West Virginia Agreement between Co-lessees as to Payment of Rent and Taxes

Description

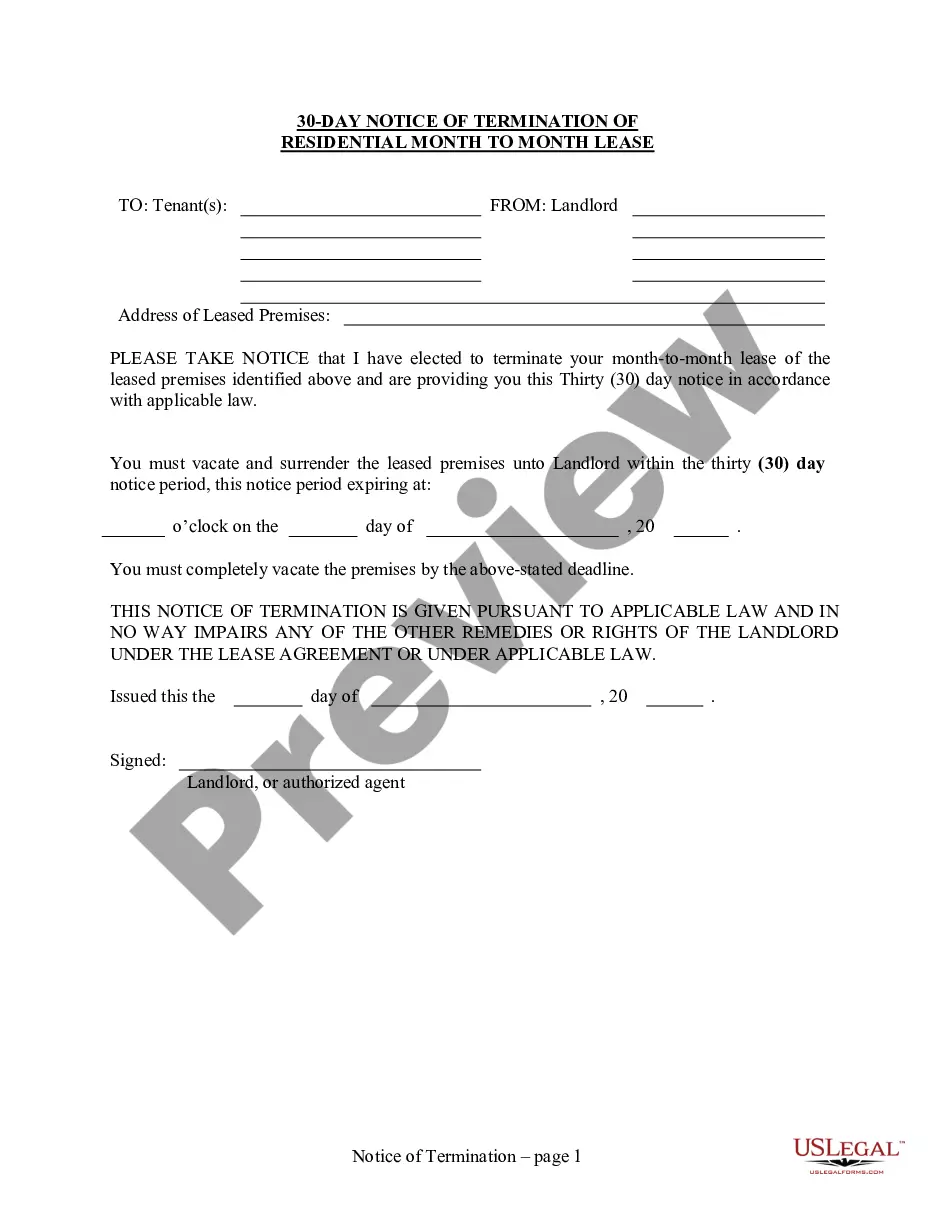

How to fill out Agreement Between Co-lessees As To Payment Of Rent And Taxes?

US Legal Forms - one of many largest libraries of authorized kinds in America - offers a wide range of authorized file web templates you may download or print. Making use of the internet site, you may get a large number of kinds for company and individual reasons, sorted by types, says, or search phrases.You will discover the most recent variations of kinds such as the West Virginia Agreement between Co-lessees as to Payment of Rent and Taxes in seconds.

If you currently have a subscription, log in and download West Virginia Agreement between Co-lessees as to Payment of Rent and Taxes from the US Legal Forms library. The Download switch will show up on each and every type you see. You have accessibility to all earlier downloaded kinds in the My Forms tab of your profile.

If you would like use US Legal Forms for the first time, listed here are basic instructions to get you started:

- Be sure you have chosen the best type for your personal city/county. Select the Preview switch to check the form`s content. Read the type information to actually have selected the correct type.

- When the type does not match your requirements, use the Search field towards the top of the display screen to discover the the one that does.

- In case you are pleased with the shape, verify your option by clicking on the Get now switch. Then, select the costs plan you want and give your accreditations to register for the profile.

- Method the transaction. Make use of your bank card or PayPal profile to complete the transaction.

- Find the format and download the shape on your system.

- Make changes. Fill up, edit and print and signal the downloaded West Virginia Agreement between Co-lessees as to Payment of Rent and Taxes.

Every template you included with your bank account lacks an expiration day which is yours forever. So, if you would like download or print another duplicate, just go to the My Forms segment and click on on the type you want.

Obtain access to the West Virginia Agreement between Co-lessees as to Payment of Rent and Taxes with US Legal Forms, probably the most substantial library of authorized file web templates. Use a large number of specialist and state-particular web templates that fulfill your company or individual needs and requirements.

Form popularity

FAQ

A lessor is a property owner who rents their property to a tenant, while a lessee is a tenant who pays to rent the property. Each party must sign a contract outlining the terms of their lease agreement.

Leases have two classifications under US GAAP . A capital lease, now known as a finance lease, resembles a financed purchase; the lease term spans most of the asset's useful life. An operating lease resembles a rental agreement in that the asset is used for a set time with useful life remaining at lease end.

While a leasehold estate grants the tenant interest in the property, it does not transfer any ownership to them. Usually, this type of estate is a legally binding agreement laid out in a written lease signed by both the property owner (the lessor), and the tenant (the lessee).

Under West Virginia law, landlords are required to maintain rental housing in a fit and habitable condition from the time of move in until the time of move out. This means a landlord must make sure that rental housing measures up to all health, safety, fire, and housing code standards at all time.

Owners of real property who lease their property to others are known as lessors. The person to whom the property is leased is known as the lessee.

For example, if a car dealership leases a vehicle to someone, the car is the asset. The person renting the car is the lessee and the dealership is the lessor. The lessee pays the dealership, or lessor, for the right to use the vehicle for an agreed-upon amount of time.

Lessors and lessees enter into a binding contract, known as the lease agreement, that spells out the terms of their arrangement. While any sort of property can be leased, the practice is most commonly associated with residential or commercial real estate?a home or office.

A lease agreement is an arrangement between two parties ? lessor and lessee, by which the lessor allows the lessee the right to use a property owned or managed by the lessor for a specified period of time, in exchange for periodic payment of rentals. The agreement does not provide ownership rights to the lessee.