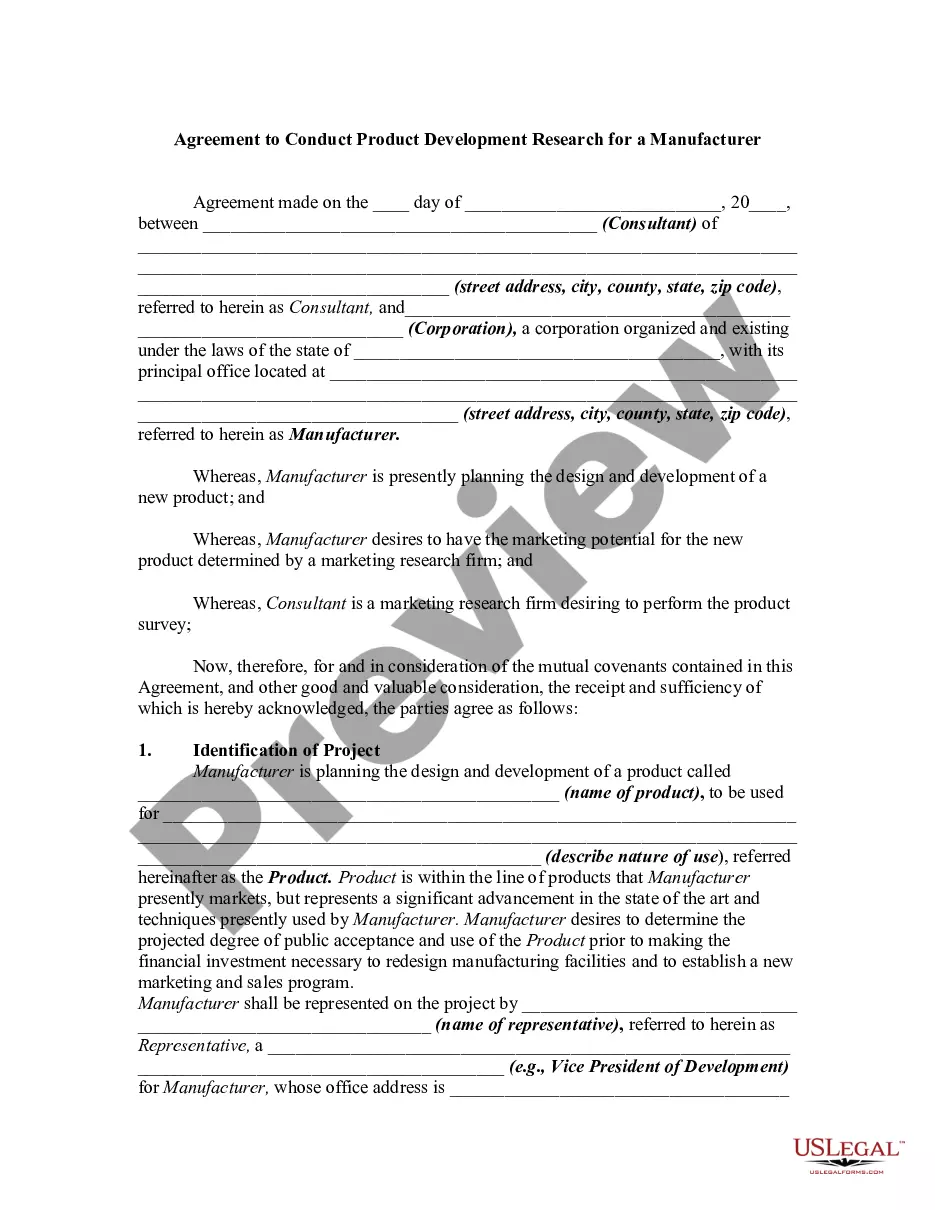

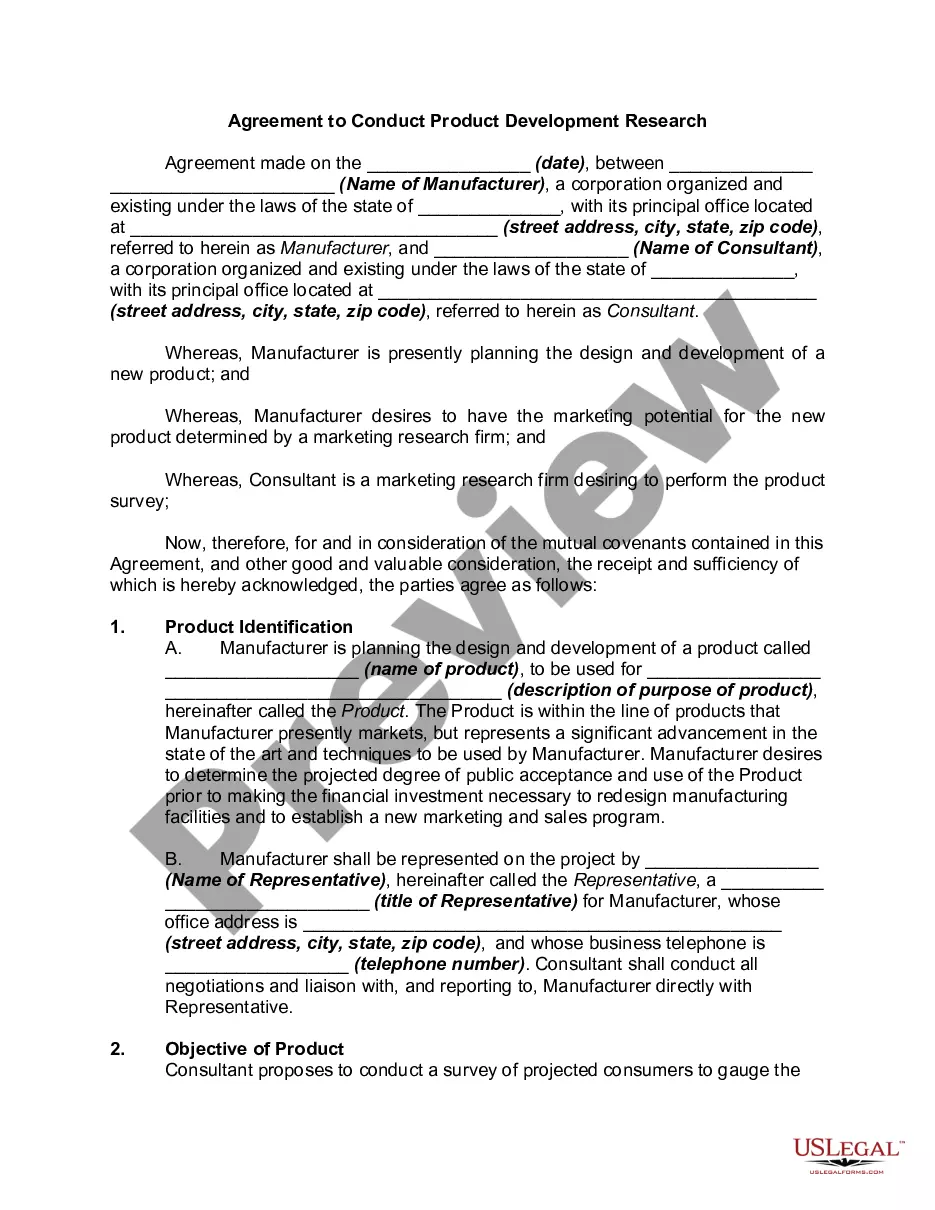

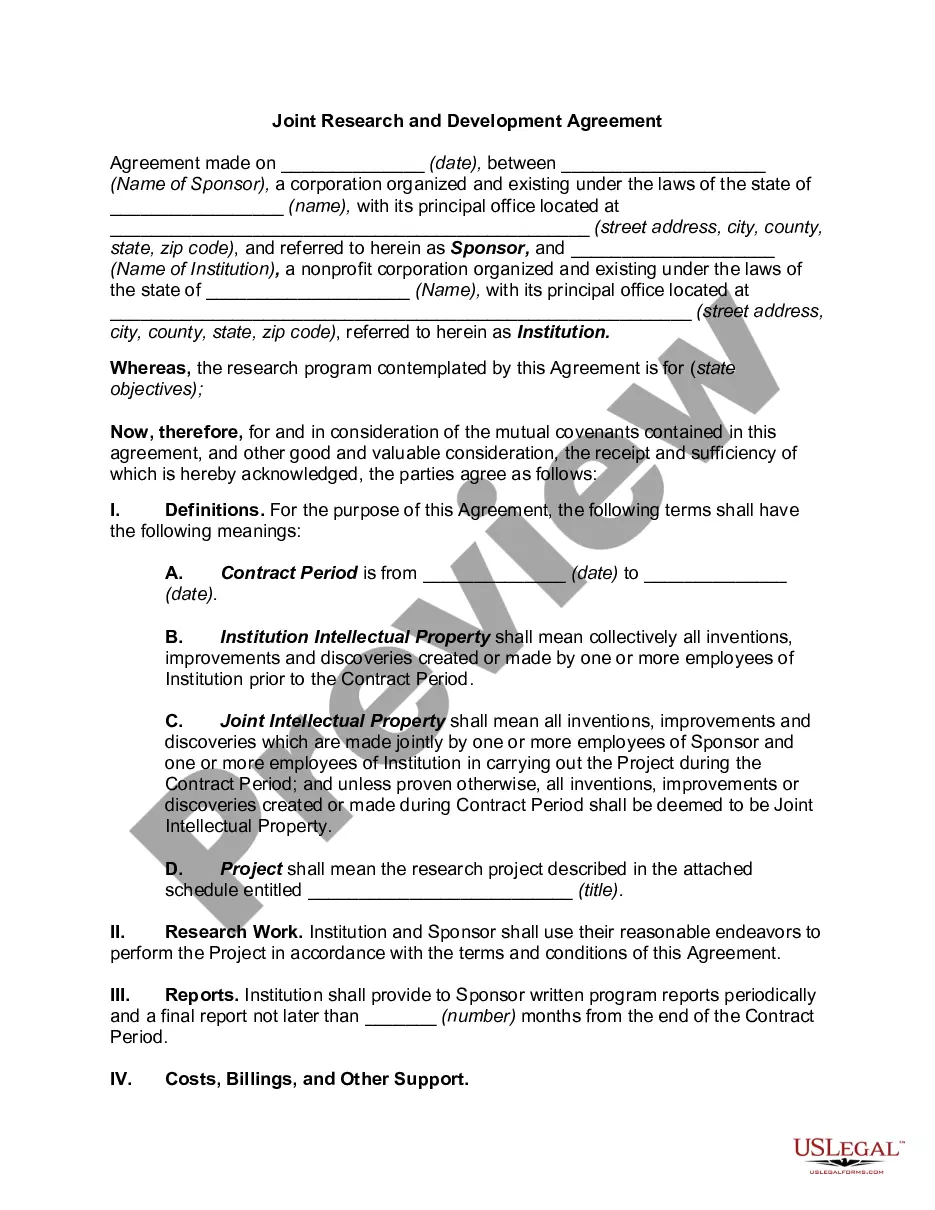

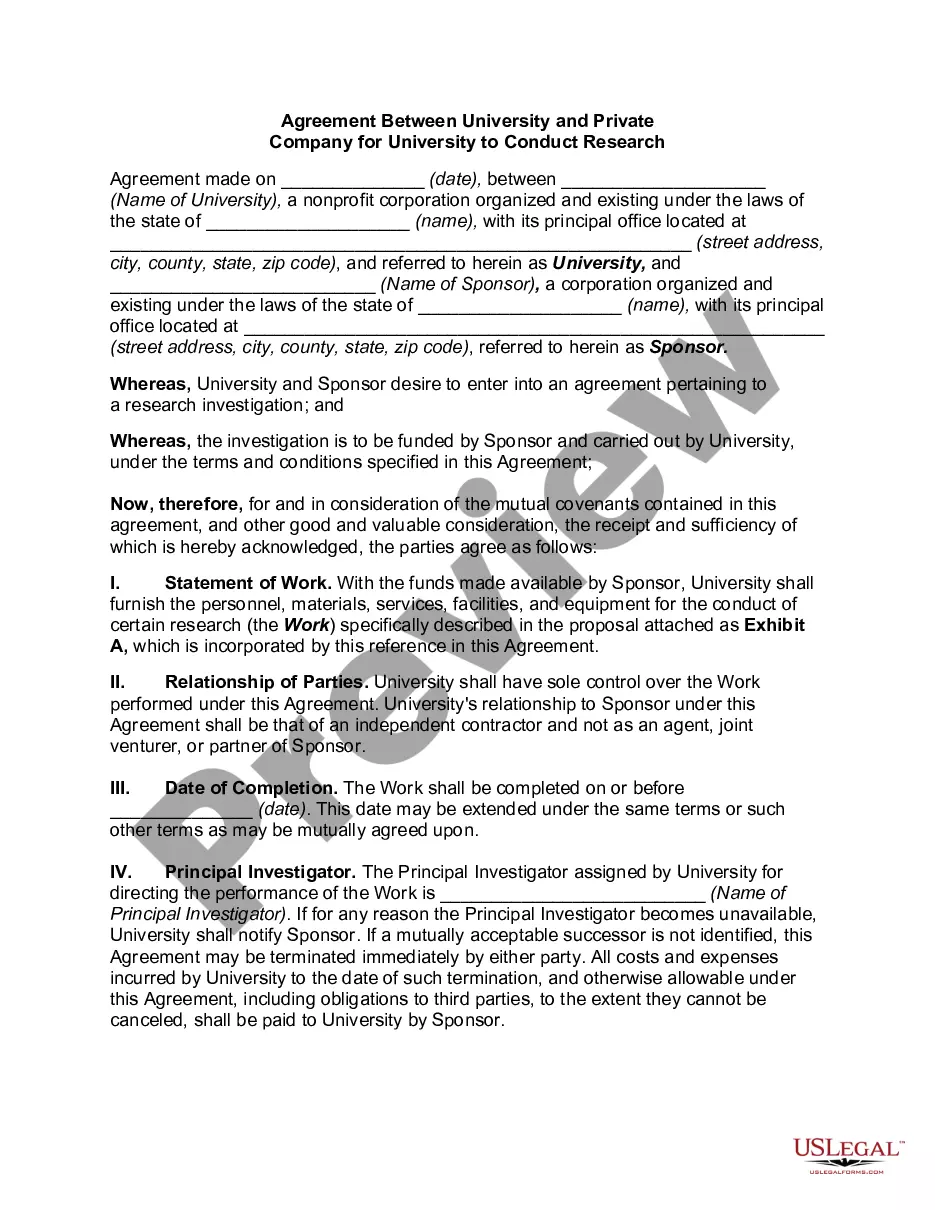

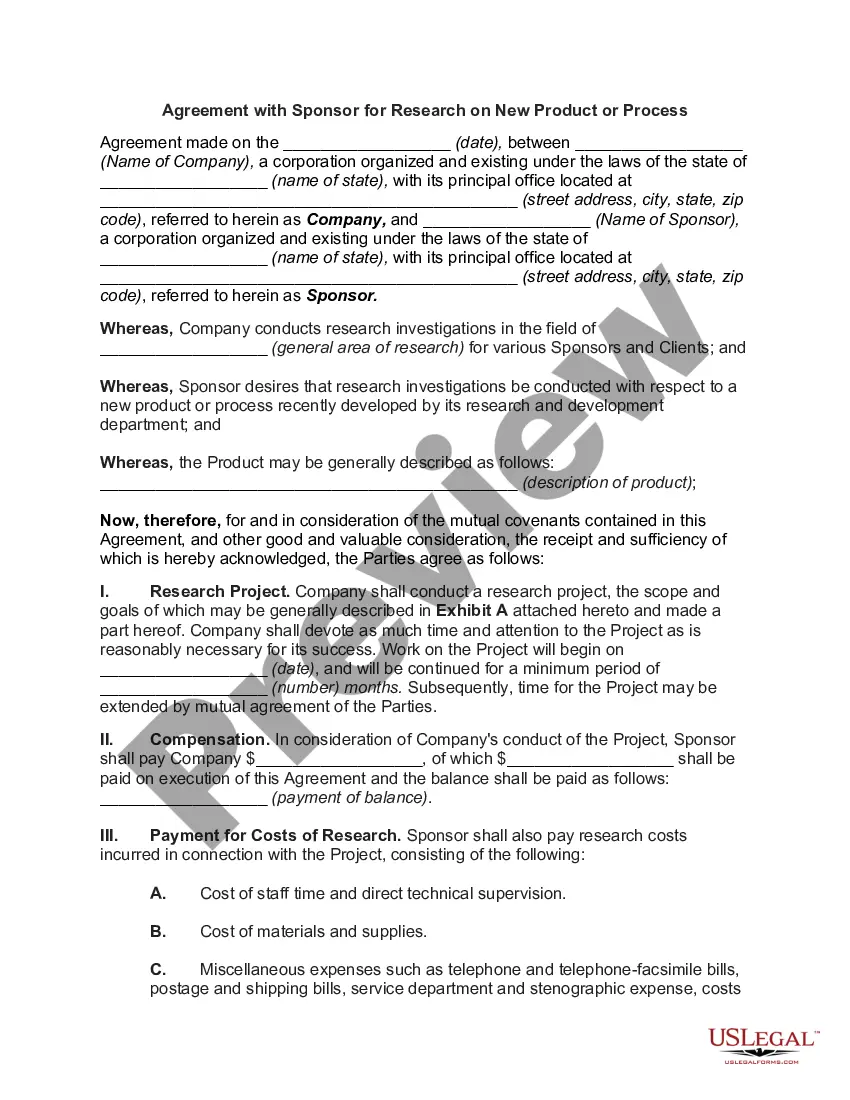

West Virginia Agreement for Research on New Product or Process

Description

How to fill out Agreement For Research On New Product Or Process?

Finding the correct legal document format can be a challenge.

Certainly, there are numerous templates accessible online, but how do you find the legal form you require.

Use the US Legal Forms website.

First, ensure that you have selected the correct document for your specific city/state.

