West Virginia Oil and Gas Division Order

Description

How to fill out Oil And Gas Division Order?

Discovering the right legitimate record format can be quite a have difficulties. Obviously, there are a lot of web templates accessible on the Internet, but how would you discover the legitimate form you need? Make use of the US Legal Forms site. The service gives a large number of web templates, such as the West Virginia Oil and Gas Division Order, which can be used for company and personal requires. Every one of the varieties are checked by professionals and satisfy federal and state needs.

When you are currently listed, log in for your bank account and then click the Down load switch to have the West Virginia Oil and Gas Division Order. Make use of your bank account to look from the legitimate varieties you might have ordered earlier. Go to the My Forms tab of the bank account and obtain another version in the record you need.

When you are a new user of US Legal Forms, listed here are easy guidelines so that you can stick to:

- Very first, ensure you have chosen the right form for your town/state. You can look through the shape utilizing the Preview switch and study the shape information to make certain this is the right one for you.

- In case the form will not satisfy your preferences, make use of the Seach discipline to obtain the right form.

- When you are certain the shape would work, click on the Acquire now switch to have the form.

- Select the costs plan you want and type in the needed information. Create your bank account and pay money for your order using your PayPal bank account or bank card.

- Select the document format and down load the legitimate record format for your system.

- Comprehensive, edit and produce and indication the received West Virginia Oil and Gas Division Order.

US Legal Forms will be the largest catalogue of legitimate varieties where you will find a variety of record web templates. Make use of the company to down load skillfully-manufactured files that stick to condition needs.

Form popularity

FAQ

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease. Oil and Gas Leasing - Earthworks earthworks.org ? issues ? oil-and-gas-leasing earthworks.org ? issues ? oil-and-gas-leasing

It's important to know the mineral rights of your property. If you own the rights, they can become a reliable source of income. If someone else owns the rights, they can remove valuable minerals from under your feet, literally.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future. Should I Sell My Mineral Rights? Weigh The Pros and Cons tenmileland.com ? 2023/05/23 ? is-selling-your-m... tenmileland.com ? 2023/05/23 ? is-selling-your-m...

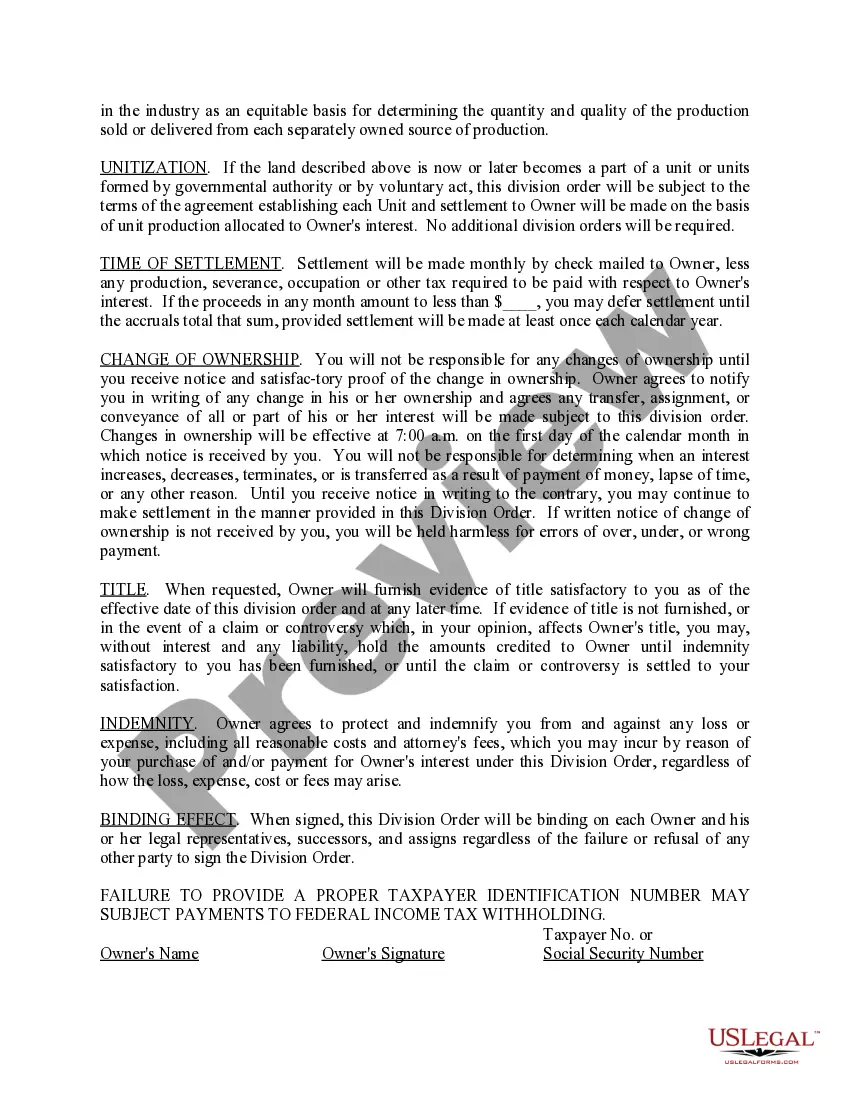

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing. The Division Order?What Every Mineral Owner Should Know gwlawok.com ? the-division-order-what-every-mi... gwlawok.com ? the-division-order-what-every-mi...

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

A Division order is an instrument that records an owner's interest in a specific well. It should include the name of the well, the well number, interest type, and your decimal interest. Division Order - ConocoPhillips conocophillips.com ? us-interest-owners ? di... conocophillips.com ? us-interest-owners ? di...

Risks Associated with Owning Mineral Rights ? Declining Oil and Gas Reserves. Oil, gas, and other minerals are finite resources. ... ? Steep Decline Curves. ... ? Held By Production (HBP)