West Virginia Documentation Required to Confirm Accredited Investor Status

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Documentation Required To Confirm Accredited Investor Status?

US Legal Forms - one of many largest libraries of lawful kinds in America - offers an array of lawful record web templates you can down load or print. While using website, you can get a huge number of kinds for enterprise and person purposes, categorized by categories, says, or keywords and phrases.You will discover the newest types of kinds much like the West Virginia Documentation Required to Confirm Accredited Investor Status within minutes.

If you already have a registration, log in and down load West Virginia Documentation Required to Confirm Accredited Investor Status from the US Legal Forms collection. The Obtain switch can look on each and every develop you look at. You gain access to all earlier delivered electronically kinds in the My Forms tab of your own bank account.

If you would like use US Legal Forms the very first time, listed here are straightforward instructions to obtain started:

- Be sure to have chosen the right develop for your city/state. Click the Review switch to examine the form`s content. Look at the develop outline to ensure that you have chosen the right develop.

- In the event the develop does not satisfy your requirements, utilize the Research area on top of the display screen to get the one that does.

- In case you are content with the form, validate your selection by clicking on the Get now switch. Then, choose the prices strategy you favor and supply your accreditations to register for the bank account.

- Approach the purchase. Utilize your Visa or Mastercard or PayPal bank account to finish the purchase.

- Select the file format and down load the form on your device.

- Make alterations. Fill up, revise and print and indicator the delivered electronically West Virginia Documentation Required to Confirm Accredited Investor Status.

Each and every web template you included with your money does not have an expiration day which is your own property eternally. So, if you wish to down load or print another version, just check out the My Forms section and then click about the develop you require.

Gain access to the West Virginia Documentation Required to Confirm Accredited Investor Status with US Legal Forms, probably the most extensive collection of lawful record web templates. Use a huge number of professional and state-certain web templates that meet up with your organization or person requires and requirements.

Form popularity

FAQ

A copy of the title deed of your primary residence. investor status by MAS. (c) income in the preceding twelve (12) months is not less than S$300,000 (or its equivalent in a foreign currency). a copy of your employment contract stating your position and income.

