West Virginia Collections Coordinator Checklist

Description

How to fill out Collections Coordinator Checklist?

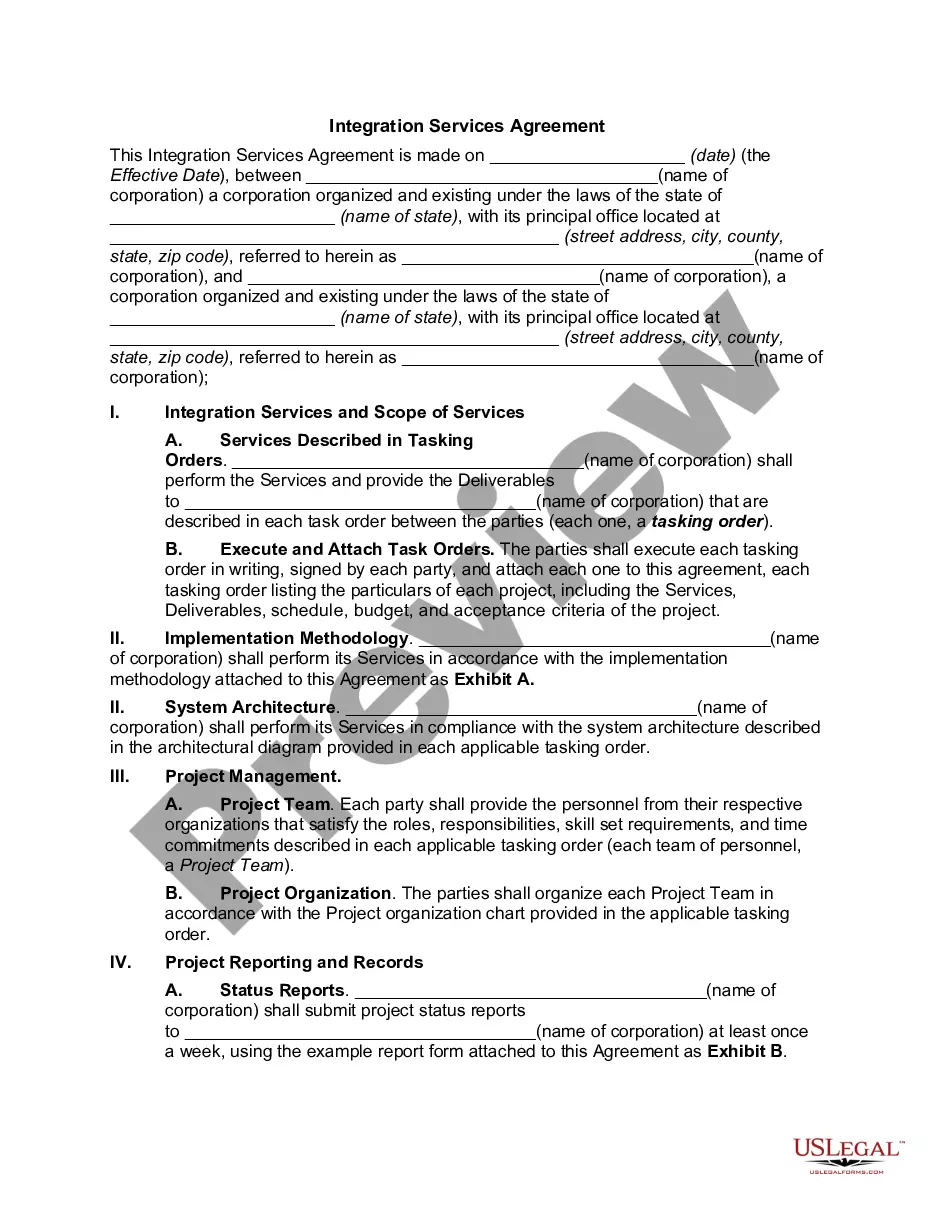

Are you presently in a circumstance where you require documentation for either business or personal use on a regular basis? There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the West Virginia Collections Coordinator Checklist, which are designed to comply with both federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the West Virginia Collections Coordinator Checklist template.

You can find all the document templates you have purchased in the My documents list. You can obtain an additional copy of the West Virginia Collections Coordinator Checklist at any time, if necessary. Simply click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

