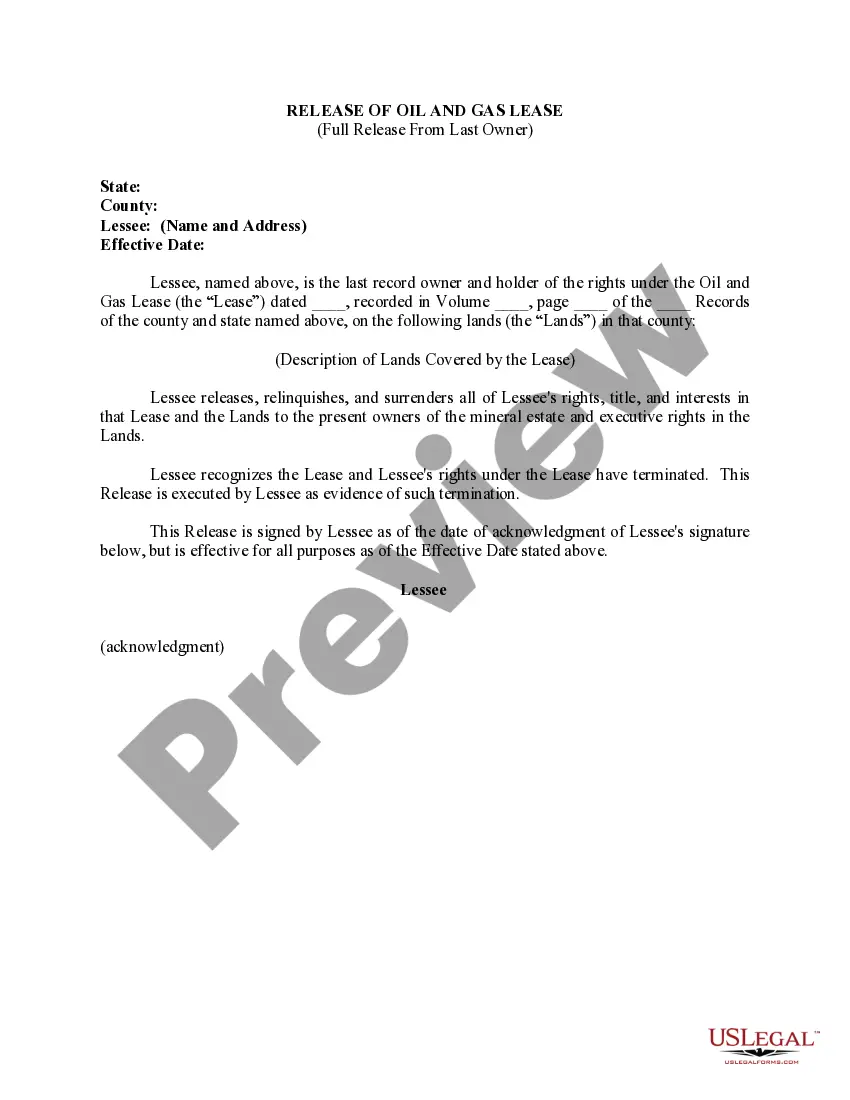

West Virginia Release of Oil and Gas Lease - Full Release from Last Owner

Description

How to fill out Release Of Oil And Gas Lease - Full Release From Last Owner?

US Legal Forms - one of several greatest libraries of authorized kinds in America - gives a wide range of authorized record web templates you may obtain or produce. Making use of the internet site, you may get 1000s of kinds for business and specific purposes, categorized by types, says, or search phrases.You can find the latest types of kinds much like the West Virginia Release of Oil and Gas Lease - Full Release from Last Owner within minutes.

If you already have a registration, log in and obtain West Virginia Release of Oil and Gas Lease - Full Release from Last Owner from the US Legal Forms library. The Download switch will show up on every type you see. You gain access to all in the past acquired kinds inside the My Forms tab of the profile.

In order to use US Legal Forms initially, allow me to share basic recommendations to help you get started out:

- Ensure you have chosen the best type for your personal metropolis/state. Go through the Review switch to examine the form`s articles. Read the type outline to actually have selected the proper type.

- In the event the type doesn`t suit your demands, use the Search industry near the top of the display screen to obtain the one that does.

- When you are pleased with the form, confirm your selection by simply clicking the Buy now switch. Then, pick the pricing prepare you prefer and offer your references to register on an profile.

- Approach the purchase. Make use of your credit card or PayPal profile to accomplish the purchase.

- Pick the file format and obtain the form in your product.

- Make modifications. Load, revise and produce and indication the acquired West Virginia Release of Oil and Gas Lease - Full Release from Last Owner.

Each and every format you put into your money does not have an expiry day and is the one you have for a long time. So, in order to obtain or produce an additional version, just check out the My Forms section and click in the type you will need.

Get access to the West Virginia Release of Oil and Gas Lease - Full Release from Last Owner with US Legal Forms, the most comprehensive library of authorized record web templates. Use 1000s of specialist and condition-specific web templates that meet up with your organization or specific requires and demands.

Form popularity

FAQ

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.

Oil is restricted to reservoirs located primarily in northern and central West Virginia. First found in the Kanawha and the Little Kanawha river valleys in the 18th century, West Virginia's oil and gas have long been important economic resources.

Mineral interests in WV are taxed the same as your home. You will pay 60% of the appraised value on the minerals at the levy rate for your county. The value of these minerals in based on WV Code procedures and is the same for all counties in WV. Minerals are taxed at a minimum value until production begins.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

As long as the lessee pays the annual rent, the lease remains in effect. This definite period of time is called the primary term. When a company fails to start production, the lease expires after the primary term. When the company starts drilling for oil and gas, the lease will remain in effect past the primary term.

Mineral rights give ownership, for a specified time, of the underground minerals that do not include sand, limestone, gravel, or subsurface water. If the mineral rights to your property have been sold before you acquired the land, that means you own only the surface rights and cannot use the minerals.

Mineral rights give ownership, for a specified time, of the underground minerals that do not include sand, limestone, gravel, or subsurface water. If the mineral rights to your property have been sold before you acquired the land, that means you own only the surface rights and cannot use the minerals.

in clause (or shutin royalty clause) traditionally allows the lessee to maintain the lease by making shutin payments on a well capable of producing oil or gas in paying quantities where the oil or gas cannot be marketed, whether due to a lack of pipeline connection or otherwise.