West Virginia Charitable Contribution Payroll Deduction Form

Description

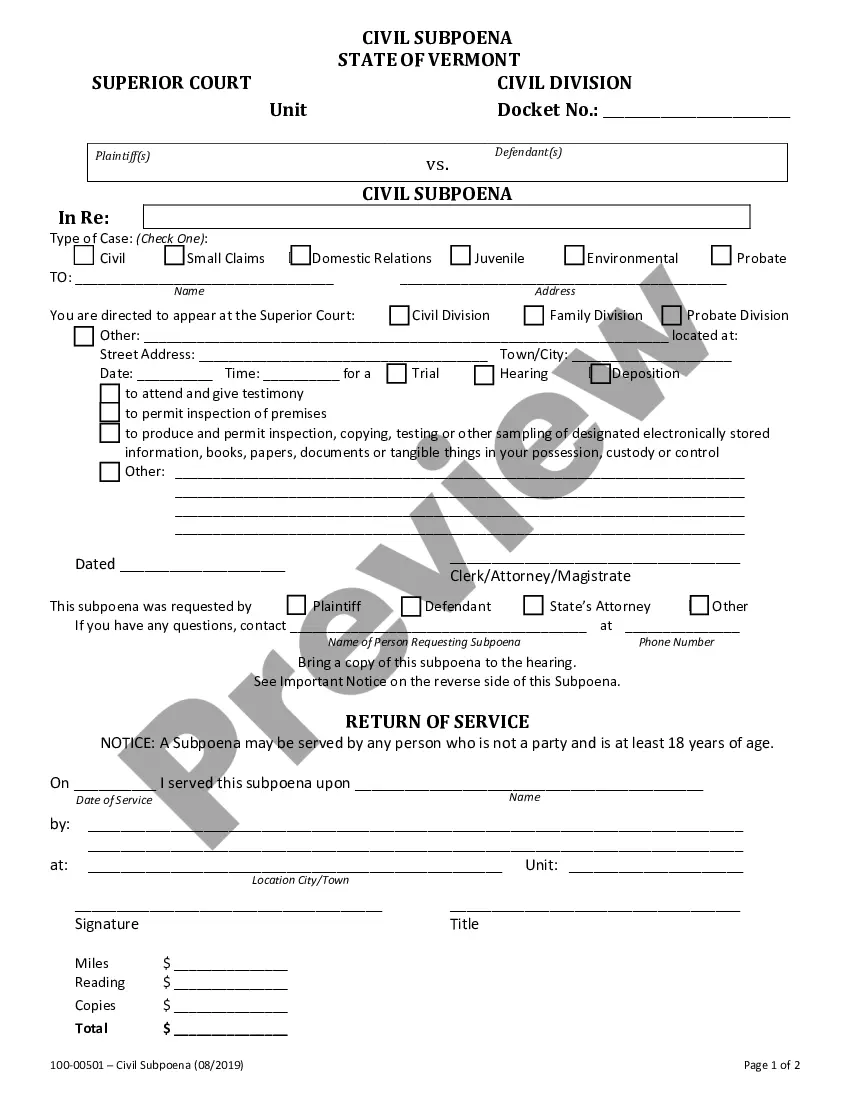

How to fill out Charitable Contribution Payroll Deduction Form?

If you require thorough, obtain, or generate authentic document templates, utilize US Legal Forms, the largest selection of legitimate forms, available online.

Leverage the site’s user-friendly and efficient search to locate the documents you need.

A variety of templates for professional and personal purposes are categorized by classes and states, or keywords.

Step 4. Once you have found the necessary form, click the Purchase now button. Choose the payment plan you prefer and provide your information to register for an account.

Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to quickly find the West Virginia Charitable Contribution Payroll Deduction Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the West Virginia Charitable Contribution Payroll Deduction Form.

- You may also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate region/state.

- Step 2. Use the Review option to browse through the contents of the form. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the document format.

Form popularity

FAQ

Form IT-140 is the standard income tax return for West Virginia residents. It allows residents to report their total income and calculate the tax they owe. This form may also include credits and deductions pertinent to state law. You may also benefit from the West Virginia Charitable Contribution Payroll Deduction Form in conjunction with the IT-140, as it supports charitable contributions you make throughout the year.

The WV/NRW-2 form is a statement of West Virginia Income Tax Withheld for Nonresident Individual or Organization. This form will produce automatically if any partner listed as a nonresident of West Virginia.

WEST VIRGINIA EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages.

FORM WV/IT-104Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages.

WV/NRW-4. NOTICE OF REVOCATION OF NONRESIDENT INCOME TAX AGREEMENT.

Step-by-Step Guide to Running Payroll in West VirginiaStep 1: Set up your business as an employer.Step 2: Register your business with the State of West Virginia.Step 3: Create your payroll process.Step 4: Have employees fill out relevant forms.Step 5: Review and approve time sheets.More items...?

Federal Form W-4 is normally used to determine West Virginia personal income tax withholding, but the state Form WV/IT-104 is used in certain circumstances. Certain nonresident employees must submit Form WV/IT-104NR to claim an exemption from withholding. See Employee Withholding Forms.

Withholding Requirements3% if annual income < $10,000. 4% if annual income > $10,000 and < $25,000. 4.5% if annual income > $25,000 and < $40,000. 6% if annual income > $40,000 and < $60,000.

Withholding - Personal Income Tax: Every employer making payment of any wage or salary subject to the West Virginia personal income tax is required to deduct and withhold the tax from such wages or salaries and remit the tax withheld to the State Tax Department.