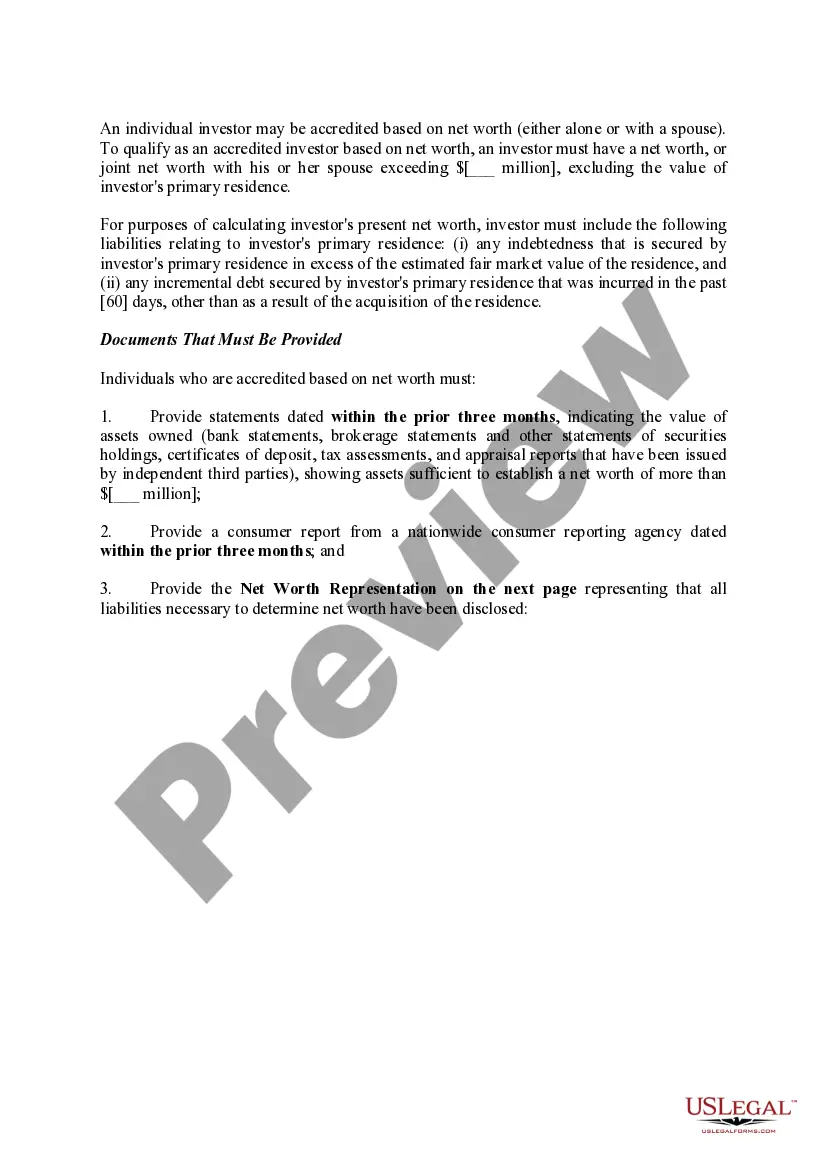

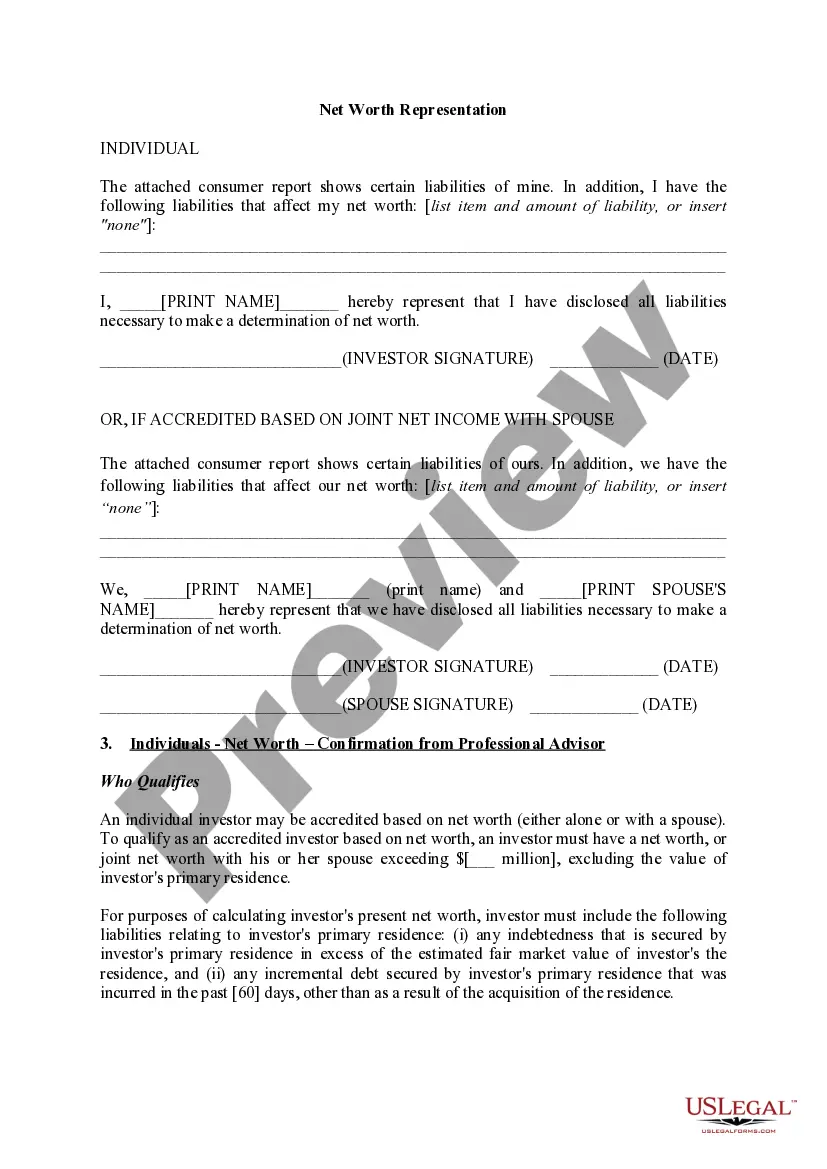

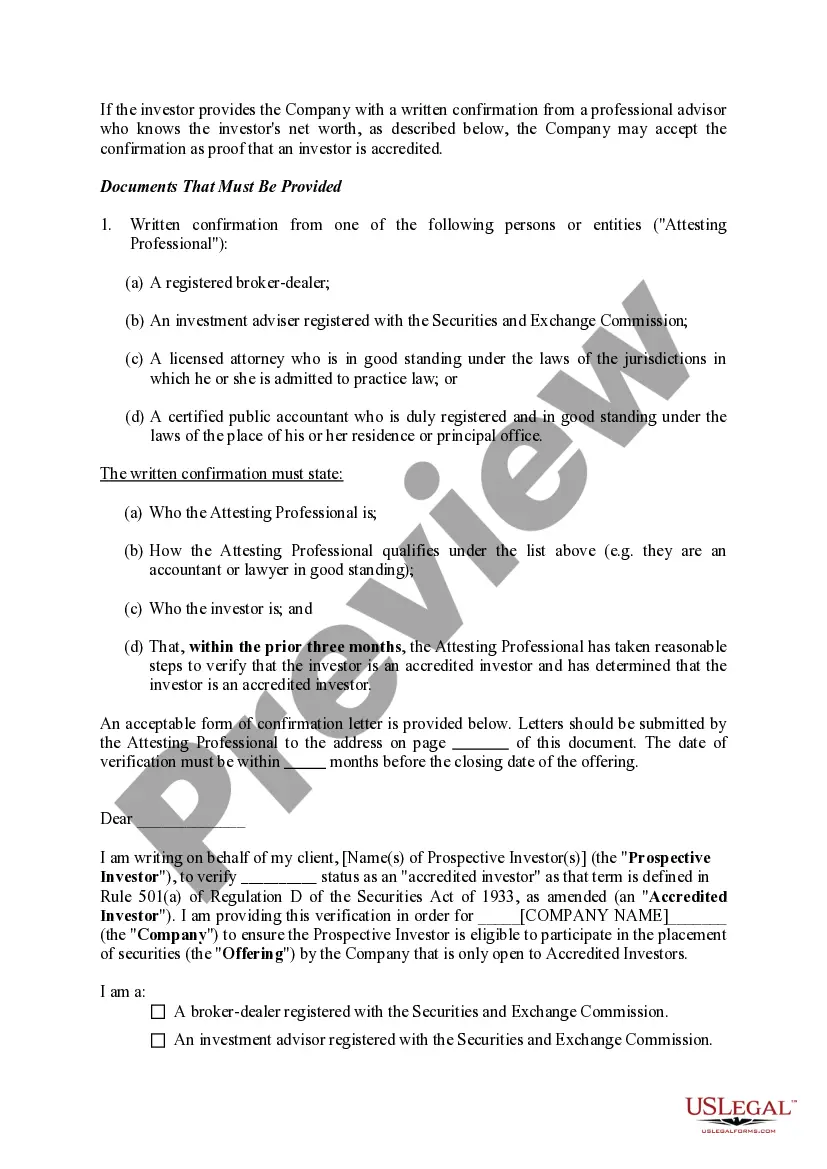

