A receipt is an acknowledgment in writing that something of value, or cash, has been placed into the possession of an individual or organization. It is a written confirmation of payment.

West Virginia Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

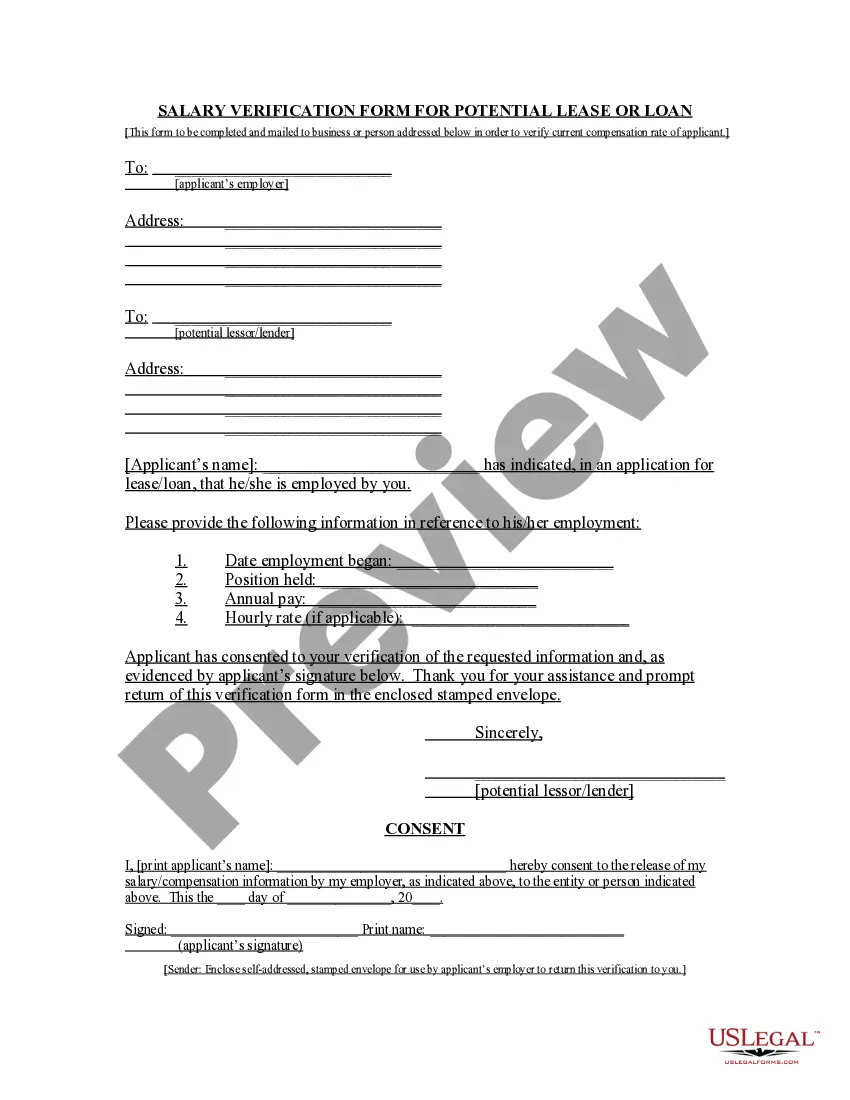

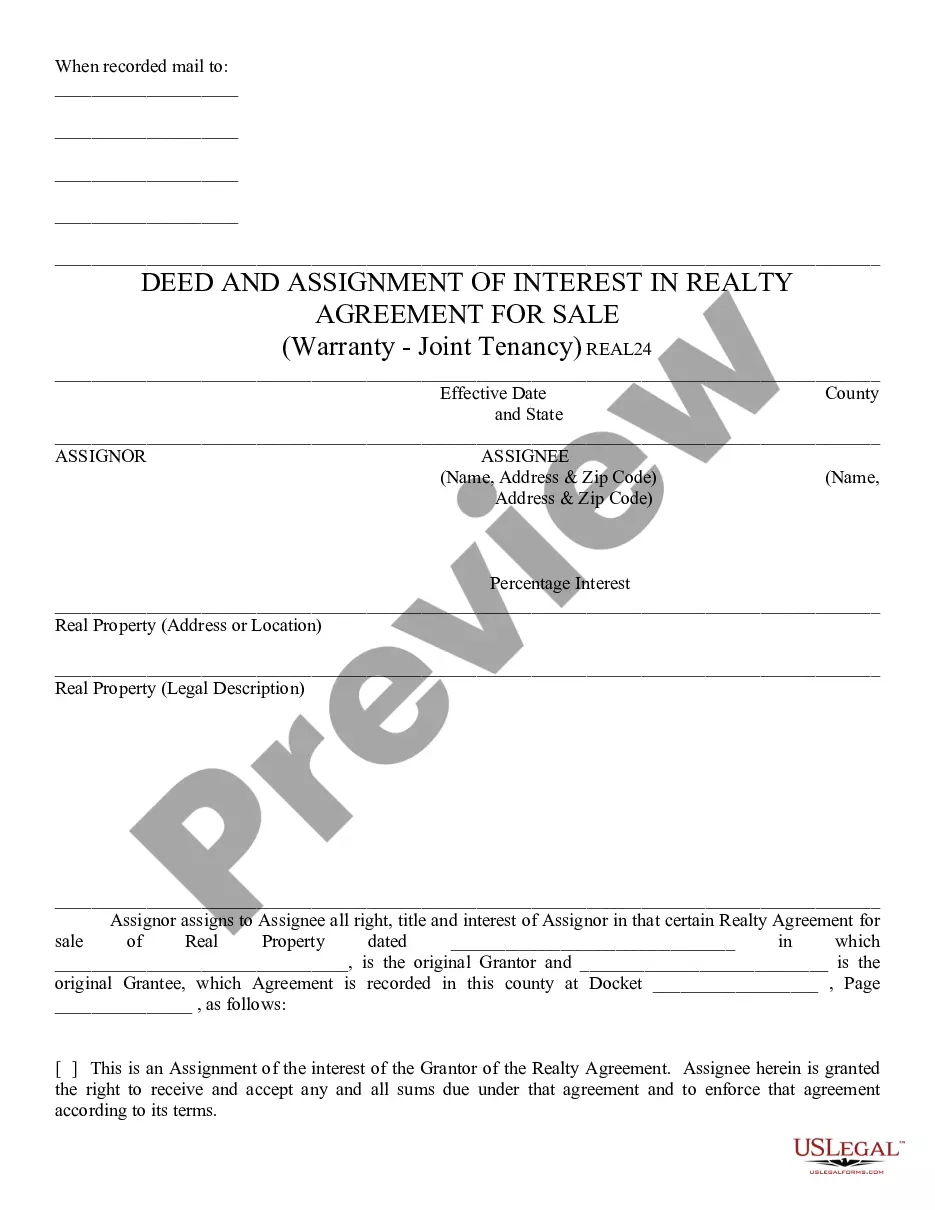

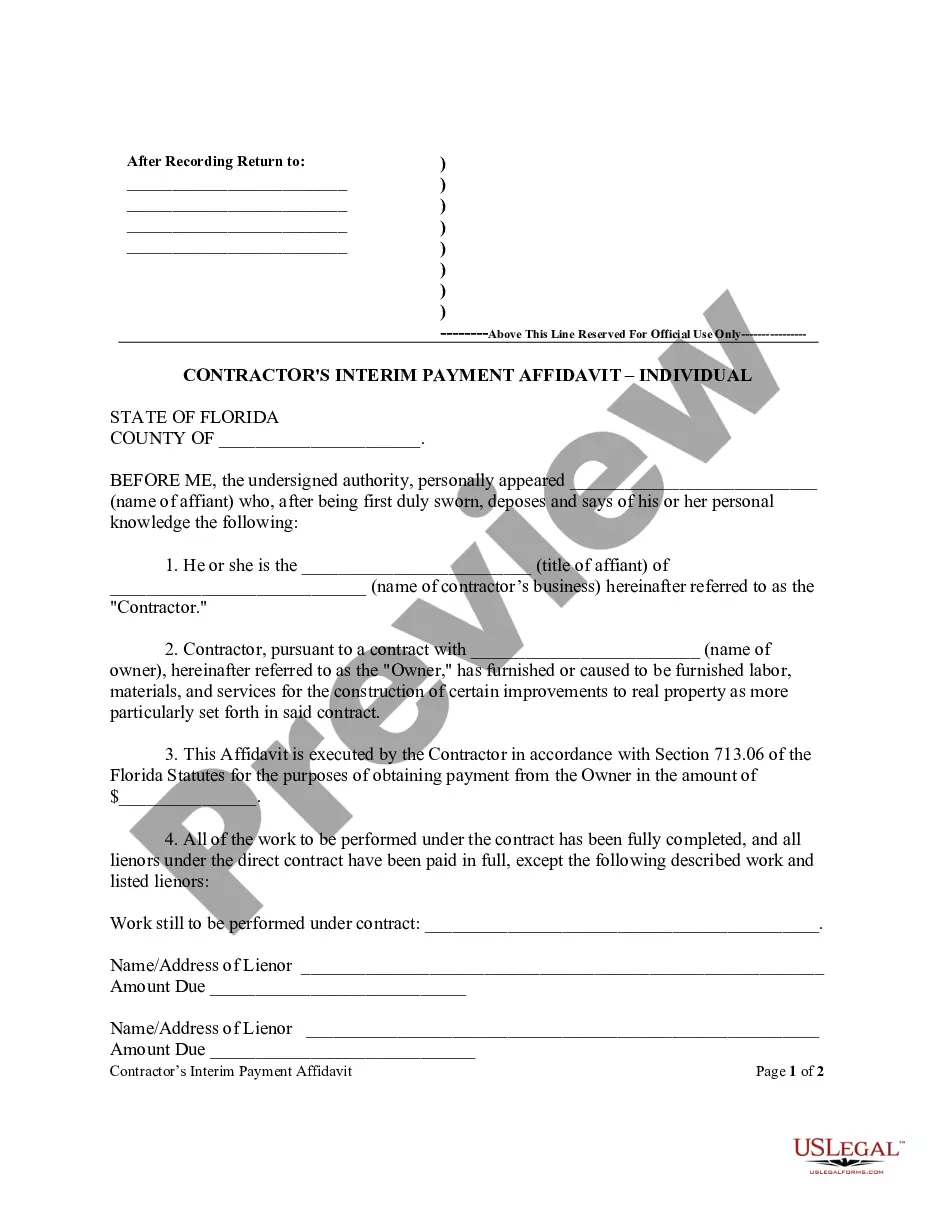

How to fill out Acknowledgment By A Nonprofit Church Corporation Of Receipt Of Gift?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal document templates that you can download or print.

By utilizing the site, you will access thousands of forms for both business and personal needs, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the West Virginia Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift in just seconds.

Read the form summary to ensure you have selected the correct document.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you already possess an account, sign in to download the West Virginia Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your profile.

- If this is your first time using US Legal Forms, here are simple steps to help you get started.

- Make sure you have selected the correct form for your locality/region.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

