West Virginia Service Site Report

Description

How to fill out Service Site Report?

If you need to acquire, procure, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

A selection of templates for business and personal purposes is categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Buy Now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Employ US Legal Forms to obtain the West Virginia Service Site Report with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the West Virginia Service Site Report.

- You can also access forms you have previously obtained in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

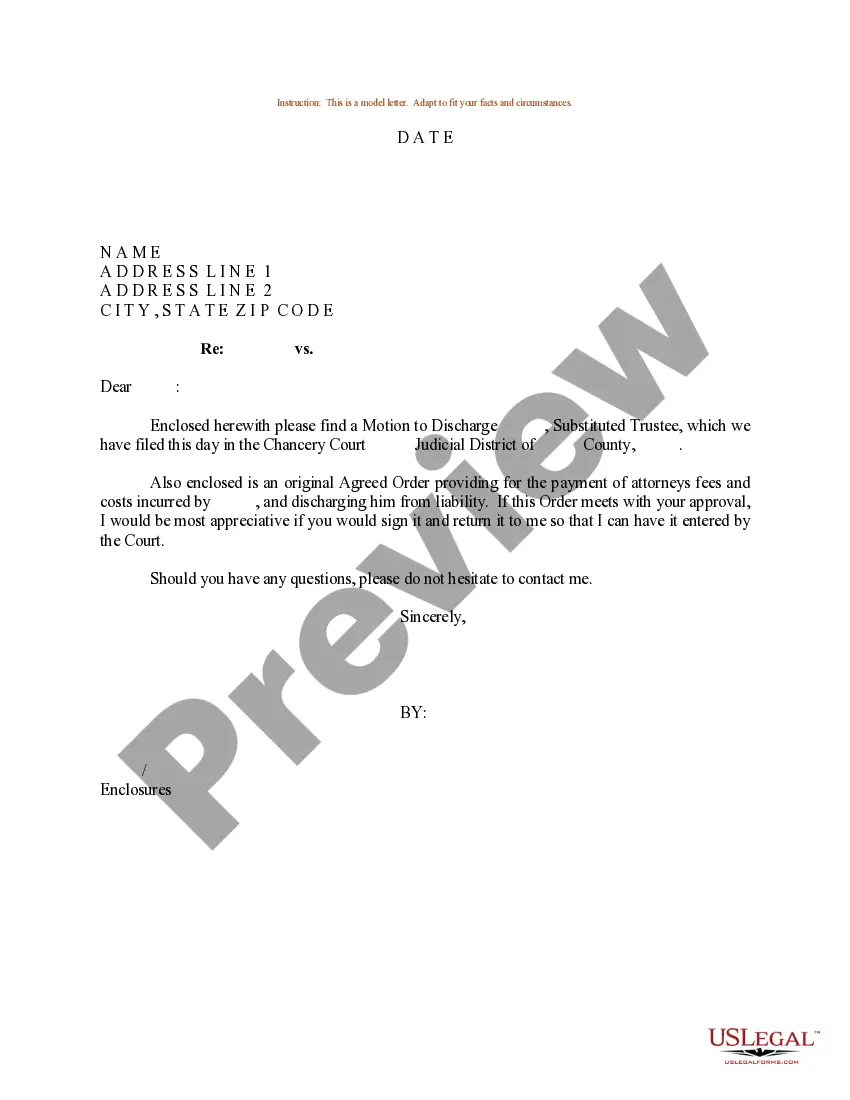

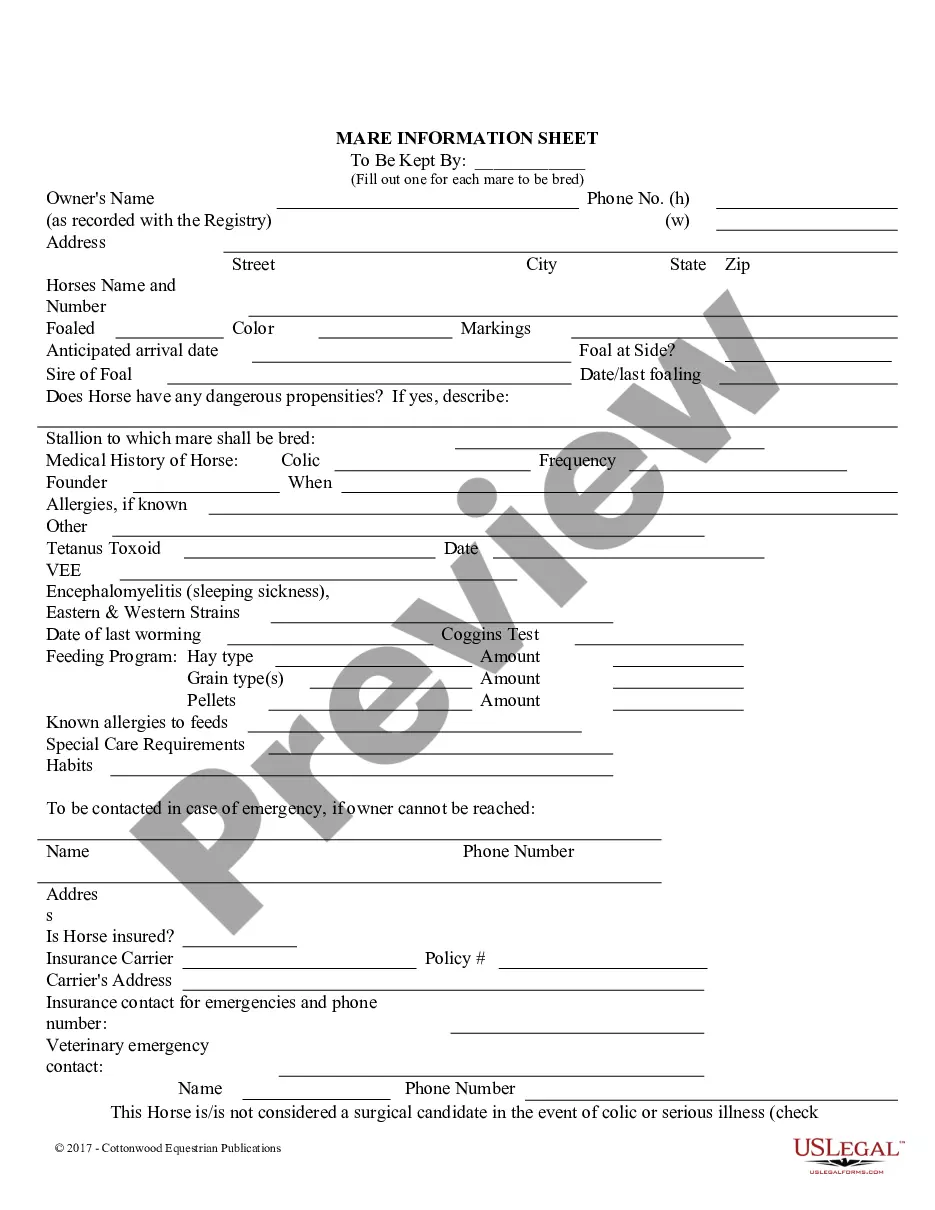

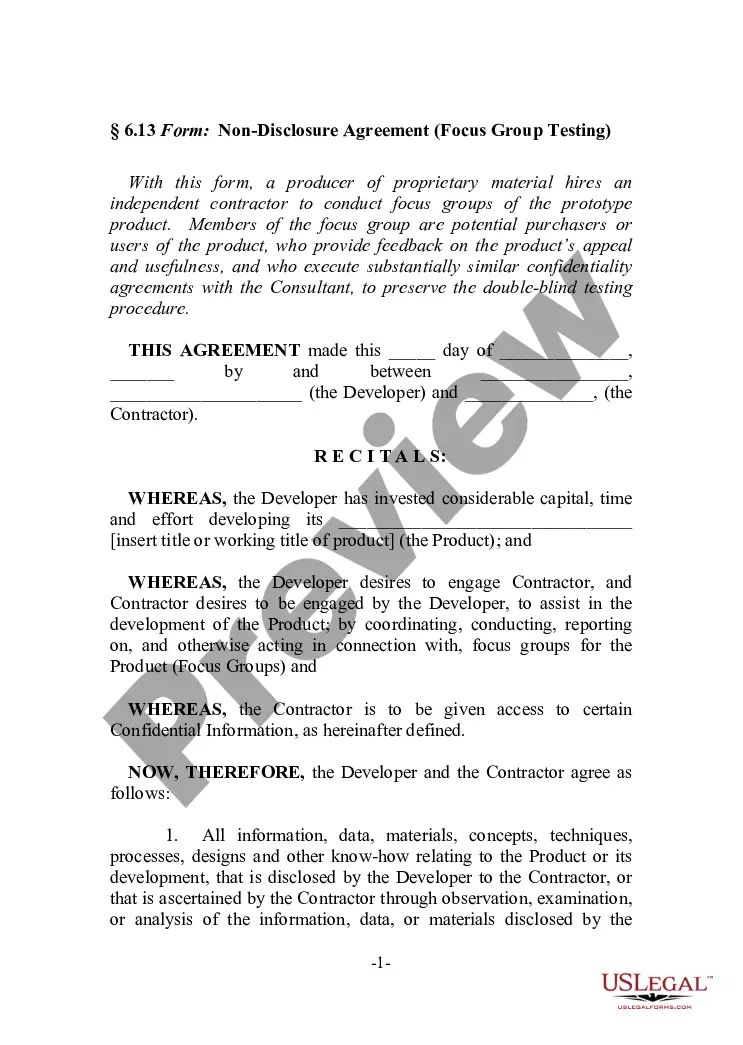

- Step 2. Utilize the Preview feature to review the form’s contents. Always remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Each Virginia corporation and foreign corporation authorized to do business in Virginia must file an Annual Report with the Office of the Clerk every year. The report is due annually by the last day of the 12th month after the entity was incorporated or issued a certificate of authority.

You may file your West Virginia Annual Report online OR by mail. Either way, you'll need to visit the West Virginia Secretary of State website. On the state website, go to the Annual Reports page. Click the blue button labeled Select Your Company Type.

A Certificate of Authority shows that you are authorized to do business in a state other than your original formation state. A Certificate of Authority is a requirement in most states. It's important to note that the name of the document can vary from state to state.

File a Consumer ComplaintState of West Virginia.Office of the Attorney General Patrick Morrisey.Consumer Protection Division.1-800-368-8808 or 304-558-8986.E-mail: consumer@wvago.gov.

Currently, all states, except Ohio, require some sort of annual report filing. Specific filing requirements and deadlines vary by state. Some states also require an initial report when first starting a business. When businesses fail to file on time, they might get hit with fines or other penalties.

Why Is a West Virginia Annual Report Required? Annual reports are required by statute in nearly every state. They provide state agencies with updated information on the entities registered in their state.

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting.

A sales tax permit can be obtained by registering online through the WV State Tax Department or by mailing the Business Registration Application (Form WV/BUS-APP). Information needed to register includes: Federal Employer Identification Number (FEIN), or SSN if a sole proprietorship with no employees.

A Certificate of Authority is a document that provides statesother than the one in which your business is registeredall of a business's important information, including official name, owners' names, and legal status (limited liability company, corporation, limited partnership, etc.).

Businesses that are incorporated in another state will typically apply for a West Virginia certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.