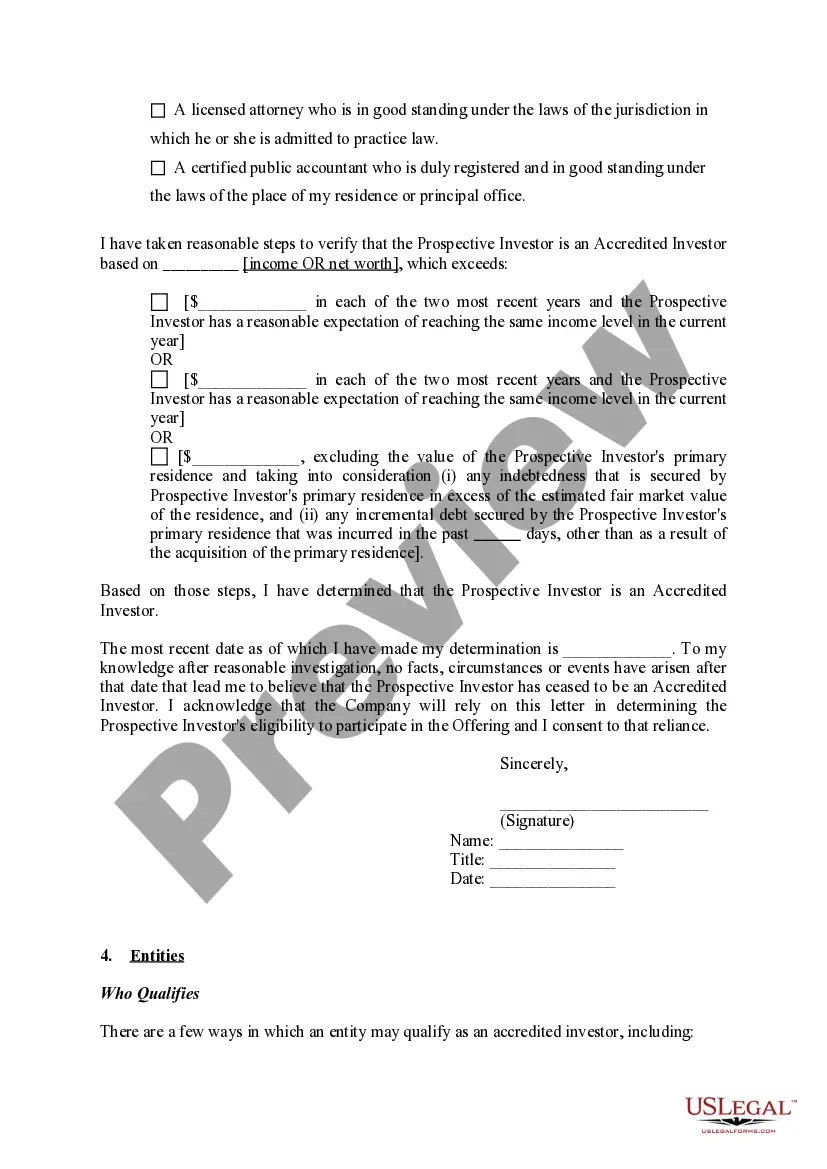

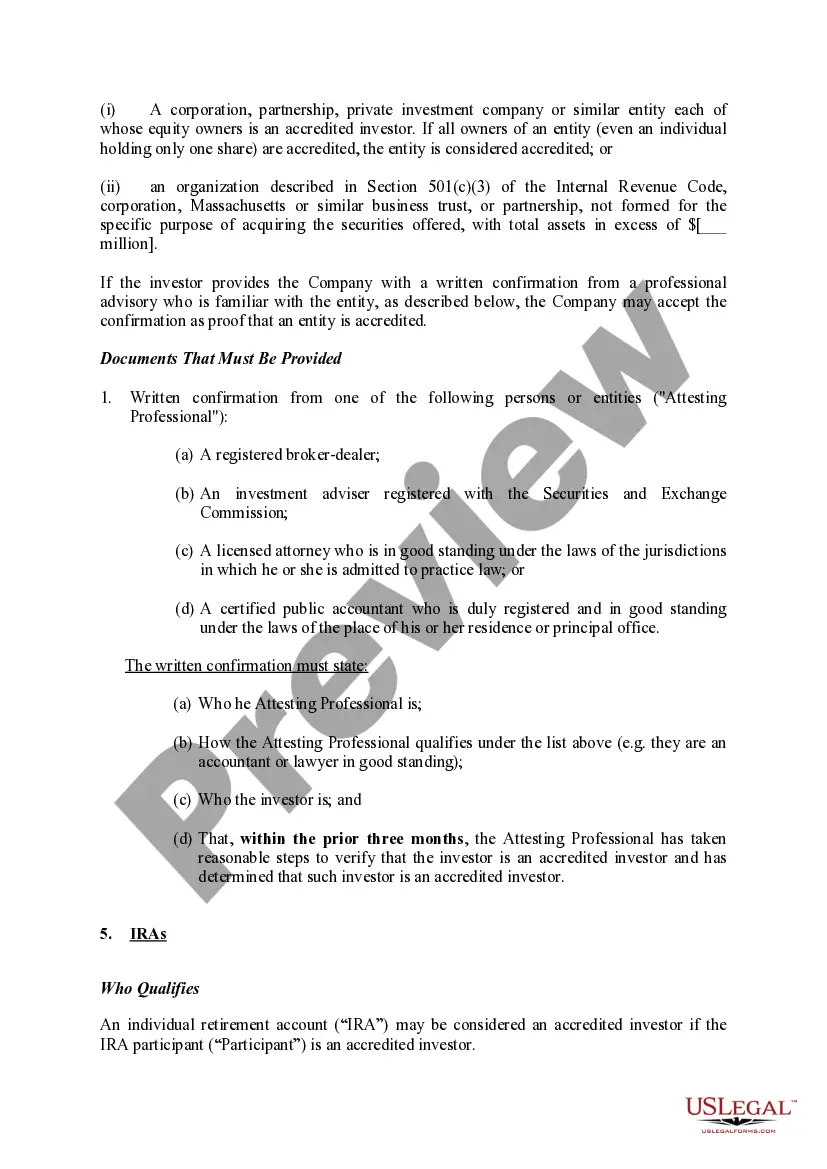

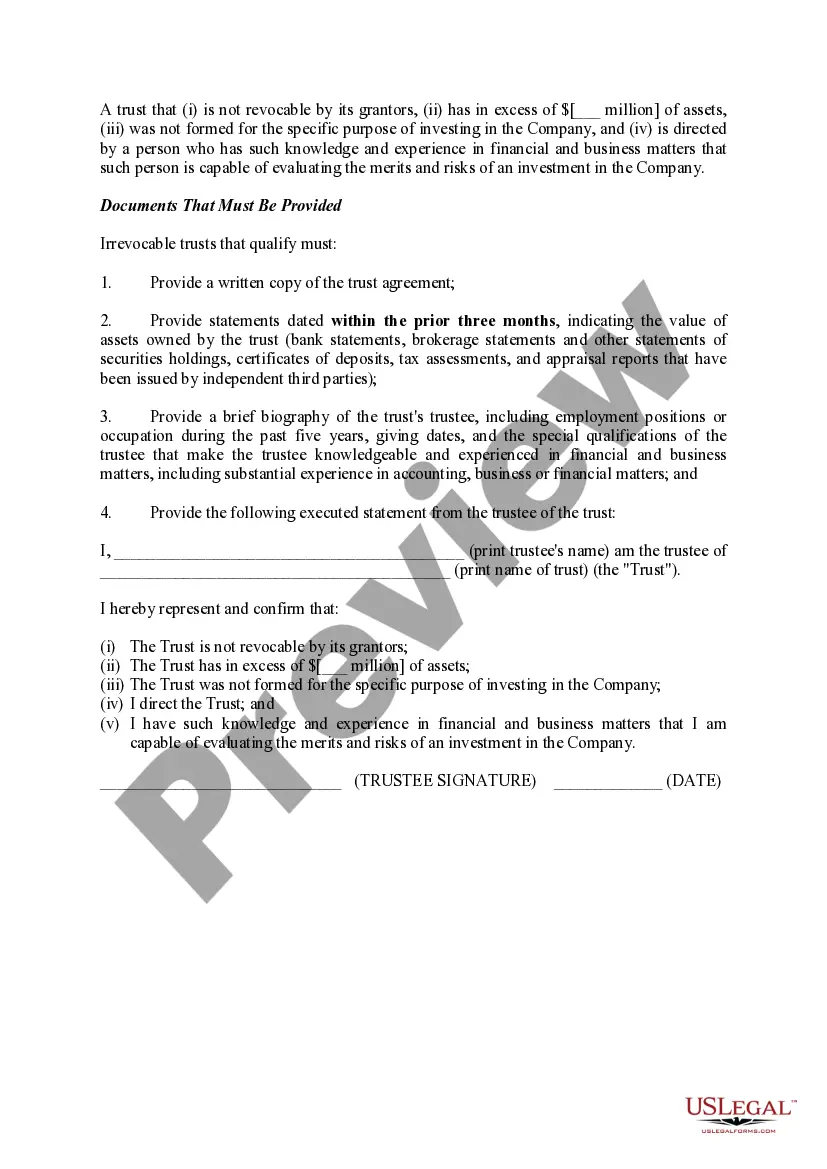

Reviewing bank statements, brokerage statements, and other similar reports to determine net worth. Obtaining written confirmation of the investor's accredited investor status from one of the following persons: a registered broker-dealer, an investment adviser registered with the SEC, a licensed attorney, or a CPA.

