West Virginia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Are you currently in a scenario where you require documents for either corporate or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable copies is not simple.

US Legal Forms offers thousands of form templates, such as the West Virginia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which are crafted to fulfill state and federal regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the West Virginia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption at any time, if needed. Click the desired form to download or print the document template.

Utilize US Legal Forms, one of the largest selections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the West Virginia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Identify the form you need and ensure it is for the appropriate city/region.

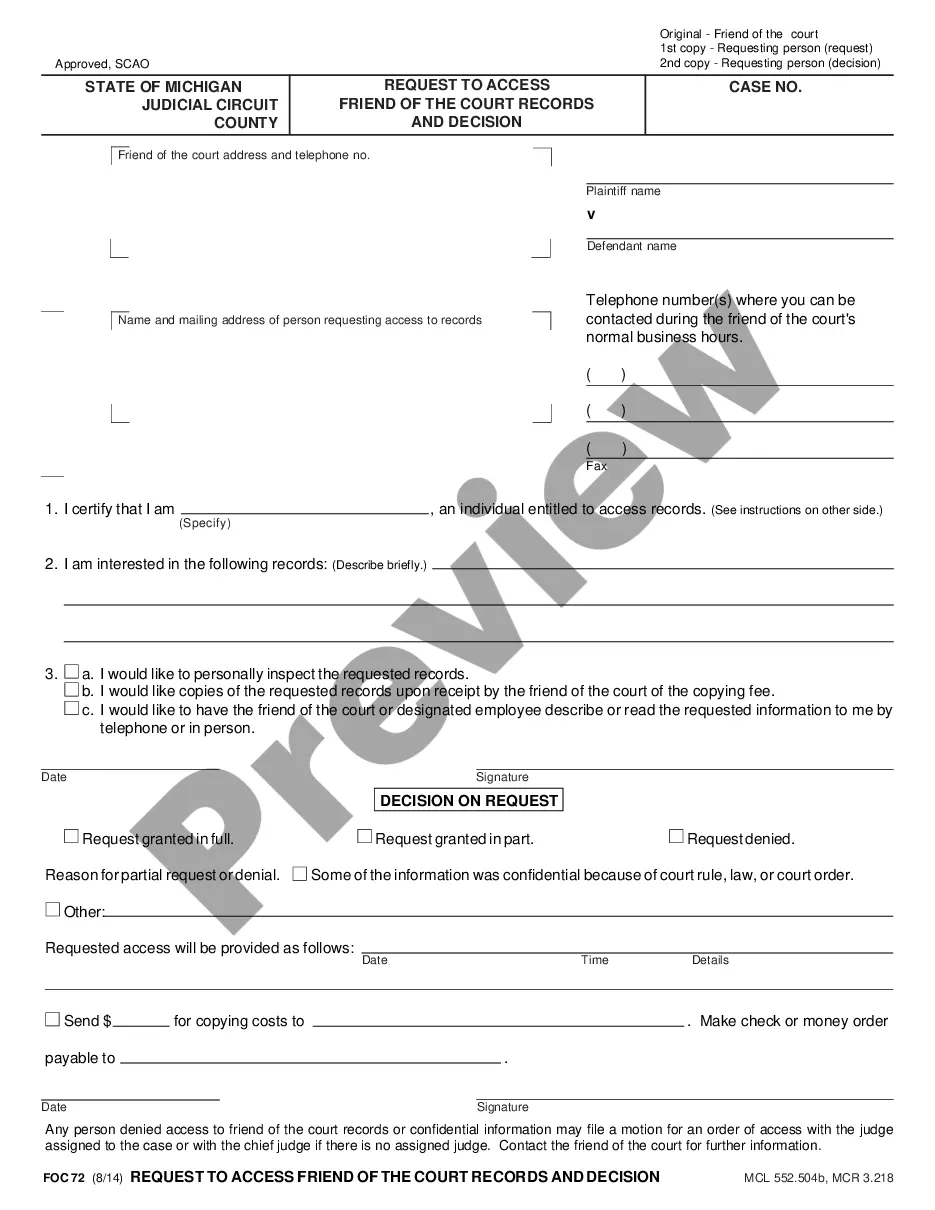

- Utilize the Preview feature to view the form.

- Review the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search feature to find the form that suits your needs.

- Once you find the suitable form, click Purchase now.

- Select the payment plan you wish to use, provide the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Resale certificates are required by most businesses operating in or selling in West Virginia every year. In addition, the certificate allows you to purchase items without paying sales tax on reselling them.

Withholding Requirements4% if annual income > $10,000 and < $25,000. 4.5% if annual income > $25,000 and < $40,000. 6% if annual income > $40,000 and < $60,000. 6.5% if annual income > $60,000.

WEST VIRGINIA EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE. Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages.

Most businesses operating in or selling in the state of West Virginia are required to purchase a resale certificate annually. Even online based businesses shipping products to West Virginia residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

West Virginia does permit the use of a blanket resale certificate, which means a single certificate on file with the vendor can be re-used for all exempt purchases made from that vendor. A new certificate does not need to be made for each transaction.

6.5% of the estimated capital gain derived from the sale or exchange. The amount of tax withheld must be paid to the real estate reporting person before the deed or other instrument transferring title to the realty is presented for recordation or filing in the county clerk's office.

How to get a sales tax permit in West Virginia. You can complete the form WV/BUS-APP found in this booklet or register online at Business for West Virginia. You need this information to register for a sales tax permit in West Virginia: Personal identification info (SSN, address, etc.)

A sales tax permit can be obtained by registering online through the WV State Tax Department or by mailing the Business Registration Application (Form WV/BUS-APP). Information needed to register includes: Federal Employer Identification Number (FEIN), or SSN if a sole proprietorship with no employees.

WEST VIRGINIA EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages.

To register with the West Virginia State Tax Department, you must complete the Application for Registration Certificate (Form WV/ BUS-APP) in this booklet and return to: West Virginia State Tax Department PO Box 2666 Charleston, West Virginia 25330-2666 You may register with all agencies online at .