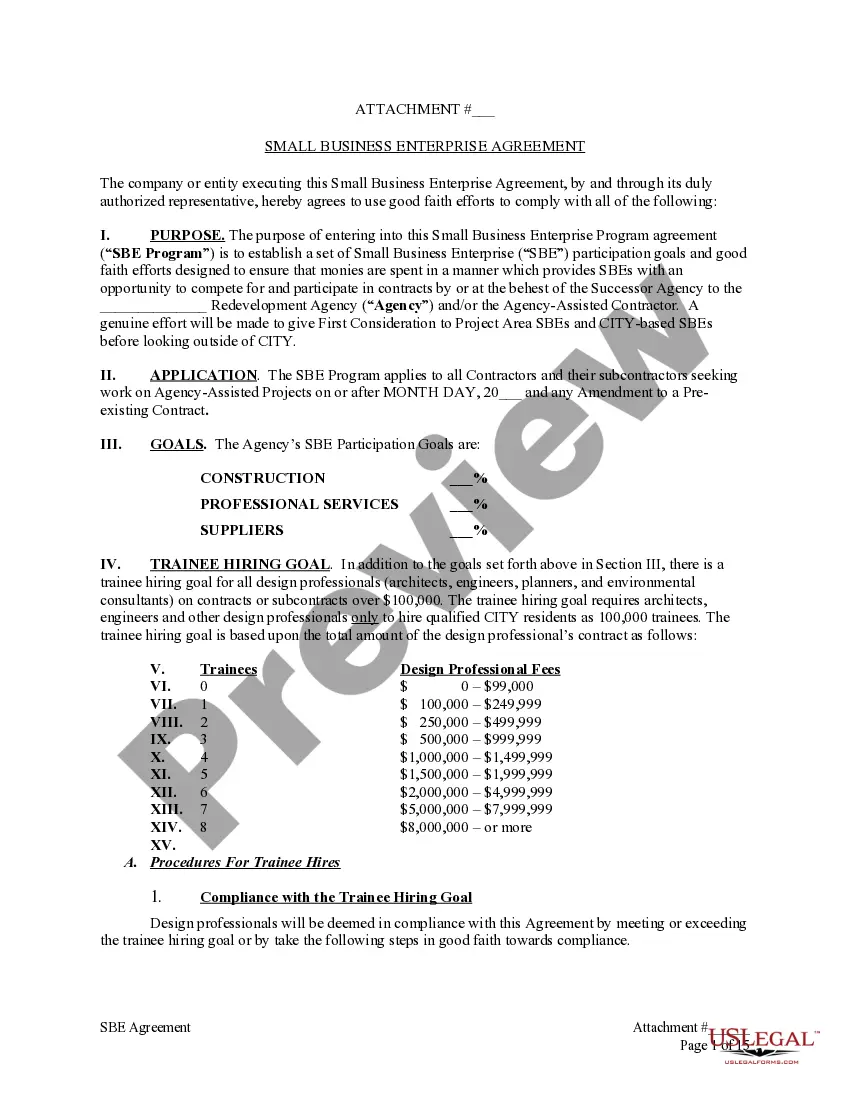

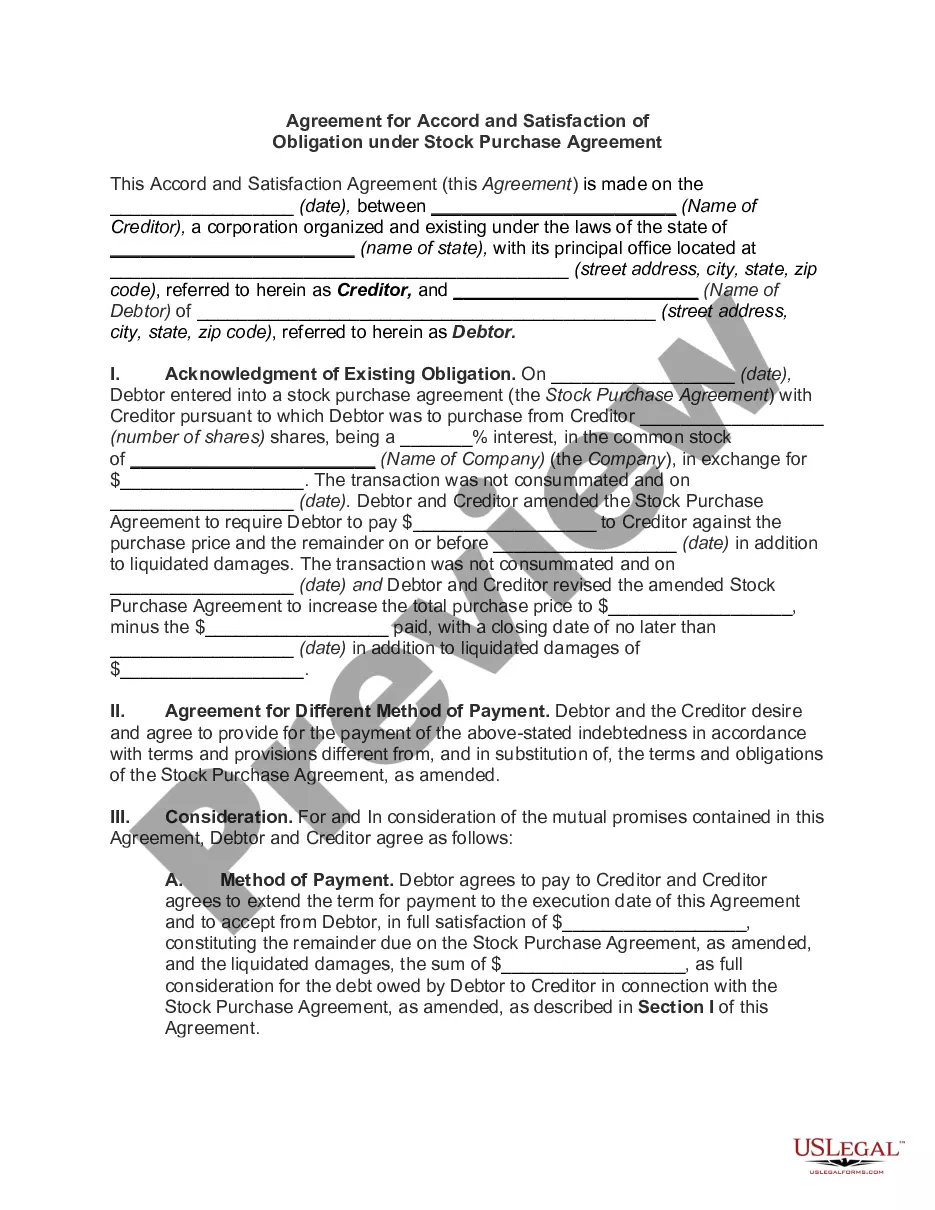

West Virginia Grant Agreement - From Government Assoc.

Description

How to fill out Grant Agreement - From Government Assoc.?

Choosing the best legitimate file design can be a have a problem. Needless to say, there are plenty of templates available online, but how will you find the legitimate develop you require? Make use of the US Legal Forms website. The assistance provides thousands of templates, like the West Virginia Grant Agreement - From Government Assoc., which you can use for organization and private demands. All the types are checked by experts and satisfy federal and state specifications.

In case you are currently listed, log in in your bank account and then click the Down load button to have the West Virginia Grant Agreement - From Government Assoc.. Utilize your bank account to check throughout the legitimate types you may have purchased previously. Go to the My Forms tab of your bank account and obtain yet another backup of the file you require.

In case you are a brand new end user of US Legal Forms, here are basic instructions that you can adhere to:

- Very first, make certain you have chosen the correct develop for your personal area/county. You can check out the shape utilizing the Preview button and look at the shape information to guarantee this is basically the right one for you.

- In the event the develop fails to satisfy your expectations, take advantage of the Seach industry to discover the correct develop.

- Once you are certain that the shape is suitable, click the Get now button to have the develop.

- Choose the prices plan you want and enter the necessary information. Make your bank account and pay for the transaction making use of your PayPal bank account or credit card.

- Pick the document file format and obtain the legitimate file design in your product.

- Complete, change and produce and sign the obtained West Virginia Grant Agreement - From Government Assoc..

US Legal Forms will be the greatest local library of legitimate types for which you can discover a variety of file templates. Make use of the company to obtain professionally-manufactured paperwork that adhere to status specifications.

