West Virginia Assignment of Profits of Business

Description

How to fill out Assignment Of Profits Of Business?

Finding the appropriate official document template can be challenging.

Certainly, there are numerous templates accessible online, but how do you locate the official form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the West Virginia Assignment of Profits of Business, suitable for both business and personal purposes.

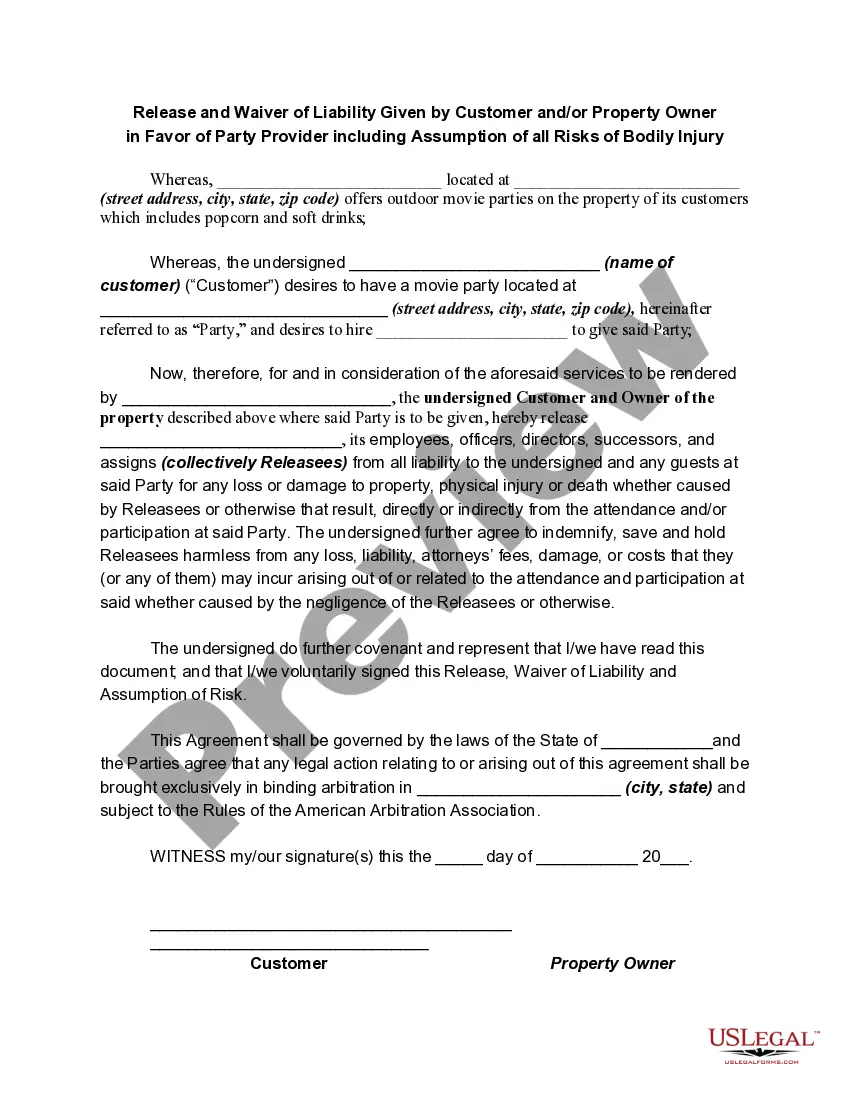

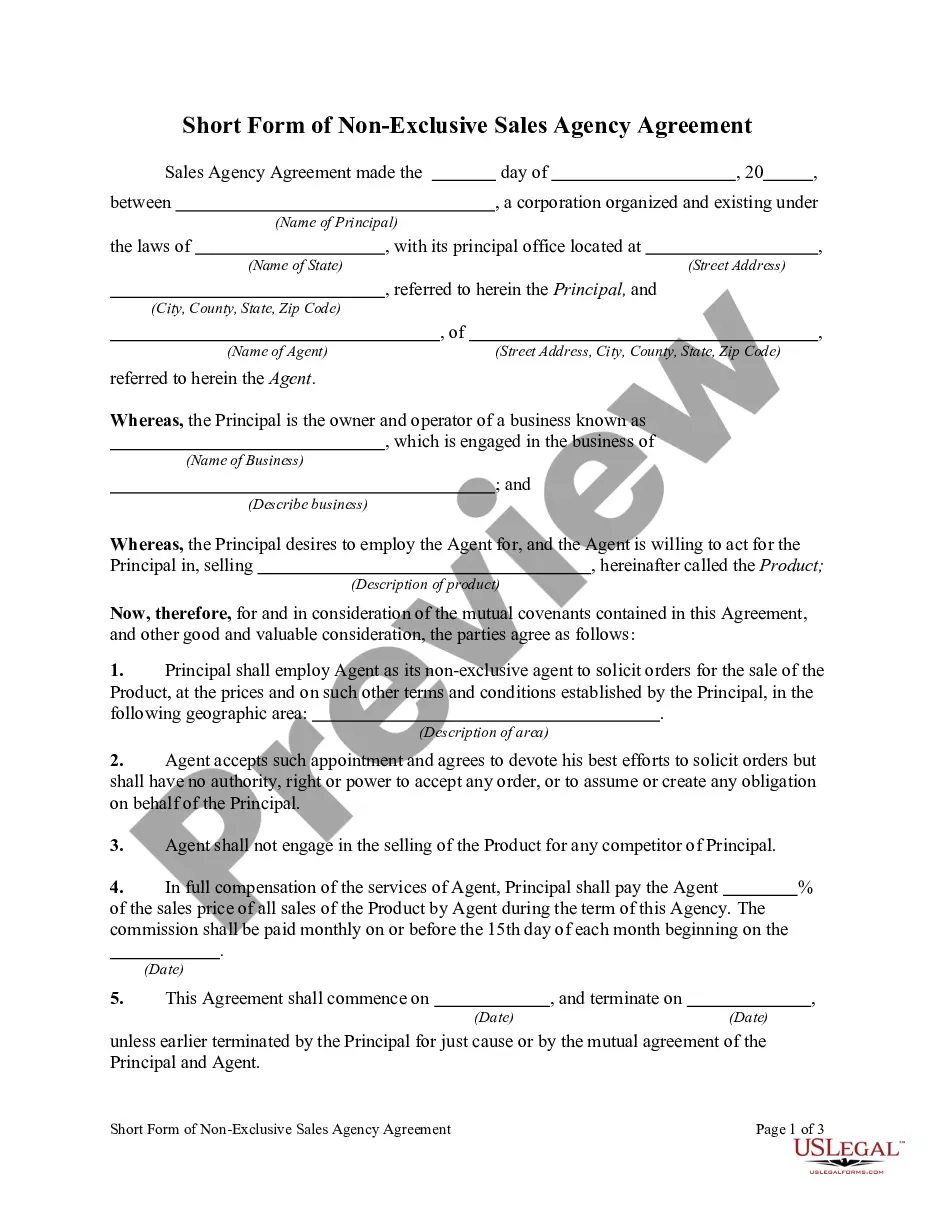

First, ensure that you have chosen the correct form for your locality/region. You can review the form using the Preview button and examine the form details to confirm it is suitable for your needs. If the form does not meet your requirements, use the Search field to find the appropriate form. When you are confident that the form is suitable, click the Acquire now button to obtain the form. Select the pricing plan you need and input the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the format and download the official document template for your records. Complete, modify, print, and sign the acquired West Virginia Assignment of Profits of Business. US Legal Forms is the largest repository of official forms, where you can find numerous document templates. Use the service to acquire professionally created documents that meet legal standards.

- All templates are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the West Virginia Assignment of Profits of Business.

- Use your account to browse through the official forms you have purchased previously.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

Form popularity

FAQ

The fee for obtaining a Business Registration Certificate is $30.00. A separate certificate is required for each fixed business location from which property or services are offered for sale or lease or at which customer accounts may be opened, closed, or serviced. The Business Registration fee cannot be prorated.

