ownership and thus a default under the lease. Generally, this type of change in ownership is couched in those provisions dealing with changes in share ownerships of corporations.

West Virginia Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership

Description

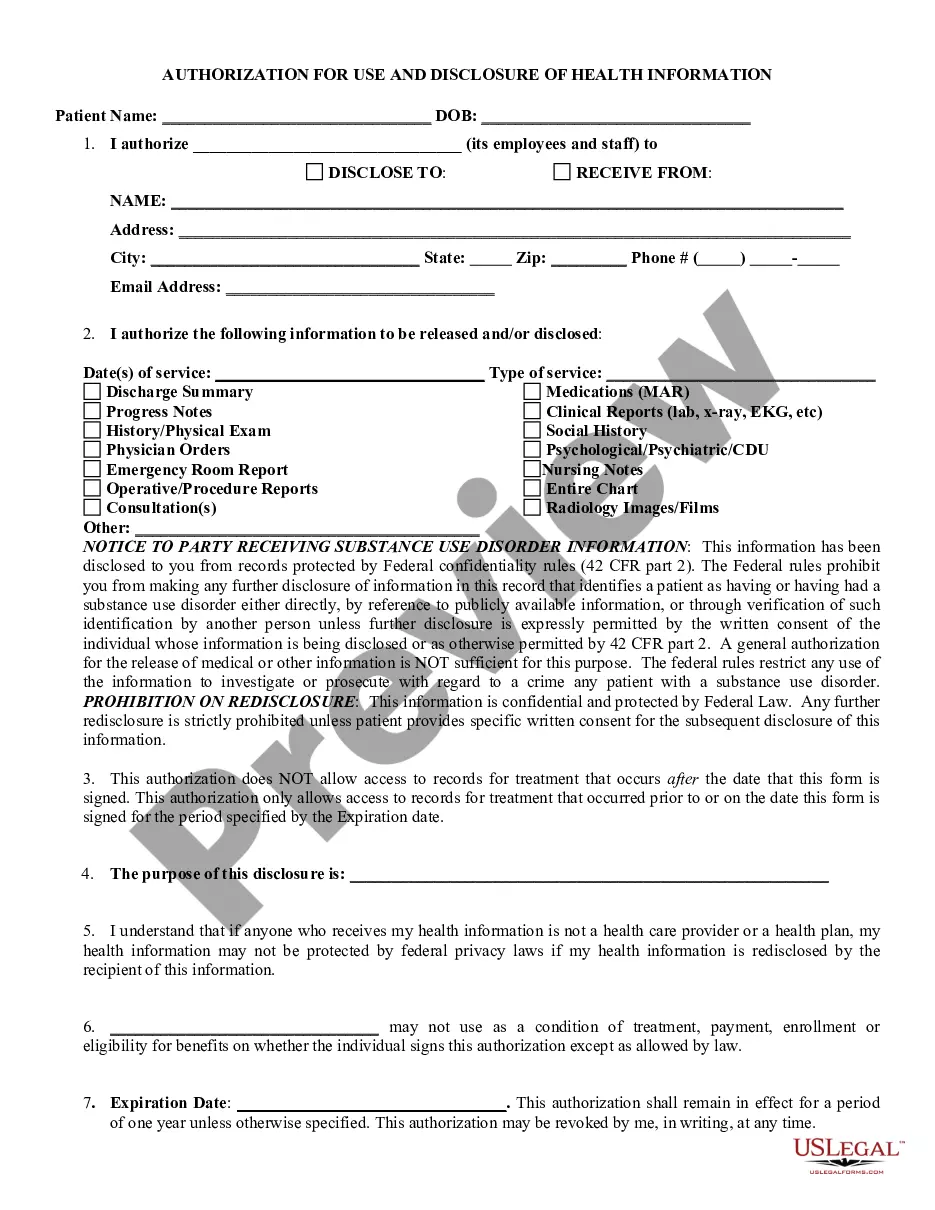

How to fill out Provision Dealing With Changes In Share Ownership Of Corporations And Changes In Share Ownership Of Partnership?

Have you been in a position in which you require documents for sometimes business or individual uses just about every time? There are a variety of legal record layouts available on the Internet, but getting ones you can rely on isn`t effortless. US Legal Forms delivers thousands of kind layouts, like the West Virginia Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership, that happen to be created in order to meet federal and state needs.

In case you are presently acquainted with US Legal Forms website and possess a merchant account, merely log in. Following that, you are able to obtain the West Virginia Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership web template.

If you do not provide an profile and want to begin to use US Legal Forms, follow these steps:

- Find the kind you want and ensure it is for that proper area/region.

- Make use of the Preview switch to analyze the form.

- Read the explanation to ensure that you have chosen the proper kind.

- If the kind isn`t what you are seeking, use the Research discipline to obtain the kind that fits your needs and needs.

- When you discover the proper kind, click Buy now.

- Select the prices plan you want, complete the necessary details to make your money, and pay for the order with your PayPal or credit card.

- Decide on a practical data file file format and obtain your version.

Get every one of the record layouts you have bought in the My Forms menus. You can get a more version of West Virginia Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership at any time, if needed. Just go through the needed kind to obtain or print the record web template.

Use US Legal Forms, probably the most extensive variety of legal forms, in order to save some time and prevent errors. The service delivers appropriately produced legal record layouts which can be used for a selection of uses. Generate a merchant account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

Virginia provides automatic tax extensions, meaning you will not need to file an application. Corporations receive an automatic six-month state extension. Some corporations will receive a deadline that is 30 days after a federal extension deadline if this date is later than the state deadline.

An automatic 6-month filing extension is allowed for pass-through entities filing on Form 502PTET. No application for extension is required. To avoid late-filing penalties, you must file Form 502PTET no later than 6 months from the original due date of the return.

Any S Corpora on or Partnership granted an extension of me to file their federal return is granted the same extension of me to file their West Virginia return. Be sure to a ach a copy of your federal extension to each tax return to avoid any penalty for late filing.

Send a letter requesting an extension before the 1st day of the 7th month following the close of your taxable year. We will give you an extension of 30 days after the date you expect to qualify for the federal exclusion. When you file, enclose a copy of the approved federal extension with your return.

On March 28, West Virginia Gov. Jim Justice signed Senate Bill 151, which allows a qualifying PTE to annually elect to be subject to the personal income tax at the entity level for tax years beginning on or after Jan. 1, 2022.

Extensions. Virginia grants an automatic 6-month filing extension for fiduciary income returns. The extension provisions do not apply to payment of any tax due with your return. To avoid penalties, you must pay at least 90% of the fiduciary's final tax liability by the original due date.

West Virginia businesses deriving income from the state while operating as an S corporation or partnership and acting as a pass-through entity should use a form SPF-100 to file their state tax due. Before you can complete this document, you will need to complete the separate Schedule SP form.