Form popularity

FAQ

The top revenue industries for West Virginia in 2022 were: Hospitals ? $11.1 billion. Coal Mining ? $7.4 billion. Gas Stations with Convenience Stores ? $6.1 billion.

Certain Nonprofit Organizations - Purchases by a corporation or organization which has a current registration certificate and which is exempt from federal income taxes under section § 501(c)(3) or (c)(4) of the Internal Revenue Code are exempt if the organization meets all of the requirements set forth in W. Va.

To start a West Virginia 501(c)(3) nonprofit organization, you'll need to first register a nonprofit corporation with the state of West Virginia, and then apply for tax exempt status under section 501(c)(3) with the Internal Revenue Service.

West Virginia has reciprocal agreements with Kentucky, Maryland, Ohio, Pennsylvania and Virginia. If you are a West Virginia resident working in one of these states, and your employer withheld the other state's income tax, you must file for a refund from that state.

Starting a nonprofit can be a lengthy process. Some of it depends on how quickly you can get organized, assemble a board of directors, incorporate your nonprofit, and prepare everything you need to apply for tax-exempt status. For most new nonprofits, this stage can take a few months.

File your nonprofit 501(c)(3) attachment with the Secretary of State, using form CD-3. If your nonprofit was incorporated in a state other than West Virginia, file an Application for Certificate of Authority with the Secretary of State, using form CF-1. File a Name Reservation with the Secretary of State on Form NR-1.

Non-profit charities get revenue from donations, grants, and memberships. They may also get revenue from selling branded products. A non-profit organization's expenses may include: Rent or mortgage payments.

West Virginia's combined state and local general revenues were $20.3 billion in FY 2021, or $11,353 per capita. National per capita general revenues were $12,277. West Virginia uses all major state and local taxes.