The state of West Virginia has both a state sales tax and a state income tax, along with some of the lowest property taxes in the U.S. The income tax system here consists of five brackets, with rates from 3% to 6.5%. The sales tax is 6% statewide, with a handful of cities collecting additional local taxes of 1%.

Individuals who have made payments totaling $50,000 or more during the most recent fiscal year may be required to file and pay their West Virginia taxes electronically. Here you will find all the information and resources you will need to electronically file and pay your taxes.

Every resident individual, estate, and trust must file state income taxes. Non-residents, including estates and trusts, with West Virginia income must also pay taxes for that income.

The state of West Virginia has both a state sales tax and a state income tax, along with some of the lowest property taxes in the U.S. The income tax system here consists of five brackets, with rates from 3% to 6.5%. The sales tax is 6% statewide, with a handful of cities collecting additional local taxes of 1%.

Page 1. FORM WV IT-104. WEST VIRGINIA EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE. Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages.

Individuals who have made total payments of $50,000 during the preceding tax year may be required to file and pay their West Virginia taxes electronically.

You must file a resident return and report all of your income in the same manner as any other resident individual unless you did not maintain a physical presence in West Virginia for more than 30 days during the taxable year.

The WV/NRW-2 form is a statement of West Virginia Income Tax Withheld for Nonresident Individual or Organization. This form will produce automatically if any partner listed as a nonresident of West Virginia.

WV/NRW-4. NOTICE OF REVOCATION OF NONRESIDENT INCOME TAX AGREEMENT.