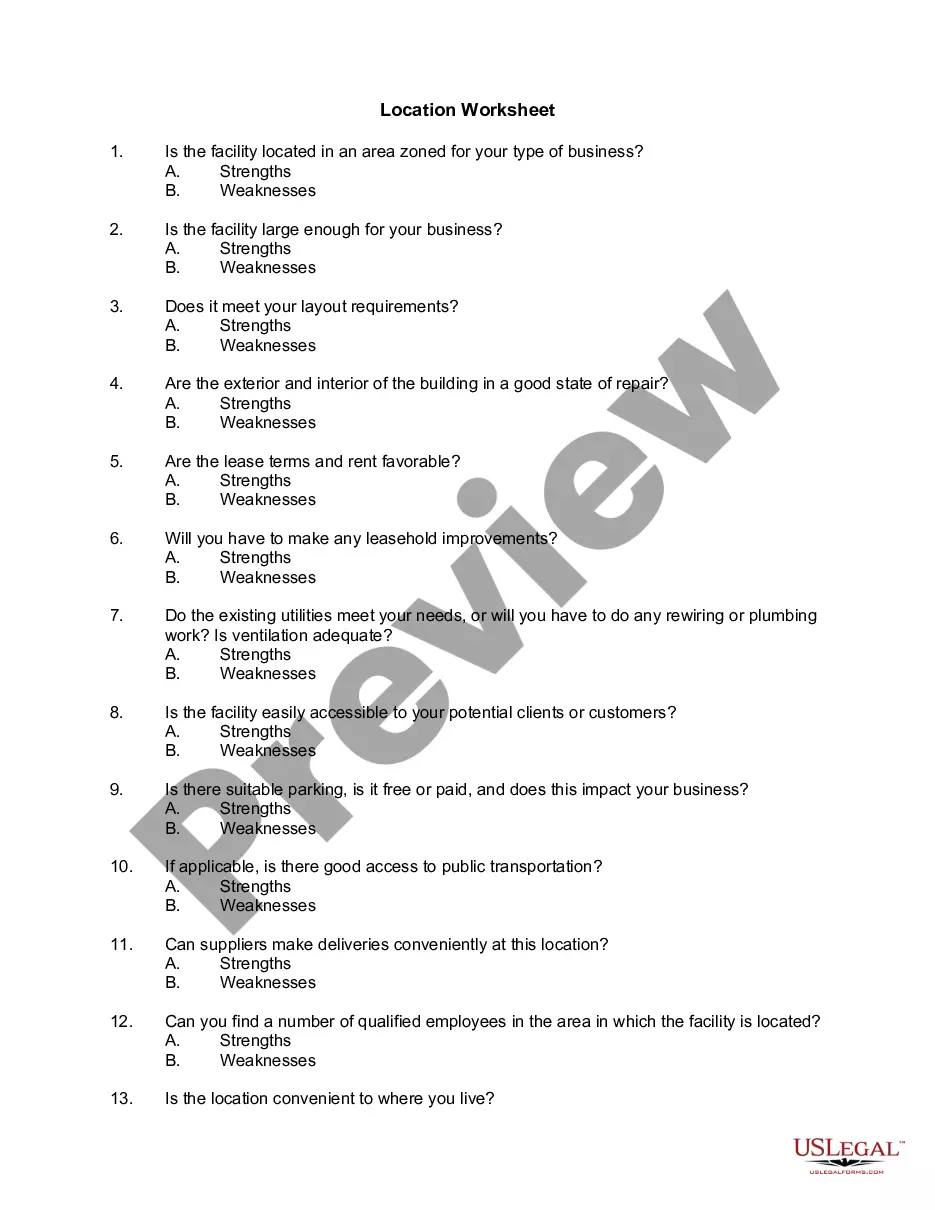

- Locate the form you need and confirm it is for the correct city/region.

- Use the Review button to evaluate the form.

- Read the description to ensure you have chosen the right form.

- If the form does not meet your expectations, use the Lookup field to find the form that suits your requirements.

- Once you identify the correct form, click Purchase now.

- Choose the payment plan you want, complete the required information to create your account, and make the payment using either your PayPal or credit card.

- Select a convenient format and download your copy.

Form popularity

FAQ

Those rules include:They must identify themselves as a debt collection agency and give their name and the address for the collection agency.They must tell you the name of the creditor (company or person you owe), the amount you owe and how you can dispute the debt or seek verification of the debt.More items...?

Our top 6 tips to become a successful collection agent:Prepare. Anticipate the questions your debtors may have on the phone.Stay positive.Listen.Communicate clearly.Know your risks and stay compliant.Manage your time efficiently.

The steps are noted below.Assign Overdue Invoices (optional)Verify Allowed Deductions (optional)Issue Dunning Letters.Initiate Direct Contact.Settle Payment Arrangements (optional)Adjust Credit Limit (optional)Monitor Payments Under Settlement Arrangements (optional)Refer to Collection Agency.More items...?09-Feb-2022

To get ready to negotiate a settlement or repayment agreement with a debt collector, consider this three-step approach:Learn about the debt.Plan for making a realistic repayment or settlement proposal.Negotiate with the debt collector using your proposed repayment plan.

View Every Interaction as a Negotiation The first way to improve your negotiation technique is to view every single interaction you have with a debtor as a negotiation. This way, by the time the debtor realizes that a negotiation is taking place, you will already have the upper hand.

The Dos and Don'ts of Debt CollectionDo seek help from a third-party vendor.Don't try to collect debts on your own without full knowledge of collection laws and regulations.Do have a plan in place for collection issues before they happen.Don't use threats or harassment to collect a debt.More items...?22-Jan-2019

What Is A Collection Policy? A collection policy is the set of procedures a company uses to ensure payment of accounts receivables. Similar to the credit policy as a whole, the collection policy should be written and strictly followed.

Communication, choice, and control. According to a 2018 Benchmark Study released by Intelligent Contacts and conducted by Marketing Research Firm AYTM, consumers carrying balances and the lenders who are owed, all want the same thing to pay it off.

Here is a breakdown of the four main stages of the process:Stage 1: 30 days past due. In this stage, you are behind on your payment.Stage 2: 60 days past due. During this stage, your debt is still with your original lender, but contact will become more aggressive and persistent.Stage 3: Charge-off status.Stage 4: Court.