For instance, if you want to make a significant investment, it's not uncommon for a company to verify your accreditation status as an investor. You'll need to provide tax returns, credit reports, and financial statements to a CPA or a 3rd-party verification company for proper verification.

There's no certification offered to prove you're an accredited investor. Instead, companies selling investments to accredited investors are required to take steps to verify you qualify.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

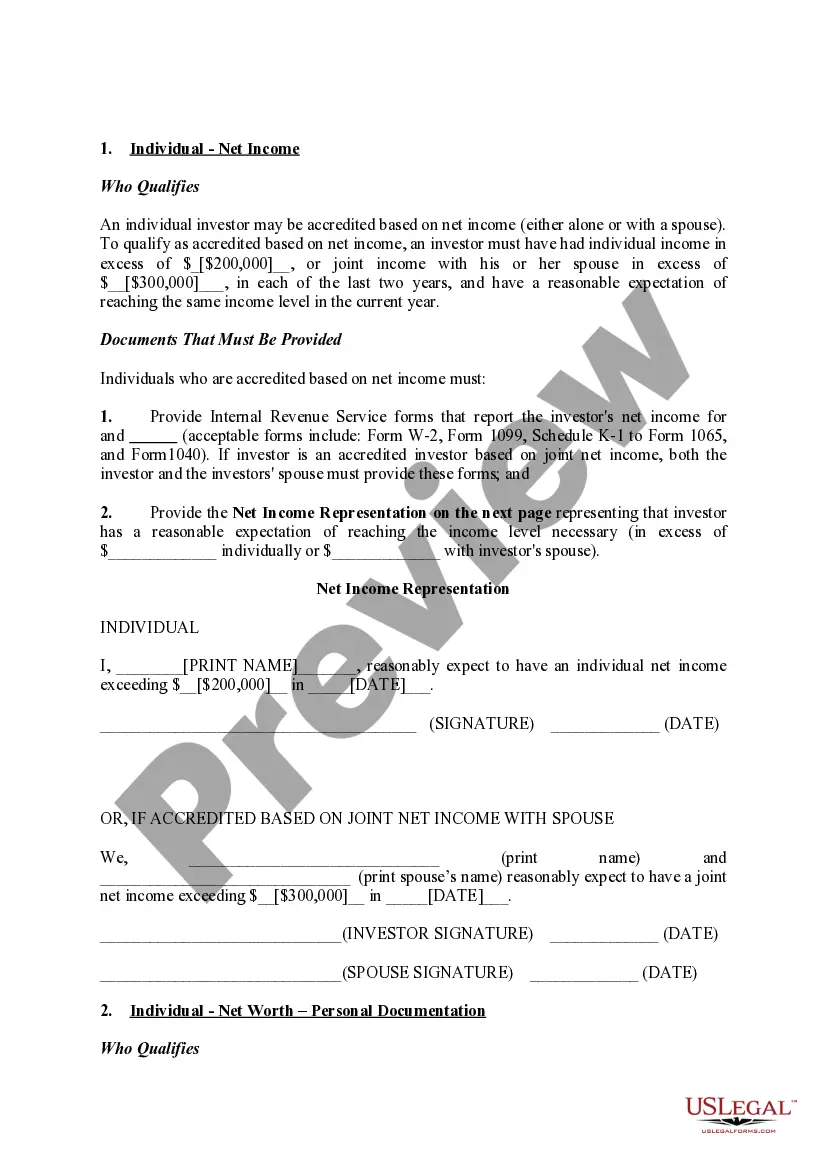

Net worth over $1 million, excluding primary residence (individually or with spouse or partner) Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

Since there is no actual accreditation process, there's no need for self-certification. Of course, accredited investors may secure the required financial statements ahead of time so that it is easier to prove their status during the investor verification process.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.