West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

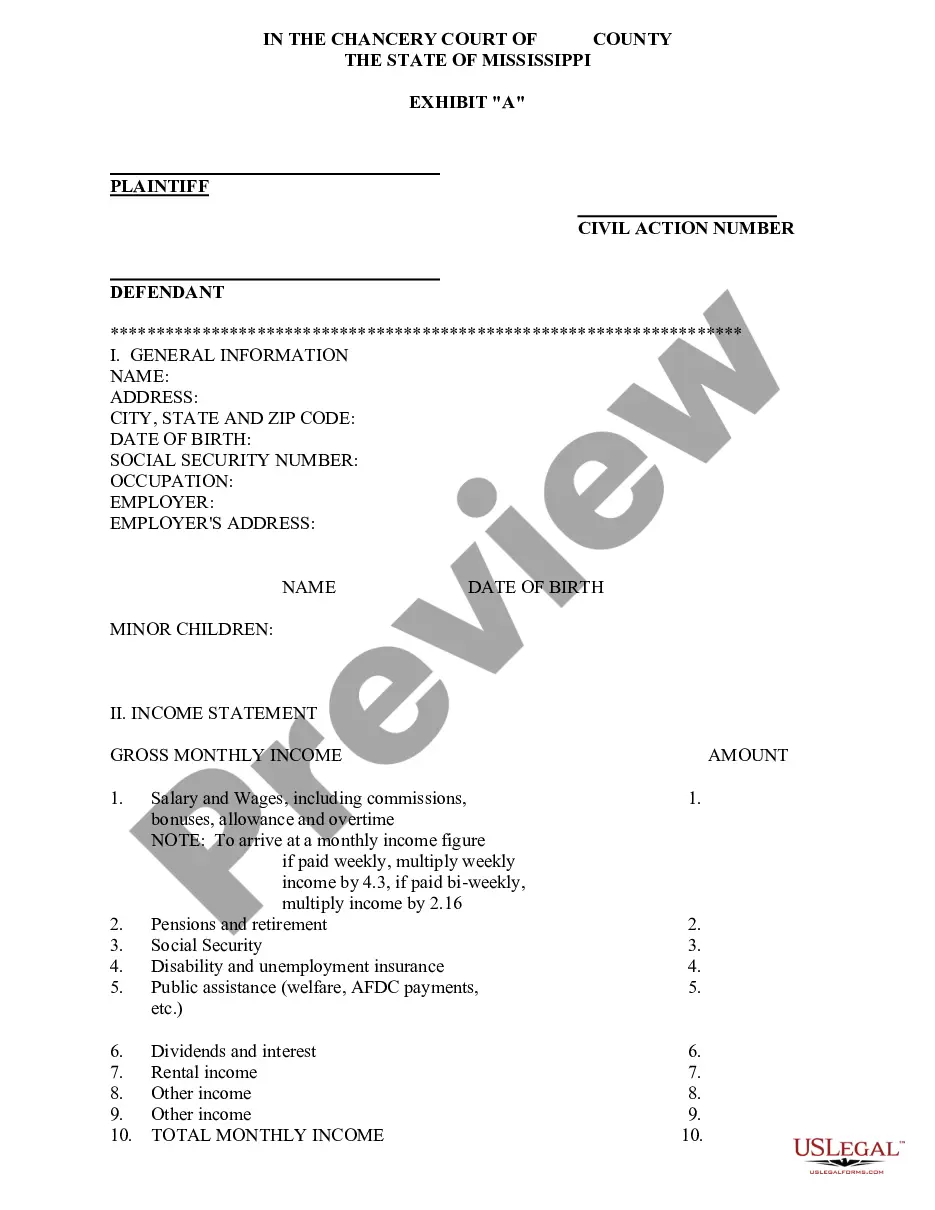

How to fill out Electronics Assembly Agreement - Self-Employed Independent Contractor?

If you need to detailed, obtain, or print lawful document templates, utilize US Legal Forms, the premier collection of legal forms, available online.

Employ the site's straightforward and user-friendly search to find the documents you need.

A selection of templates for business and personal purposes are classified by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and input your information to create an account.

- Use US Legal Forms to obtain the West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to retrieve the West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously stored within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to check the description.

Form popularity

FAQ

Creating an independent contractor agreement involves several key steps. Start by identifying the scope of work, payment structure, and duration of the project. Next, ensure all terms comply with local laws, particularly those relevant to the West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor. Platforms like US Legal Forms offer templates and guidance to streamline this process, making it easier for you to draft a comprehensive agreement.

A legal agreement for an independent contractor outlines the terms of the working relationship between the contractor and the client. This document specifies the services to be provided, payment terms, and the duration of the contract. It helps protect both parties and clarifies their rights and responsibilities. Using the West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor ensures that you have a solid foundation for your business arrangement.

To write an effective independent contractor agreement, begin by stating the names and addresses of both parties involved. Next, outline the scope of work, compensation rate, and payment schedule. Include clauses that mention confidentiality, liability, and termination conditions. If you're working under a West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor, incorporating these elements ensures clarity and protection for all parties. For ease, consider using uslegalforms, which offers templates to help you create a professional agreement.

Filling out an independent contractor agreement involves specifying the services you will provide, the payment terms, and the duration of the agreement. Clearly outlining responsibilities and expectations can help prevent misunderstandings later on. Remember to include any important details relevant to your specific role, particularly if you are engaging in a West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor. Utilizing a platform like uslegalforms can streamline this process with ready-made templates.

To fill out a W-9 form as an independent contractor, start by providing your name and business name, if applicable. You will also need to enter your taxpayer identification number, which may be your Social Security number or Employer Identification Number. This form is crucial for reporting your income as a West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor. Completing this accurately helps ensure proper tax documentation and compliance.

Yes, West Virginia allows independent contractors under state law. Many individuals choose to work as self-employed independent contractors in various industries, including electronics assembly. This status provides flexibility in work arrangements and can lead to potential tax benefits. If you're considering operating as a West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor, it's essential to understand your rights and obligations.

The new federal rule aims to clarify the classification of independent contractors to protect workers' rights. This change emphasizes the importance of accurately defining the relationship between the contractor and the hiring entity. Familiarizing yourself with the West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor can help align your contracts with these regulations.

Yes, having a contract is essential when working as an independent contractor. A well-drafted agreement, like a West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor, clarifies roles and expectations, minimizing misunderstandings. This contract serves as a legal safeguard for both parties involved.

Yes, you can hire independent contractors in West Virginia. This flexibility allows businesses to manage costs and meet specific project needs. When hiring, it’s wise to use a West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor to outline the terms and responsibilities to protect both parties.

As of now, there are no outright bans on individual contracting in any state, including West Virginia. However, some states have implemented stricter regulations surrounding independent contractors. Understanding these nuances can help you in developing a comprehensive West Virginia Electronics Assembly Agreement - Self-Employed Independent Contractor that aligns with these regulations.