West Virginia Investment Transfer Affidavit and Agreement

Description

How to fill out Investment Transfer Affidavit And Agreement?

If you need to complete, acquire, or printing lawful papers layouts, use US Legal Forms, the most important variety of lawful kinds, that can be found on the web. Take advantage of the site`s simple and easy handy lookup to get the papers you want. Numerous layouts for organization and personal uses are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to get the West Virginia Investment Transfer Affidavit and Agreement in just a number of clicks.

When you are previously a US Legal Forms buyer, log in for your accounts and then click the Download switch to find the West Virginia Investment Transfer Affidavit and Agreement. You can even accessibility kinds you in the past delivered electronically in the My Forms tab of your accounts.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the form for the right town/region.

- Step 2. Make use of the Preview method to look through the form`s content. Never forget about to read the outline.

- Step 3. When you are unhappy with all the form, take advantage of the Search area near the top of the monitor to locate other types in the lawful form web template.

- Step 4. After you have discovered the form you want, go through the Buy now switch. Opt for the prices program you choose and add your qualifications to sign up to have an accounts.

- Step 5. Procedure the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to perform the financial transaction.

- Step 6. Find the formatting in the lawful form and acquire it on the product.

- Step 7. Total, modify and printing or indicator the West Virginia Investment Transfer Affidavit and Agreement.

Each lawful papers web template you acquire is the one you have permanently. You have acces to each form you delivered electronically in your acccount. Click on the My Forms portion and choose a form to printing or acquire once more.

Remain competitive and acquire, and printing the West Virginia Investment Transfer Affidavit and Agreement with US Legal Forms. There are many professional and express-particular kinds you can use for your personal organization or personal needs.

Form popularity

FAQ

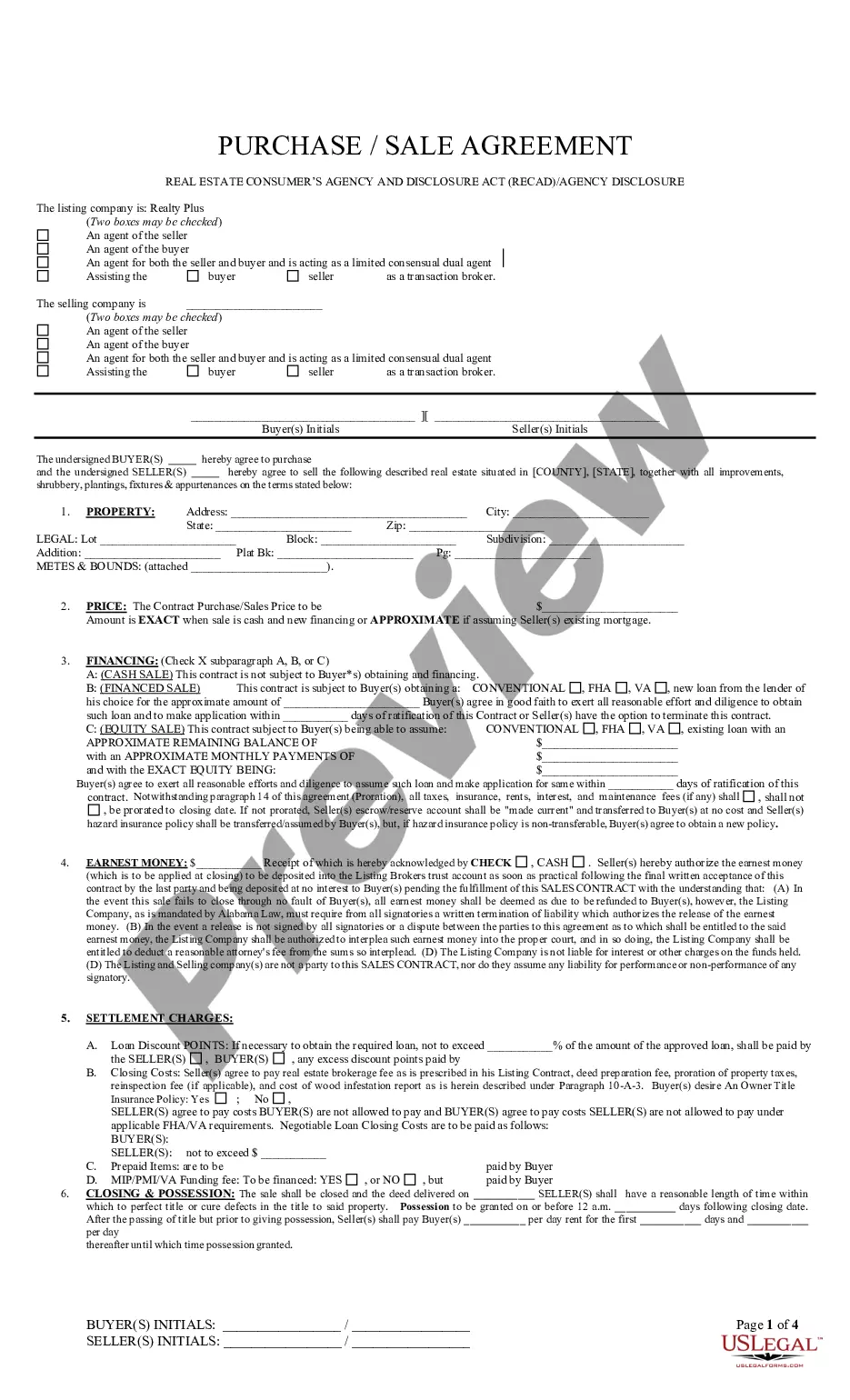

West Virginia deeds must meet the following content requirements: Current owner and new owner names. ... Legal description of property. ... Preparer's name. ... Granting clause. ... Declaration of consideration or value. ... Statement of exemption.

Declaration of Consideration of Value (This is the monetary amount for which the property is sold. If the property is being transferred without monetary value, it must state in the declaration paragraph 'why' it is exempt from transfer tax.)

West Virginia has legalized TOD deeds by enacting the WV Real Property Transfer on Death Act. Previously, a property owner would most likely have named a beneficiary by creating a life estate with a remainder interest, a more complicated option usually involving a property lawyer.

The followings are exempt from the transfer tax: (1) wills; (2) testamentary or inter vivos trusts; (3) deeds of partition; (4) deeds made pursuant to mergers of corporations, limited liability companies, partnerships, and limited partnerships; (5) deeds made pursuant to conversions to limited liability companies; (6) ...

A West Virginia small estate affidavit, also known as a 'short form settlement', is a form that can be used to hasten the distribution of an estate worth $50,000 or less in the State of West Virginia.

The basic filing fee to record a West Virginia deed is $27.00, which includes a $2.00 preservation fee. The clerk charges an extra $1.00 fee for each page beyond five pages. A deed transferring real estate for consideration costs an extra $20.00 fee.

Property Tax: The average property tax in West Virginia is 0.55% of the total sale price of the property. Capital Gains Tax: The IRS (Internal Revenue Service) authority levies the capital gains tax on a stepped-up basis.

In West Virginia (WV), an easement can grant utilities permission to operate underground, grant mineral extraction rights, or more. Understanding the impact of WV easements and rights of way is critical to the success of a commercial real estate transaction.