West Virginia Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

It is feasible to invest hours online searching for the valid document template that meets the state and federal criteria you require.

US Legal Forms provides an extensive collection of valid forms that can be assessed by experts.

You can easily download or print the West Virginia Carpentry Services Contract - Self-Employed Independent Contractor from our platform.

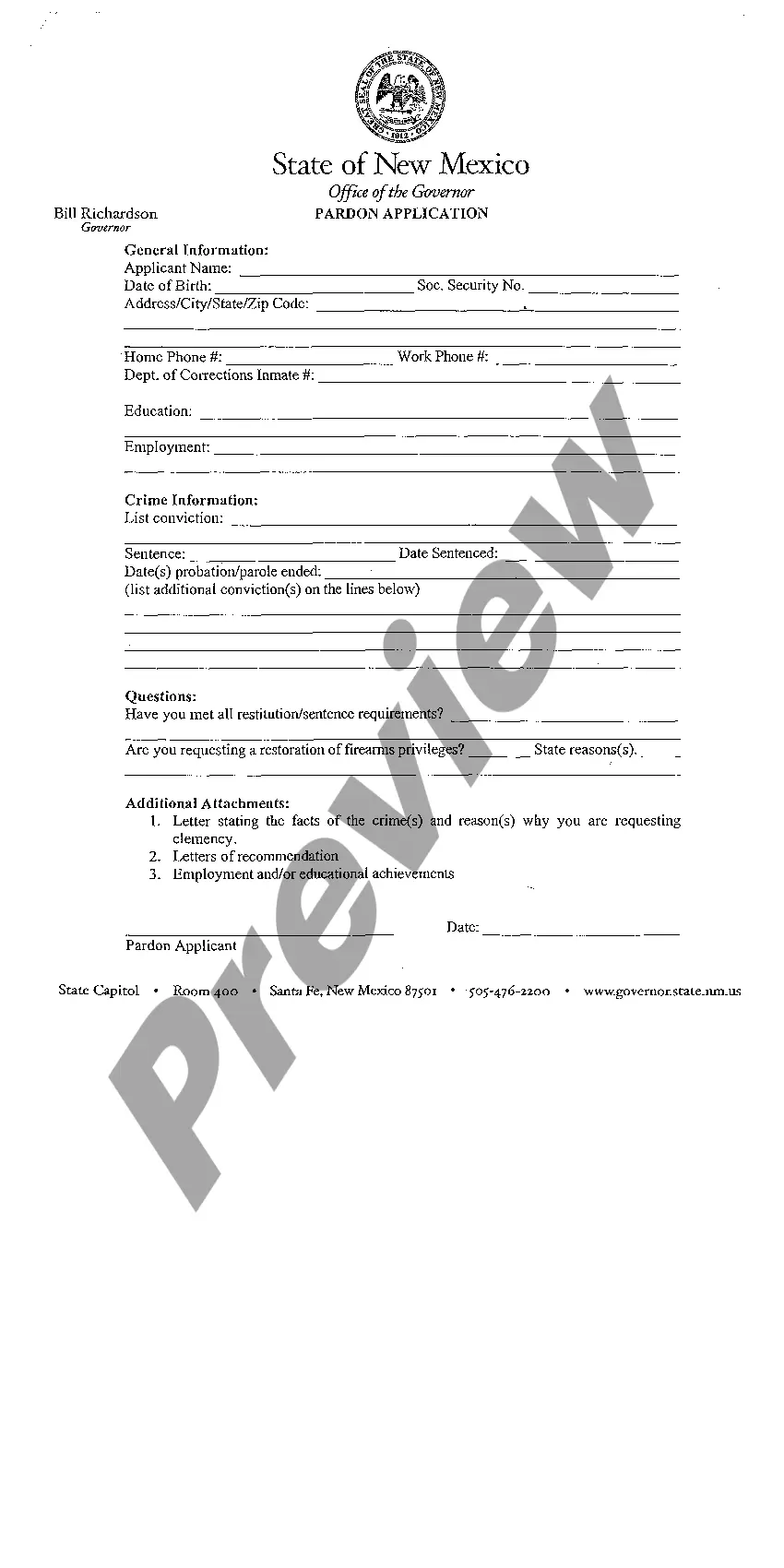

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the West Virginia Carpentry Services Contract - Self-Employed Independent Contractor.

- Each valid document template you purchase is yours to keep for years.

- To obtain another copy of a purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/town of your choice.

- Review the form outline to make sure you have chosen the appropriate form.

Form popularity

FAQ

In the United States, including West Virginia, independent contractors must report all income, regardless of the amount. However, if your earnings exceed $400 in a year, you typically need to file a tax return. Engaging with a West Virginia Carpentry Services Contract as a self-employed independent contractor can help clarify your income and tax obligations. For assistance with tax matters, resources available on US Legal Forms can be very helpful.

An independent contractor typically fills out various paperwork, including contracts, tax forms, and permits. For West Virginia carpentry services, ensure you have clear service agreements and invoicing records. Depending on the project, you may also need to submit insurance documents or business licenses. Platforms like UsLegalForms can provide the necessary templates to facilitate this process efficiently.

When filling out an independent contractor form, start by entering your personal information and business details. Clearly describe your expertise, such as carpentry, and any relevant qualifications. Include terms regarding payment, duration of the contract, and any other specifics related to your services. For a streamlined experience, consider using templates from UsLegalForms to ensure no critical details are overlooked.

Filling out an independent contractor agreement involves providing essential details such as names, addresses, and the nature of the work. Specify the payment structure, milestones, and any required materials or tools. It is important to review the agreement thoroughly for clarity. Utilizing UsLegalForms can help you fill out your West Virginia carpentry services contract accurately.

To write an independent contractor agreement for West Virginia carpentry services, start by outlining the scope of work. Clearly define the responsibilities of both parties, including payment terms, deadlines, and delivery specifics. Make sure to include clauses for termination and confidentiality to protect both parties. Using a structured template from UsLegalForms can simplify this process.

Having a contract as an independent contractor is highly recommended. A well-drafted West Virginia Carpentry Services Contract - Self-Employed Independent Contractor clearly outlines your scope of work, payment terms, and project deadlines. This written agreement safeguards you against potential conflicts and ensures you have a documented understanding with your clients. Working without a contract can expose you to risks and legal ambiguities.

The new federal rule on independent contractors affects how workers are classified for labor protections. This rule aims to clarify the criteria for independent contractor status, emphasizing the nature of the work relationship. It is important for self-employed individuals, like you, to understand these changes as they may impact your classification under a West Virginia Carpentry Services Contract - Self-Employed Independent Contractor. Knowing your rights will help you navigate your responsibilities more effectively.

Yes, you can have a contract even if you are self-employed. In fact, a West Virginia Carpentry Services Contract - Self-Employed Independent Contractor is essential to define your work terms clearly. This contract protects both your rights and those of your clients, ensuring mutual understanding and commitment. Having a written agreement helps prevent misunderstandings and disputes down the line.

As of now, few states have implemented laws to restrict individual contracting significantly. Regulations may vary across the country, so always check the local laws in the state you're operating in. For clarity on these laws, including how they relate to the West Virginia Carpentry Services Contract - Self-Employed Independent Contractor, consider consulting with a legal expert.

You can perform tasks up to a certain monetary limit without a contractor license in West Virginia. Generally, projects costing less than $1,000 are exempt from licensing requirements. Be sure to utilize the West Virginia Carpentry Services Contract - Self-Employed Independent Contractor to protect your interests and clarify the scope of your work.