West Virginia Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

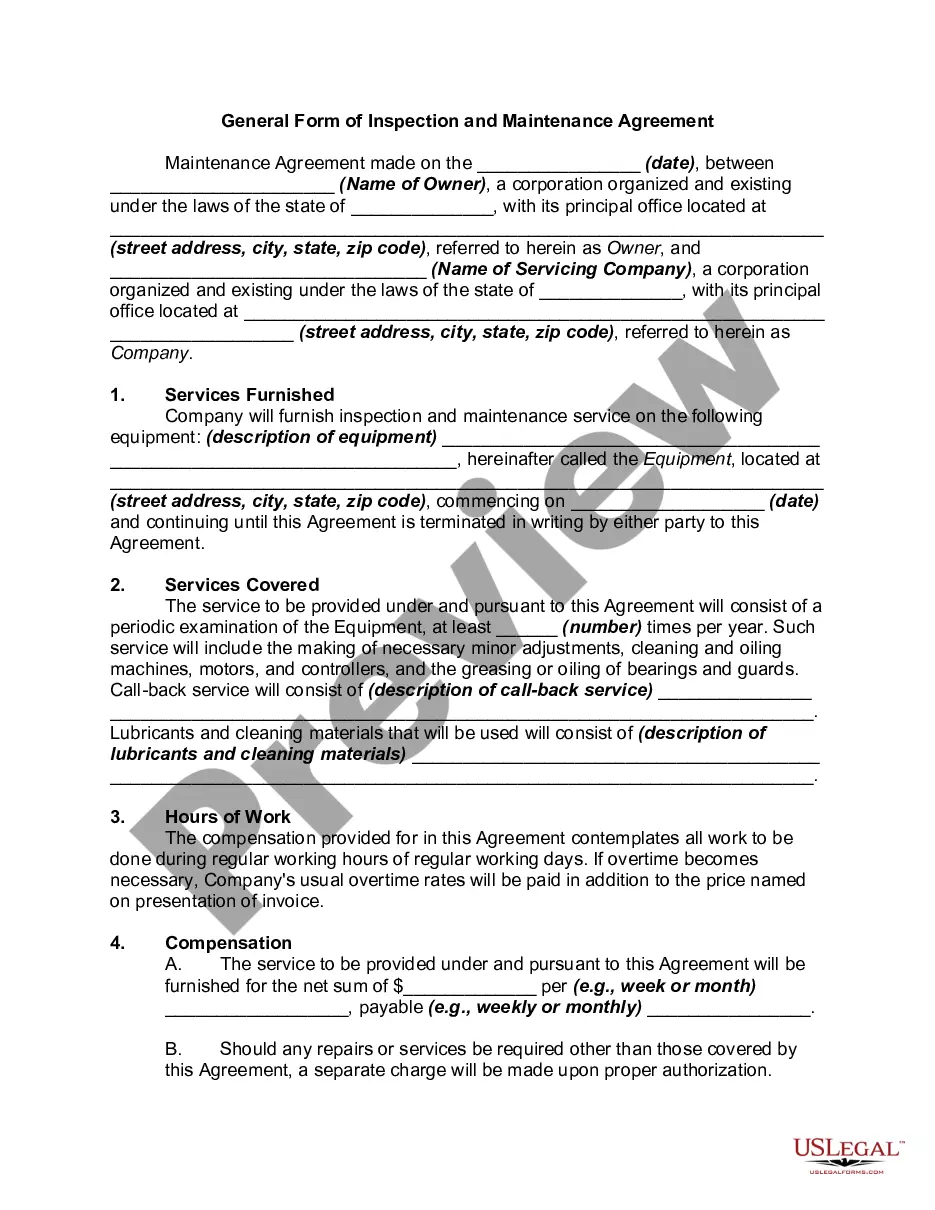

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Are you presently in a role where you require documents for either professional or personal purposes almost every day.

There are many legal document templates available online, but locating ones you can depend on isn't easy.

US Legal Forms offers numerous form templates, such as the West Virginia Liquidation of Partnership with Sale and Proportional Distribution of Assets, which are designed to comply with federal and state regulations.

Once you find the correct form, click Buy now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the West Virginia Liquidation of Partnership with Sale and Proportional Distribution of Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to examine the form.

- Check the description to confirm you have selected the appropriate form.

- If the form isn’t what you’re looking for, use the Research field to find the form that meets your needs.

Form popularity

FAQ

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.

For a loss, credit and zero out income summary and debit each partner's capital account. Finally, debit each partner's capital account by the balance in the corresponding drawing account, which records cash withdrawals by partners and credit and zero out the drawing accounts.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

After the dissolution of the partnership, the partner is liable to pay his debt and to wind up the affairs regarding the partnership. After the dissolution, partners are liable to share the profit which they have decided in agreement or accordingly.

Losses are allocated first to the extent of positive capital account balances and second 50% to A and 50% to B. Cash is first disbursed to pay the preferred return, second to pay any unreturned capital, and last 50% to A and 50% to B.

Winding up is the process of collecting, liquidating, and distributing the partnership assets. Dissolution can be brought about by acts of the partners, operation of law, or by judicial decree.