A gift acknowledgment is a formal document that confirms the receipt of a donation, often provided by organizations such as a nonprofit church corporation. In West Virginia, the Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift serves to validate the contribution for both the donor and the receiving entity. This acknowledgment is important for tax purposes, as it can substantiate claims during tax filing. Using uSlegalforms, you can easily create a compliant acknowledgment that meets all legal requirements, ensuring clarity and professionalism in your donor communications.

Please accept this letter as a contemporaneous written acknowledgement of the following: (1) no goods or services were provided in exchange for your QCD; (2) our organization is a qualified public charity and therefore we may receive your QCD; and (3) your QCD is a gift to us for general purposes or to a designated

Thank you for your great generosity! We, at charitable organization, greatly appreciate your donation, and your sacrifice. Your support helps to further our mission through general projects, including specific project or recipient. Your support is invaluable to us, thank you again!

How do you acknowledge a donation?The name of your donor.The full legal name of your organization.A declaration of your organization's tax-exempt status.Your organization's employer identification number.The date the gift was received.A description of the gift and the amount received.More items...

Each donor receipt should include the name of the donor as well....Whatever the form, every receipt must include six items to meet the standards set forth by the IRS:The name of the organization;The amount of cash contribution;A description (but not the value) of non-cash contribution;More items...?

Each donor receipt should include the name of the donor as well....Whatever the form, every receipt must include six items to meet the standards set forth by the IRS:The name of the organization;The amount of cash contribution;A description (but not the value) of non-cash contribution;More items...?

15 Best Practices For Your Nonprofit Thank You LetterUse the donor's name. Nothing says, This is a form letter more clearly than failing to include a donor's name.Send it promptly.Send it from a person.Show impact.Be warm and friendly.Use donor-centered language.Avoid empty jargon.Reference their history.More items...?

To serve both these purposes, your donation receipt should contain the following information:The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.More items...?

15 creative ways to say thank you to your donorsSend a handwritten letter.Make the phone call.Organize an office tour.Highlight donors on social media and website.Send small gifts.Send a welcome package.Send birthday/anniversary cards.Send a thank you video.

What's the best format for your donation receipt?The name of the organization.A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number.Date that the donation was made.Donor's name.Type of contribution made (cash, goods, services)More items...