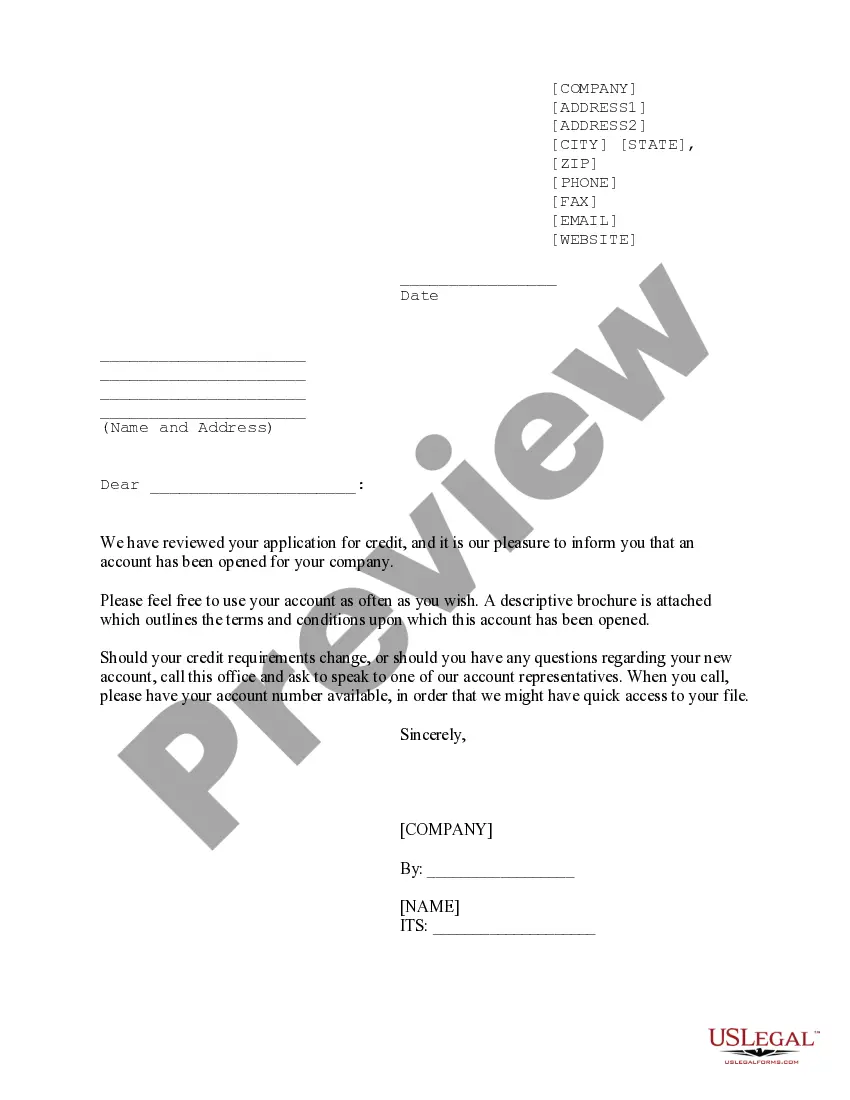

West Virginia Credit Approval Form

Description

How to fill out Credit Approval Form?

Are you currently in a situation where you need documentation for either business or personal purposes nearly all the time.

There are numerous legal form templates available on the internet, but finding ones you can trust isn't simple.

US Legal Forms offers a vast array of form templates, including the West Virginia Credit Approval Form, that are designed to meet state and federal requirements.

When you find the right form, click Buy now.

Choose the pricing plan you want, fill out the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the West Virginia Credit Approval Form template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your correct city/state.

- Use the Review button to inspect the form.

- Check the description to ensure that you have chosen the right form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that matches your needs.

Form popularity

FAQ

To establish a West Virginia domicile, an applicant must prove that he or she had a continued presence within the state for at least twelve (12) months prior to July 1 of the year of matriculation, or by having a continued presence within the state for less than twelve (12) months prior to July 1 of that year, if

A Mandate Opt Out Form is available for taxpayers who choose not to have their income tax returns filed electronically. This form must be signed and retained by the tax preparer. E-File Registration Requirements - Acceptance in the West Virginia e-file program is automatic with acceptance in the federal e-file program.

Ohio Reciprocity Agreement As the result of a special agreement, students from Ohio who are fully admitted to certain approved majors can enroll at WVU and pay in-state tuition rates. Students must be admitted to the University and enrolled full time in an approved major as authorized by the reciprocity agreement.

The State of West Virginia recognizes the Federal tax extension (IRS Form 4868). Therefore, if you have a valid Federal extension, you will automatically be granted a corresponding West Virginia tax extension for the same amount of time.

The following states are partners - Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, Oklahoma, South Carolina, Tennessee, Texas, Virginia, and West Virginia.

The WVU Office of Admissions assigns students a residency status for admission, tuition, and fee purposes. Students who are determined to be residents of West Virginia pay resident tuition and fees at WVU; students who are residents of other states and nations pay non-resident tuition and fees.

WV/NRW-4. NOTICE OF REVOCATION OF NONRESIDENT INCOME TAX AGREEMENT.

A Family Tax Credit is available to certain individuals or families that may reduce or eliminate their West Virginia personal income tax. You may be entitled to this credit if you meet certain income limitations and family size. Individuals who file their income tax return with zero exemptions cannot claim the credit.

Use the IT-140 form if you are: A full-year resident of West Virginia. A full-year non-resident of West Virginia and have source income (mark IT-140 as Nonresident and complete Column C of Schedule A)

To establish a West Virginia domicile, an applicant must prove that he or she had a continued presence within the state for at least twelve (12) months prior to July 1 of the year of matriculation, or by having a continued presence within the state for less than twelve (12) months prior to July 1 of that year, if