- The service offers a vast array of templates, including the West Virginia Agreement for Research on New Product or Process, that can be utilized for both business and personal needs.

- All documents are vetted by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download option to obtain the West Virginia Agreement for Research on New Product or Process.

- Utilize your account to review the legal forms you have previously acquired.

- Navigate to the My documents tab in your account to retrieve another copy of the necessary document.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

Form popularity

FAQ

A remote seller or marketplace facilitator has economic nexus if they sell or facilitate the sale of more than $100,000 in annual gross retail sales or 200 or more transactions to Virginia customers.

Taxation of digital goods under the states' sales tax rulesApproximately 20 of the 45 states currently do not have laws to tax digital goods because they either do not have the ability to tax electronically delivered products or they have specifically identified digital goods as not subject to their sales tax.

West Virginia has enacted legislation that requires remote sellers, marketplace facilitators, and referrers that satisfy the state's economic nexus requirements to collect use tax, effective July 1, 2019.

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

The sales of digital photographs electronically transferred to your customers are subject to tax when you provide your customer a tangible form of the photograph, such as a print, negative, or tangible storage medium such as a CD or flash drive.

A sales tax permit can be obtained by registering online through the WV State Tax Department or by mailing the Business Registration Application (Form WV/BUS-APP). Information needed to register includes: Federal Employer Identification Number (FEIN), or SSN if a sole proprietorship with no employees.

West Virginia Tax Nexus Generally, a business has nexus in West Virginia when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

You can find resale certificates for other states here. West Virginia allows the use of uniform sales tax exemption certificates, which are general exemption certificates that can be used across multiple states. You can find more info about these uniform certificates at the bottom of this page.

Every West Virginia LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Sales of digital products are exempt from the sales tax in West Virginia.